Editor's PiCK

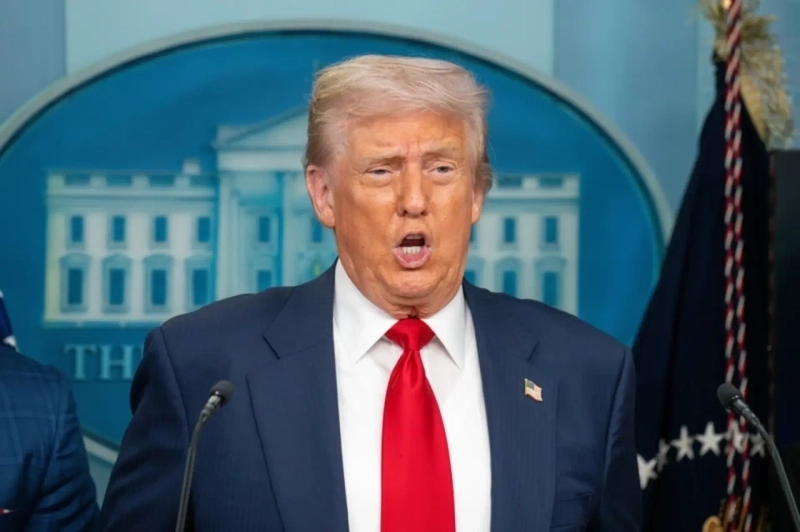

South Korea’s US Investment, a ‘Trophy’ for the Trump Administration… Stoking US Impatience [Lee Sang-eun’s Washington Now]

Summary

- US President Donald Trump said he would raise tariffs on South Korean automobiles, lumber, and pharmaceuticals from 15% to 25%.

- The Trump administration said it is pressuring South Korea to follow through on its $350 billion investment in the United States, taking issue with delays in legislation for the special act on investment in the United States.

- The move has highlighted risks tied to US reciprocal tariffs and investment in the United States, and heightened concerns about possible post-investment incentive rollbacks and additional burdens.

US President Donald Trump said on the 26th (local time) that he would suddenly raise reciprocal tariffs and auto tariffs imposed on South Korea back to 25% from 15%. He said this was because South Korea’s National Assembly is not proceeding with the legal steps needed to implement the Korea-US trade deal, but other reasons cannot be ruled out.

In a post on social media that day, Trump said, “South Korea’s National Assembly is not keeping its promises to the United States,” adding, “South Korea’s National Assembly is not ratifying our historic trade agreement.” He went on to say, “Accordingly, I am increasing all reciprocal tariffs on South Korean automobiles, lumber, pharmaceuticals, and everything else from 15% to 25%.”

In trade negotiations with South Korea last year, the United States agreed to cut reciprocal and auto tariffs from the original 25% to 15%. In return, South Korea agreed to invest $350 billion in the United States along with additional market opening. The South Korean government is pushing for the National Assembly to pass a “special act on investment in the United States” for this purpose, having introduced the bill in November last year. However, the bill is currently pending before the National Assembly’s Finance and Economy Planning Committee. Trump is taking issue with this.

Trump did not specify when the tariff hike would take effect. To actually raise tariffs, legal steps such as an executive order and publication in the Official Gazette must follow. The presidential office said it has not yet received any official notification from the United States.

The government and the ruling party said that they plan to pass the special act on investment in the United States—which Trump cited as the reason for the tariff increase—within February. After holding an emergency meeting centered on Kim Yong-beom, senior presidential secretary for policy, the government decided to convey to the US side its intent to implement the tariff deal. Government officials will also travel to the United States to maintain close communication between the two countries’ authorities. Kim Jeong-gwan, minister of trade, industry and energy, who is visiting Canada, will head to the United States as soon as he finishes his local schedule to discuss the matter with US Commerce Secretary Howard Lutnick, his counterpart in the tariff negotiations. Trade Minister Yeoh Han-koo is also expected to visit the United States soon to confer with US Trade Representative (USTR) Jamieson Greer.

The stated reason Trump suddenly said he would revert tariffs on South Korean products to 25% is the delay in passing South Korea’s US investment law. In the National Assembly, a special act on investment in the United States to support the $350 billion investment was introduced on Nov. 26 last year, but it has yet to even undergo a standing-committee review. However, observers say that while this may be the ostensible reason, there could be other motives.

○Legislative delays are the stated rationale

In the National Assembly, discussions on legislation related to investment in the United States largely fall into two tracks. The special act on investment in the United States, which Trump appears to be targeting, is pending before the Finance and Economy Planning Committee. To complete the legislative process, it must pass through the committee, the Legislation and Judiciary Committee, and then the National Assembly plenary session. Since the US investment plan was already fleshed out in November last year and the bill was introduced by the Democratic Party of Korea, there is little chance it will be blocked. However, as some within the party argue that the contents should be closely reviewed for potential harm to national interests, it has not been designated for fast-track processing, meaning it is likely to take at least several months. After Trump’s social-media post, the government asked the Democratic Party to “pass the special act by February.”

On the People Power Party side, some have argued that the “memorandum of understanding (MOU) based on strategic investment” itself, which contains the US investment commitment, should be ratified. Their logic is that since it promises a massive investment, sufficient disclosure of information and a consent process in the National Assembly are needed. Song Eon-seok, floor leader of the People Power Party, criticized the administration, saying, “All responsibility lies with this president and the government, which concluded a major trade agreement requiring parliamentary ratification and then turned away from the ratification process.”

