[Analysis] "Bitcoin’s 'Supply in Loss' Share Rises…A Signal of Entry Into a Bear Market"

Summary

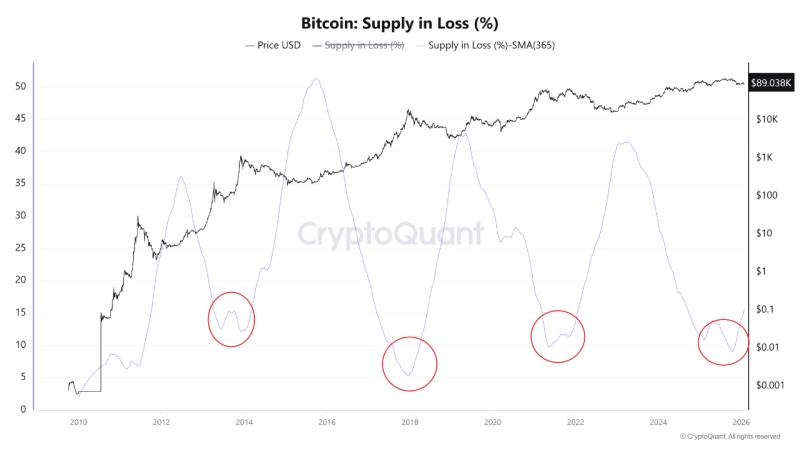

- Bitcoin’s 'Supply in Loss' has shifted back into an uptrend, which he said is a signal repeatedly observed in the early stages of bear markets in past cycles.

- He noted that in 2014, 2018, and 2022 as well, the indicator turned upward before the actual market bottom formed; prices then continued to weaken, and the true bottom was formed only after Supply in Loss expanded much more sharply.

- Woominkyu said Supply in Loss remains quite low compared with past capitulation levels, but analyzed that this upward turn suggests the market may be entering a bear-market phase rather than experiencing a temporary pullback within a bull market.

Bitcoin’s (BTC) 'Supply in Loss' has recently turned back to an upward trend.

Woominkyu, a CryptoQuant contributor, said via CryptoQuant on the 28th (local time) that "Bitcoin’s supply in loss has shifted back to an uptrend," calling it "a signal that was repeatedly observed in the early stages of bear markets in past cycles." He added that "this indicates a phase in which losses begin to spread beyond short-term holders (STH) to long-term holders (LTH)." Supply in Loss is an indicator that shows the share of Bitcoin in total supply that was purchased at prices higher than the current price.

Woominkyu stressed that "the implications of a shift in direction are significant." He noted that "in past cycles such as 2014, 2018, and 2022, this indicator turned upward before the actual market bottom formed," adding that "prices continued to weaken thereafter, and the true bottom was formed only after Supply in Loss expanded much more sharply."

He analyzed that "while Supply in Loss remains quite low compared with past capitulation levels," this latest upward turn "suggests the possibility that the market is entering a bear-market phase rather than undergoing a temporary pullback within a bull market."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul