Summary

- Tennessee said it has introduced the “Tennessee Strategic Bitcoin Reserve Act” to build a state-level Bitcoin reserve as a strategic asset.

- If passed, the Tennessee state government would be able to invest part of public funds in Bitcoin and establish a reserve strategy.

- Supporters said they expect Bitcoin to serve as an inflation hedge, citing its limited supply and global liquidity, and anticipate economic spillover effects.

The U.S. state of Tennessee is moving to build a state-level reserve of Bitcoin (BTC) as a strategic asset.

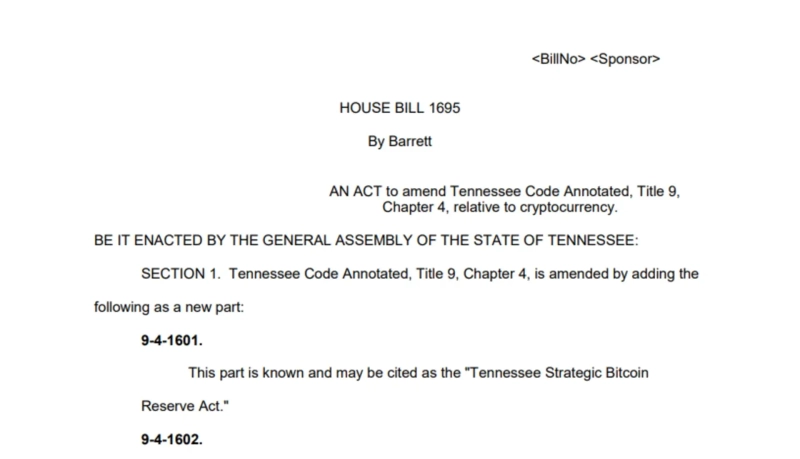

On the 30th (local time), Tennessee state representative Jody Barrett recently formally introduced to the 114th General Assembly the “Tennessee Strategic Bitcoin Reserve Act” (HB1695).

The bill’s centerpiece is to establish a legal basis for the state treasury to lawfully hold and manage Bitcoin. It has been referred to the House Government Operations Committee and is pending review.

If passed, the Tennessee state government would be able to invest a portion of public funds in Bitcoin. Specifically, it would grant the state treasurer authority—under clear guidelines—to increase Bitcoin holdings or formulate a reserve strategy.

Supporters argue that Bitcoin’s limited supply and global liquidity make it a tool to hedge inflation in state finances. They also expect economic spillover effects from building an image of “innovative governance” as the state takes a leading role in embracing virtual assets in the digital-economy era.

If the bill ultimately clears votes in both chambers and is enacted, it is scheduled to take effect on July 1.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