However, with a ruling from the US Supreme Court on the International Emergency Economic Powers Act (IEEPA)—the legal basis for imposing reciprocal tariffs—expected soon, many assess that it is not appropriate for South Korea to formalize the matter legislatively. The concern is that only South Korea’s commitments would become legally binding, while the US commitments would not be subject to such constraints—or the commitments themselves could become unnecessary (if ruled illegal).

○Pressure to “honor the investment plan”

Some analysts also suggest that a Bloomberg report on the 20th, citing remarks by Deputy Prime Minister Koo Yun-cheol, minister of economy and finance, that South Korea was trying to delay investment in the United States, may have provoked the Trump administration. The article pointed to Koo’s comment that “it is unlikely that the $350 billion investment in the United States will begin in earnest in the first half of this year.” Choi Ji-young, director-general for international economic affairs at the Ministry of Economy and Finance, also said at a recent press briefing held after US Treasury Secretary Scott Bessent’s verbal intervention on the exchange rate that she conveyed to the US Treasury the view that “if volatility and instability in the FX market increase, implementation of investment in the United States could be constrained.” This may have been taken as a sign of weak commitment on South Korea’s part.

From the Trump administration’s perspective, investment pledges by South Korea and Japan are the biggest haul from the tariff war over the past year. In Commerce Secretary Howard Lutnick’s office, panels listing the amounts to be invested by South Korea, Japan, and the European Union (EU) are reportedly displayed like trophies. Trump administration officials are touting these funds as “free contributions that can be used at President Trump’s direction.” If the funds are delayed or not executed, the blow to the Trump administration would be significant. This helps explain the impatience behind complaining that the legislative process has not been completed even though only two months have passed since the bill was introduced.

It can also be interpreted as the United States hoping South Korea’s legislative process will be wrapped up before the Supreme Court’s ruling on reciprocal tariffs. Jang Sang-sik, head of the Korea International Trade Institute at the Korea International Trade Association, said, “Ahead of the Supreme Court ruling, this is likely a process of further nailing down mutual agreements with counterpart countries.” He added that it was “a negotiating message to pressure the special act to pass the National Assembly quickly.” The EU and South Korea are the only ones where the timing of the tariff cut was specified as “when legislation related to trade talks with the United States is introduced”; as the EU recently decided to delay passage procedures after the Greenland issue flared up, complaints reportedly grew that South Korea might also be adopting a delay tactic.

Recent remarks by the Ministry of Economy and Finance that the timing of investment in the United States could be delayed due to FX issues may also have heightened US concerns. With a Supreme Court decision on reciprocal tariffs looming, the Trump administration may be applying another round of pressure to preserve the negotiated outcome.

A deterioration in the domestic political environment—after Immigration and Customs Enforcement (ICE) officers in Minnesota shot and killed US citizens in succession—is also a factor increasing the Trump administration’s need to deliver foreign-policy results.

Some also speculate that a “Coupang issue” may lie behind the surprise tariff hike. After Trump posted the tariff plan on social media, a lobbying firm in Washington, DC, with ties to Coupang circulated to South Korean media a statement citing as the cause “South Korea’s continued attacks on Coupang and overall discriminatory treatment of US companies.” The claim is that Trump’s post came at a time when US Vice President J. D. Vance had raised the issue of treatment of Coupang in a meeting with Prime Minister Kim Min-seok, and when firms that invested in Coupang had filed lawsuits seeking damages from the South Korean government. However, there is no evidence that Trump had Coupang in mind.

○Talk of “TACO”

Trump’s threat to restore tariffs could be a pressure tactic, but it fundamentally underscores that risks surrounding investment in the United States have risen sharply. Trump previously threatened to impose tariffs of up to 25% on eight European countries that deployed troops to Greenland, but later backed down after agreeing with NATO on a framework to strengthen US activity in Greenland. The threat is that he can change tariff rates as he pleases, regardless of negotiated outcomes already reached with the EU.

He has also continued to threaten Canada and Mexico—parties to the United States-Mexico-Canada Agreement (USMCA)—with additional tariffs depending on circumstances, separate from the fentanyl-related tariffs already applied.

If market backlash grows, he has repeatedly used a strategy of taking a step back (TACO—Trump Always Chickens Out), so there is a possibility that demands for a hike on South Korea will also be withdrawn.

But in the process, doubts are growing about the very need to negotiate with the United States. Concerns are also emerging that even after companies invest, the United States could at any time demand equity stakes on national-security grounds, withdraw promised incentives, or require a certain portion of revenue to be handed over.

Washington=Correspondent Lee Sang-eun / Choi Hyung-chang / Kim Dae-hoon selee@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Big Tech rises on earnings hopes, but value stocks see sentiment sour [New York Market Briefing]](https://media.bloomingbit.io/PROD/news/1a6322ec-f445-459b-8188-9bb9dad0f875.webp?w=250)

![South Korea’s US Investment, a ‘Trophy’ for the Trump Administration… Stoking US Impatience [Lee Sang-eun’s Washington Now]](https://media.bloomingbit.io/PROD/news/5139a063-a5f2-4f45-a7ef-a2b3ee0cd9c9.webp?w=250)