"Bitcoin realized losses near KRW 6.4tn… biggest in three years, a 'capitulation zone' signal"

Summary

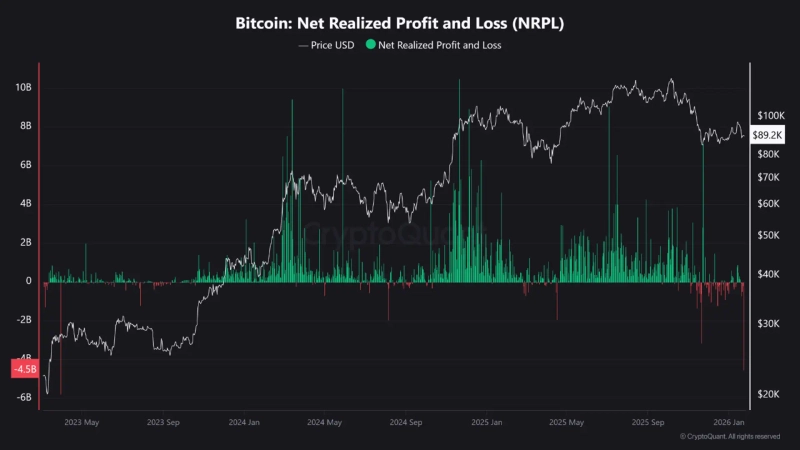

- According to CryptoQuant Quicktake, the Bitcoin network recently recorded about $4.5 billion in realized losses, the largest in three years.

- Gaah said the sharp rise in realized losses is a capitulation signal that tends to appear before a price bottom forms.

- He said that when a similar level of realized losses was observed in the past, Bitcoin was at $28,000, followed by a brief correction phase lasting about a year.

As large-scale realized losses emerged in the Bitcoin (BTC) market, an analysis said the figure is an indicator suggesting the possibility of entering a capitulation phase (capitulation·mass selling).

According to CryptoQuant Quicktake, an on-chain data analytics platform for virtual assets (cryptocurrencies), Gaah, an analyst, said on the 26th, "The Bitcoin network recently posted realized losses of about $4.5 billion (about KRW 6.48tn). This is the largest amount in the past three years."

The analyst said, "Bitcoin saw realized losses of about $4.5 billion," adding, "This is the biggest realized loss in three years." He explained that "a sharp surge in realized losses is a capitulation signal that tends to appear before a price bottom is formed."

He also cited past cases. "When realized losses like this were last observed, Bitcoin was trading around $28,000," he said, adding, "That was followed by a brief correction phase lasting about a year."

He added, "(Typically) capitulation phases appear before a price bottom is formed."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.