Editor's PiCK

'Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]

Summary

- Speculation that Trump will nominate Kevin Warsh as Fed chair has fueled fears of a taper tantrum across risk assets, including stocks, bonds, gold, silver and Bitcoin.

- Warsh argues for pairing quantitative tightening (QT) and balance-sheet reduction to curb inflation with policy-rate cuts, a stance that could materially affect risk assets and long-term yields.

- JPMorgan, Bank of America and others said key variables under a Warsh Fed include the draining of excess liquidity, a weakening of the currency-debasement trade (including gold, silver and Bitcoin), and whether the FOMC will back large rate cuts.

Turmoil after Trump taps Warsh for Fed chair

Markets hit by a 'taper tantrum'

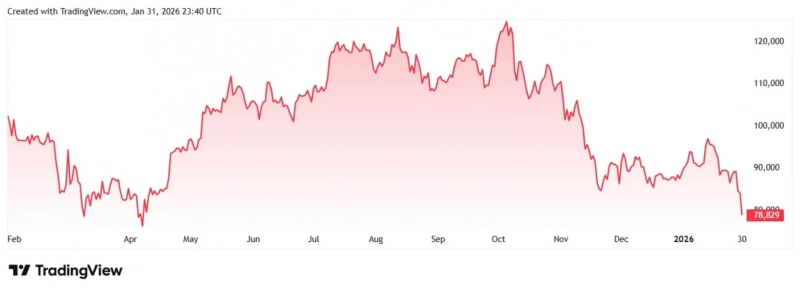

After gold and silver plunge, Bitcoin too

Drops below $80,000 for the first time in 9 months

Warsh, a longtime critic of QE

"Cut rates, but tighten the spigot"

QT = rate cuts, in his logic

Not a simple 'hawk' but a 'small Fed' advocate

Markets have been thrown into turmoil over Kevin Warsh, the former Fed governor whom President Donald Trump has tapped as the next chair of the Fed (the U.S. central bank). The confusion stems from uncertainty over whether Warsh is a dove who will deliver the low rates Trump wants—or a hawk who will halt the Fed’s “money printing” and lock down the vault.

A slump in small-cap stocks, rising bond yields, a plunge in gold and silver, and a drop in Bitcoin—these moves reflect fears of a market “taper tantrum.” Compared with the other three contenders, who looked like clearer doves, Warsh does not appear likely to deliver the “easy-money” conditions the market had anticipated. JPMorgan Asset Management said, “Markets are reacting to his argument that the balance sheet should be reduced,” adding that “this could have a very large impact on risk assets.”

Amid the turmoil, Bitcoin fell as low as the $77,000 range on the 31st (local time), hitting its lowest level since tariff announcements in April last year. Ethereum retreated to the $2,400 range. In fact, Warsh is not particularly negative on crypto. Close to Silicon Valley heavyweights such as Peter Thiel and Marc Andreessen, he has invested in crypto asset manager Bitwise and in 2021 said that “(in an era of excess liquidity) for younger people under 40, Bitcoin is being accepted like a new form of gold.”

But liquidity-sensitive crypto is sliding on speculation that, if Warsh becomes Fed chair, he could implement quantitative tightening. A Wall Street bond investor said, “There had been hopes that if BlackRock’s Rick Rieder, bond CIO, were chosen, BlackRock’s crypto-friendly stance could gain momentum, but Warsh’s selection has dashed those expectations—and that has also contributed to the selloff in crypto.”

Warsh is, in the traditional sense, a leading hawk who prioritizes inflation control and has criticized the Fed’s quantitative easing (QE). More recently, however, he has also made dovish arguments that the Powell Fed misdiagnosed the causes of inflation and has maintained overly high rates, insisting policy rates should be cut faster. That is where the market’s confusion originates.

Is Warsh really a hawk? If so, why did Trump choose him? We look at Warsh’s seemingly contradictory views and his blueprint for the next Fed through his op-eds and interviews.

Who is Kevin Warsh

Warsh studied public policy at Stanford and graduated from Harvard Law School. After working at Morgan Stanley, he became Special Assistant to the President for Economic Policy at the National Economic Council (NEC) in 2002 under President George W. Bush. That same year, he married Jane Lauder, a third-generation member of the Estée Lauder family, becoming the son-in-law of Ronald Lauder—Trump’s Wharton alumnus and longtime friend of 60 years. Lauder, who is also president of the World Jewish Congress, has long supported Trump and the Republican Party and is known as the person who suggested Trump buy Greenland.

In 2006, Warsh became the youngest Fed governor in the central bank’s history at age 35. During the 2008 global financial crisis, he was involved in managing the fallout from Lehman Brothers’ collapse and supported QE—under which the Fed directly buys assets—calling it a “necessary evil in a crisis.”

But in 2010, when the Fed moved to buy U.S. Treasuries and mortgage-backed securities (MBS) to stimulate the economy, Warsh turned into a skeptic of QE, believing it would ultimately fuel inflation. In an interview with the Hoover Institution in July last year, Warsh said this was why he resigned from the Board in 2011 despite having seven years left in his term.

Warsh joined an advisory group shortly after Trump’s first election victory in 2016 and competed with Jerome Powell for the Fed chair job, but Trump rejected Warsh—then 47—saying he “looked too young.” Trump then chose Powell on the advice of Treasury Secretary Steven Mnuchin, a decision he has repeatedly said he regrets. Now, after a long detour, Trump has chosen Warsh.

“Balance-sheet reduction is the key to rate cuts”

At the core of Warsh’s argument is a seemingly paradoxical mix: “tighten the Fed’s spigot (the vault) while cutting policy rates.”

