Summary

- According to Walter Bloomberg, major Nordic pension funds were reported to be reassessing their investment allocation to U.S. assets.

- Swedish, Danish and Finnish pension funds assessed a rise in the risk premium on U.S. equities, bonds and dollar assets, and some were reported to be selling U.S. Treasuries.

- The outlet said discussions are intensifying about diversification of investment regions away from U.S.-centric asset allocation due to geopolitical tensions and U.S. policy uncertainty.

According to Walter Bloomberg, a breaking-news account, on the 22nd (local time), major Nordic pension funds are reassessing their allocation to U.S. assets.

Swedish, Danish and Finnish pension funds have recently judged that the risk premium applied to U.S. equities, bonds and dollar assets has risen, and some institutions are reportedly selling U.S. Treasuries.

The outlet said discussions are intensifying about diversifying investment regions away from U.S.-centric asset allocation, as rising geopolitical tensions and growing policy uncertainty in the U.S. have increased investment risks.

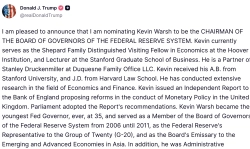

Meanwhile, U.S. President Donald Trump has previously warned that he could take strong retaliatory measures if Europe sells U.S. Treasuries or other U.S. assets.

JH Kim

reporter1@bloomingbit.ioHi, I'm a Bloomingbit reporter, bringing you the latest cryptocurrency news.