Weaker won, stock-market impact in focus…NPS moves to moderate pace of overseas investment

Summary

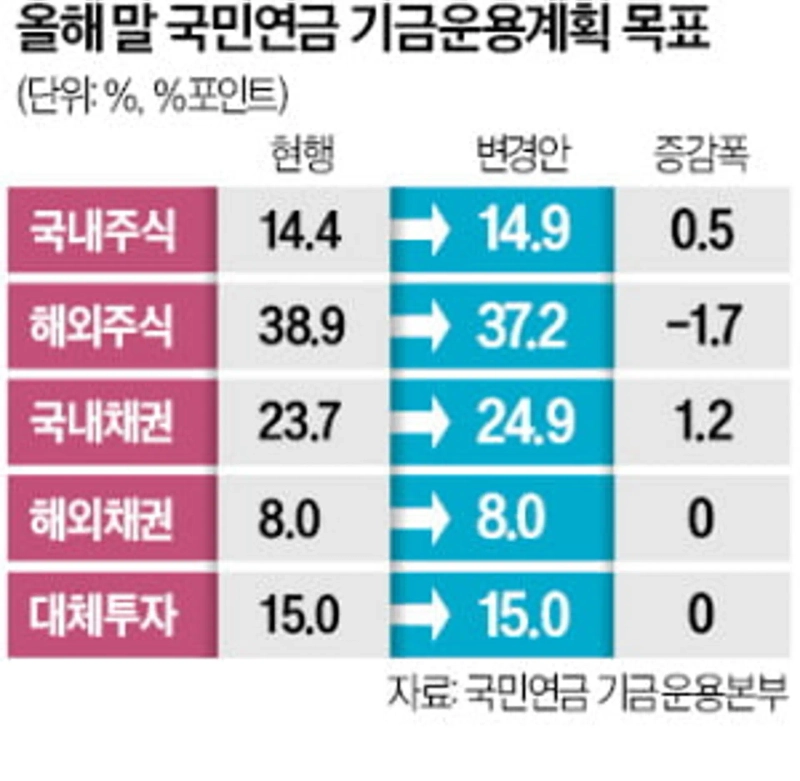

- The NPS Fund Management Committee said it will reassess its asset allocation and rebalancing framework, including scaling back the planned increase in the target allocation to overseas equities while raising the allocation to domestic equities.

- The NPS said it will temporarily suspend mechanical selling for a certain period even if allocations move outside the permitted strategic asset allocation range, to help ease market volatility and market impact.

- An amendment to the National Pension Act to enable the NPS to issue overseas bonds is being pursued, and the Ministry of Health and Welfare said it plans to push it ahead as quickly as possible in consultation with relevant ministries.

Fund Management Committee cuts year-end target allocation to overseas equities by 1.7%P

Raises allocation to domestic equities by 0.5%P

Even if it strays outside the strategic asset allocation range

to temporarily suspend 'mechanical selling'

No mention of introducing a standing currency hedge

Exceptions applied under the banner of easing market impact

Criticism also raised that it "undermines long-term investment principles"

The National Pension Service (NPS) said it will reassess its asset-allocation and rebalancing framework, citing the need to consider the market impact of its growing fund size. It decided to temporarily suspend mechanical selling even if rising domestic share prices push its domestic equity allocation above the pre-set target. Still, critics warn that repeated exceptions to the rules under the pretext of "reducing market impact" could weaken the consistency and predictability of long-term investment principles.

◇ Concerns over 'erosion of principles' in fund management

On the 26th, the NPS Fund Management Committee received a report on the agenda item "NPS Fund portfolio review" and approved improvement measures. The committee’s main concern was the side effects that "mechanical management" could bring about. The NPS has automatically adjusted assets when allocations move outside the permissible range under strategic asset allocation (SAA), but the asset-management industry has long pointed out that as the fund grows, the market shock from applying the same rules increases proportionally.

In particular, with the KOSPI recently breaking above 5,000 and maintaining a solid trend, the prospect of adjusting equity allocations raised concerns that large-scale trades could occur in a short period and affect price formation in the market.

The current rebalancing framework was designed based on 2019, when the fund size was in the 700 trillion won range. Since then, the fund has grown through the 1,400 trillion won range to around 1,500 trillion won earlier this year, meaning that if the criteria are applied unchanged, the rebalancing scale is bound to expand sharply. The committee judged that if market volatility rises in such circumstances, automatic trading by pension funds could instead amplify market anxiety.

This portfolio review is seen as focusing on securing "operational flexibility" rather than abruptly changing direction. For this year, it moved to moderate the pace by cutting the planned increase in the target allocation to overseas equities by more than half compared with the original plan, while maintaining the domestic equity allocation to keep the overall portfolio balanced.

Still, the measure has prompted concerns in the market that the boundary between "flexibility" and "erosion of principles" could become blurred. If precedents of suspending rule application in a bull market on the grounds of market impact are repeated, it could return as an even bigger burden during future correction phases.

A pension investment expert noted, "If exceptions are made permanent depending on market conditions, the predictability of asset-allocation principles can deteriorate," adding, "If the conditions and end point of the suspension are not clearly defined, trust in 'rule-based management' itself could be shaken."

◇ Push to legislate overseas bond issuance

The introduction of a standing currency hedge and whether to expand strategic hedging ratios—issues that had drawn market attention as measures to stabilize the FX market—were not discussed at the committee meeting that day. A committee official who attended the meeting said, "The hedging strategy is something to be addressed in the new framework." Since suspending currency hedging in 2015, the NPS has maintained a strategic hedging stance of intervening only when exchange rates swing sharply. The FX authorities believe reviving a standing currency hedge would help ease one-sided moves in the exchange rate.

Efforts are also accelerating on a plan for the NPS to issue foreign-currency bonds locally when investing overseas, rather than doing so in the domestic FX market. Ahn Do-geol, a lawmaker from the Democratic Party of Korea, is reported to be preparing to sponsor an amendment to the National Pension Act to establish a legal basis enabling the NPS to issue overseas bonds. An official at the Ministry of Health and Welfare said, "We plan to push ahead with the NPS’s overseas bond issuance as quickly as possible in consultation with relevant ministries."

Kim Ik-hwan / Nam Jeong-min / Min Kyung-jin, reporters lovepen@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.