That stems from his view of what causes inflation. He has stressed that “inflation occurs when the government spends too much money and prints too much.” In his view, the Powell Fed—which has argued inflation was driven by “supply-chain problems caused by the Ukraine war and COVID” or by “an economy growing too fast and wages rising too much”—was wrong from the start about the causes of inflation.

In a Wall Street Journal op-ed last November titled “The Fed’s Broken Leadership,” Warsh wrote, “Money is too easy on Wall Street, and credit is too tight on Main Street,” adding that “the Fed’s bloated balance sheet, built in past crises to support large corporations, can be reduced significantly. That capacity can be redeployed into lower rates that support households and small and mid-sized businesses.” The message is that today’s swollen balance sheet is supplying liquidity to Wall Street and asset markets, stoking inflation—while the Fed, rather than correcting the root cause, is keeping policy rates too high to compensate for its own mistakes, squeezing the real economy and the housing market.

Under Warsh’s logic, QT and policy-rate cuts are not mutually incompatible. If reducing the balance sheet removes inflation at the root, rates can be cut without prices flaring up again.

Moreover, he believes artificial intelligence (AI) will be a powerful disinflationary force that boosts productivity and strengthens U.S. competitiveness. Such productivity-driven disinflation could provide a rationale for the immediate rate cuts Trump is demanding.

Warsh also argues that tariff-driven price increases should be treated as temporary. In his view, the core drivers of inflation are government spending and the Fed’s QE-enabled money supply growth. For this reason, JPMorgan assessed that “if Warsh takes office, he is expected to call for rate cuts this year.” Seen this way, it is hard to label Warsh simply as a “hawk.”

Market signals a looming “taper tantrum”

Warsh’s critique that the Fed has become a “money-printing machine” that actually fuels inflation resonates with many. A common argument is that the deepening K-shaped economy globally reflects how unlimited liquidity has delivered greater wealth to asset holders, while debasing the currency and cutting off the ladder for those with fewer assets and incomes, including younger generations. A prescription of draining excess liquidity through QT while keeping policy rates lower could be a direct way to ease polarization.

The issue is execution. A market addicted to “easy money”—via abundant liquidity and fiscal expansion—could throw a “taper tantrum” if a Warsh Fed implements QT. That is already hinted at by the selloff triggered merely by news of his selection, much as the prices of gold and silver posted their biggest plunge since 1980.

Given that expectations of further money printing by the Fed and government—and consequent currency depreciation—have underpinned gains in real assets and equities, markets could treat an actual Warsh QT as a de facto rate hike, pushing asset prices lower. Evercore ISI said, “Warsh’s selection could prompt some reduction of positions that had been asymmetrically tilted toward a weaker dollar and could weaken the ‘debasement’ trade,” citing this as the backdrop to the sharp drop in gold and silver.

Of course, Warsh would try to offset this with rate cuts. The question is whether he can bring FOMC participants on board for cuts of more than 50bp. Bank of America noted, “If economic data remain resilient through June, support for large cuts (50bp or more) could weaken,” adding, “In particular, Governor Bowman did not dissent from the decision to hold rates steady in January.”

“Powell failed—restore credibility and rates will fall on their own”

A counterargument is that shrinking the balance sheet is a factor that pushes up long-term yields. JPMorgan in fact pointed out that after news of Warsh’s selection, long-term yields rose more than short-term yields. Wall Street had expected the Trump administration to work with the Fed to suppress long-term yields by increasing issuance of short-term Treasuries rather than long-dated bonds, with the Fed buying the short end. Warsh’s skepticism of QE reduces the likelihood of such coordination.

Jon Faust, a professor at Johns Hopkins University who served as chief adviser to Chair Powell at the Fed from 2018 to 2024, also argues that “QT raises long-term yields.” To shrink the balance sheet, the Fed would have to sell its holdings of long-term Treasuries and MBS back into the market or stop reinvesting proceeds. That would force private banks to absorb additional supply, reducing liquidity in private portfolios and lifting the term premium—pushing long-term rates higher.

Despite these objections, Warsh insists that a “regime change” is needed—shrinking the Fed and fundamentally rewriting its inflation framework. He argues that “Powell’s Fed has failed,” citing failures in rate policy and a loss of market credibility. Quoting former Chair Paul Volcker, he says the job of a central bank is not only to set rates but to make markets believe it knows what it is doing—something the Fed has missed on both counts.

In his view, by focusing on issues other than its core mission—such as balance-sheet policy and climate and diversity agendas—the Fed has lost credibility and thus cannot control long-term yields. Therefore, he argues, if the Fed scales back such involvement and reforms itself to restore trust, “the market will bring rates down on its own.”

Warsh’s “small Fed” doctrine

Is the market—and Trump—ready to accept it?

In the end, because he advocates cutting policy rates and easing financial regulation while shrinking the balance sheet, Warsh is less a simple hawk than a proponent of a “small Fed.” It remains unclear whether his ambitious plan—restore Fed credibility → lower rates—will succeed, or whether it will trigger a market taper tantrum and provoke Trump’s anger(?). JPMorgan analyzed that “balance-sheet reduction will put upward pressure on long-term yields, which would run counter to the administration’s desire to bring mortgage rates down.”

Whether he can pull a divided FOMC in the direction he wants will also be crucial. Bank of America said, “If the scale of turnover among FOMC participants is not large, Warsh could face significant resistance.”

What is clear for now is that Warsh’s selection has turned Wall Street’s hopes for even more “easy money” into disappointment. Markets accustomed to an era of excess liquidity do not appear to have the patience to wait for Warsh’s “straightforward” prescription. Some on Wall Street also say Trump’s patience, heading into the midterm elections, may not be deep either. How Trump responds to a market taper tantrum that often moves ahead of policymakers will be another key point to watch.

New York = Correspondent Bin Nansa binthere@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)