Summary

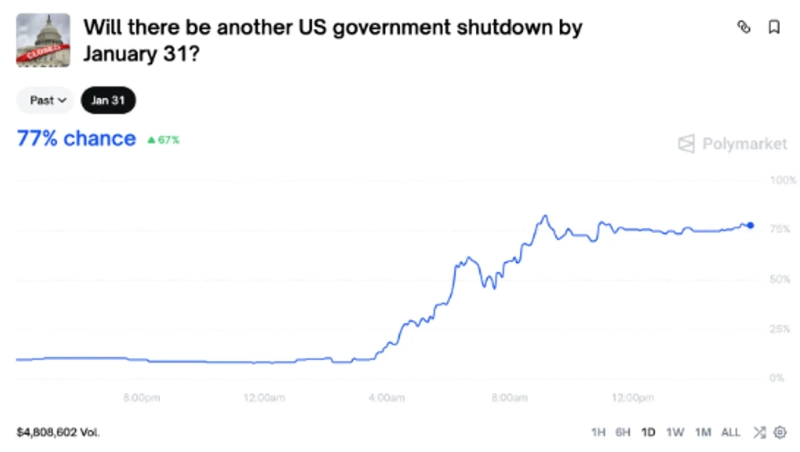

- Polymarket reported that the implied probability of a U.S. federal government shutdown before the end of January surged to 77%.

- The sharp rise in shutdown odds was linked to Democrats’ opposition to the budget package and to shifts in bettors’ expectations following remarks by President Trump.

- Markets warned that if a shutdown becomes reality, it could delay the legislative timetable for digital assets and increase regulatory uncertainty.

The likelihood that the U.S. federal government could enter another shutdown at the end of this month is rising sharply. In prediction markets, the implied probability of a shutdown has jumped significantly in just one day, bringing political uncertainty back into focus.

According to Cointelegraph on the 24th (local time), the decentralized prediction platform Polymarket put the probability of a U.S. federal government shutdown before the end of January at 77%. That represents a roughly 67% surge from the previous day. With political tensions intensifying in Washington, bettors’ expectations appear to have shifted abruptly.

The spike in odds coincides with Democrats’ move to oppose the budget package. Senate Minority Leader Chuck Schumer has said Democrats would “not cooperate on a vote to begin consideration” of an appropriations bill that includes funding for the Department of Homeland Security (DHS). Immediately after the remarks, bets on a shutdown surged on Polymarket.

U.S. President Donald Trump also did not rule out the possibility of a shutdown. In a recent interview with Fox Business, he said there was “a problem” and noted that it was “highly likely to lead to another Democrat shutdown.” Analysts say a string of hardline comments from political leaders is stoking market anxiety.

The uncertainty is also affecting the timetable for crypto legislation. The CLARITY Act, aimed at clarifying regulation, remains stalled after failing to pass Congress, and views within the industry are mixed. Coinbase CEO Brian Armstrong recently said “the current proposal is worse than the status quo,” announcing he was withdrawing his support.

Markets are concerned that if a shutdown materializes, discussions on crypto-related legislation could be delayed again. Industry watchers warn that if the political impasse drags on, regulatory uncertainty could widen once more.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE