Summary

- Matrixport said shrinking stablecoin liquidity is weakening short-term buying demand in the crypto market.

- It said that due to the U.S. GENIUS Act, investors are moving into yield-bearing alternatives such as tokenized money market funds (MMFs) and safe havens like gold and silver.

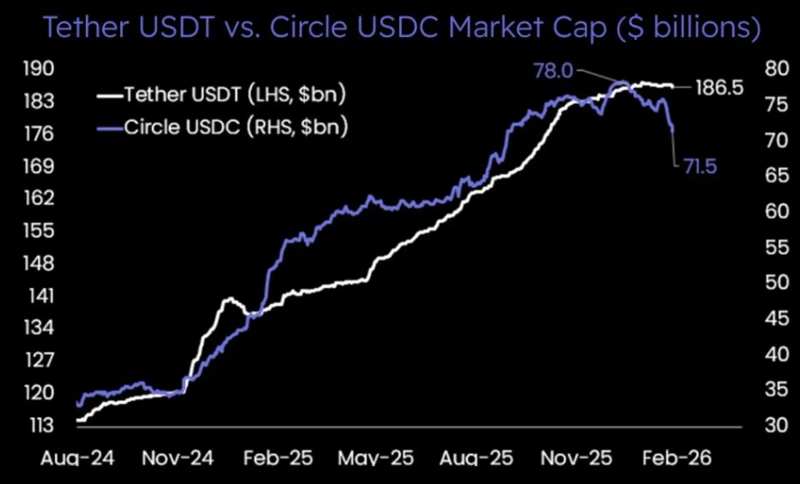

- It noted that Circle (USDC) alone saw net redemptions of $6.5 billion over the past six weeks, intensifying downward pressure on stablecoin supply.

An analysis suggests that shrinking liquidity in stablecoins such as Circle’s USDC is weakening buying demand in the crypto market.

Crypto analytics firm Matrixport said on the 28th (local time) via its official X account that “the U.S. GENIUS Act is expected to prohibit stablecoin issuers from paying interest,” adding that “investors are moving into yield-bearing alternatives such as tokenized money market funds (MMFs).” Matrixport noted, “As a result, Circle alone has seen net redemptions totaling $6.5 billion over the past six weeks,” and added that “this, alongside shrinking stablecoin liquidity, is acting as a factor weakening short-term buying demand in the crypto market.”

It also underscored that investors are shifting toward safe-haven assets. Matrixport said, “Funds are also moving out of stablecoins and into traditional safe havens such as gold and silver, increasing downward pressure on stablecoin supply,” adding that “in response to these changes, Circle is pivoting to a strategy focused on transaction velocity rather than simply expanding market capitalization.” It added that Circle plans to prioritize expanding real-economy use cases, including building the Circle Payments Network and its partnership with Intuit.

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul