Editor's PiCK

US Bitcoin ETFs saw $1.6bn in net outflows last month, the third-largest on record

Summary

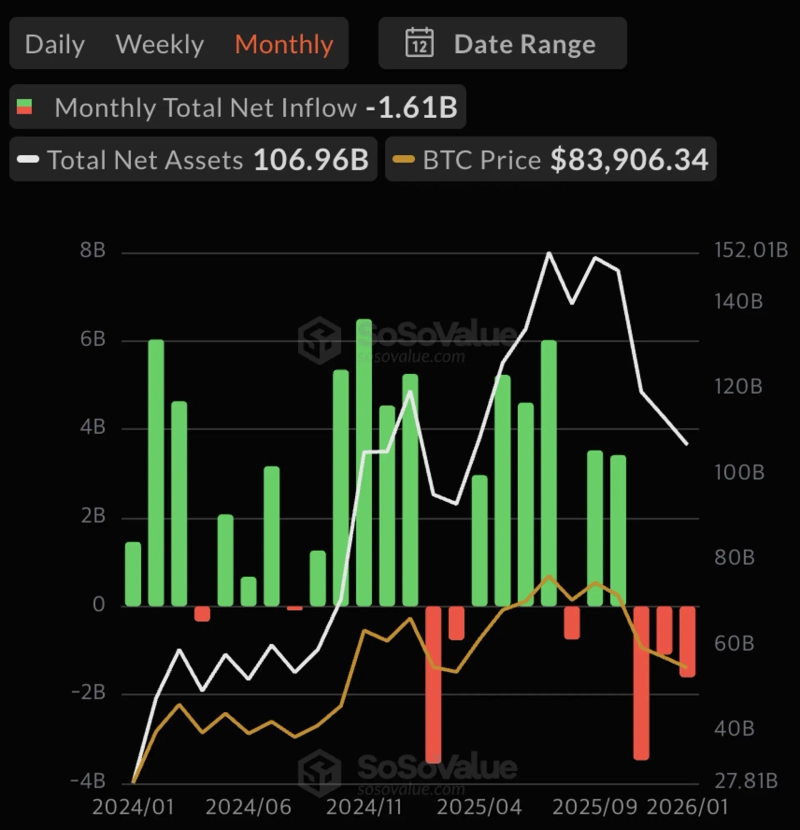

- US spot Bitcoin ETFs posted $1.61bn in net outflows last month, the third-largest on record.

- Both spot Bitcoin ETFs and spot Ethereum ETFs recorded net outflows for three consecutive months on a monthly basis.

- Amid institutional outflows, Bitcoin returned -10.17% and Ethereum returned -17.25%.

US spot Bitcoin (BTC) exchange-traded funds (ETFs) saw $1.6bn (about KRW 2.3trn) of money flow out last month.

According to SosoValue on the 1st (local time), spot Bitcoin ETFs recorded net outflows of $1.61bn last month. This is the third-largest net outflow on record, following February last year (-$3.56bn) and November (-$3.48bn).

Spot Bitcoin ETFs also posted net outflows for three consecutive months on a monthly basis. It is the first time since their launch in January 2024 that spot Bitcoin ETFs have recorded net outflows for three straight months.

The picture is similar for US spot Ethereum (ETH) ETFs. According to SosoValue, spot Ethereum ETFs saw $350m flow out last month, marking net outflows for three consecutive months on a monthly basis. It is also the first time since their 2024 launch that spot Ethereum ETFs have recorded net outflows for three straight months.

As institutional money exits, Bitcoin prices have continued to struggle. According to Coinglass, Bitcoin’s return last month was tallied at -10.17%. It is the first time in four years that Bitcoin has posted a negative January monthly return since 2022 (-16.68%).

Meanwhile, Ethereum posted a return of -17.25% last month.

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)