Summary

- CEO Jeremy Allaire said interest-bearing stablecoins are not a threat to banks, calling bank-run concerns "completely ridiculous."

- Allaire said paying interest helps boost customer retention and attract new customers, and is not large enough to weaken monetary policy.

- Allaire said Circle aims to build a stablecoin-based lending model and that AI will be a key driver of future stablecoins.

Jeremy Allaire, CEO of Circle, said that paying interest on stablecoins does not threaten banks.

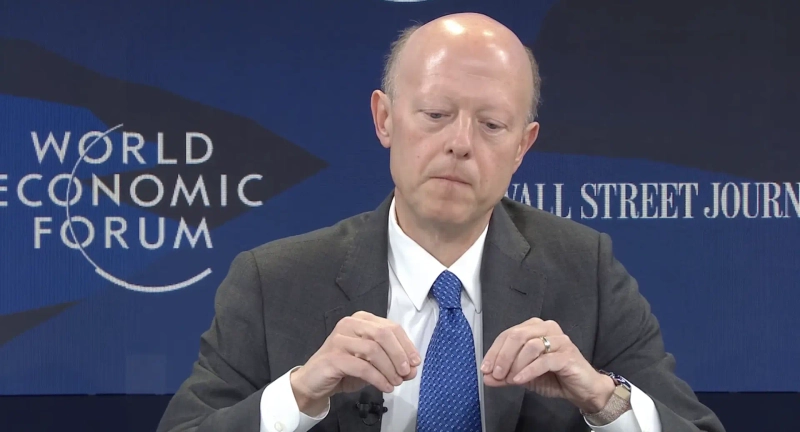

According to Cointelegraph on the 22nd (local time), Allaire, speaking at the World Economic Forum (WEF) in Davos, Switzerland, said concerns that interest-bearing stablecoins could trigger bank runs are "completely ridiculous." Allaire said, "(Paying interest) helps improve customer retention and attract new customers," adding that "the interest itself is not large enough to weaken monetary policy."

He also referenced banks' lending services. Allaire said, "Lending is already shifting from banks to private credit and capital markets," explaining that "in the United States, over multiple cycles, a significant portion of GDP growth has been financed through capital-market debt rather than bank lending." He added, "We (Circle) want to build a stablecoin-based lending model."

On artificial intelligence (AI), he said it "will be a key driver of future stablecoins." He said, "Billions of AI agents will need payment systems," adding, "At present, there is no alternative other than stablecoins."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul