Bitcoin spot ETFs post net outflows for 12 straight trading days…cumulative withdrawals near $2.9 billion

Summary

- U.S.-listed Bitcoin spot ETFs recorded $2.9 billion in net outflows over 12 trading days, adding to downside pressure on Bitcoin prices.

- Forced liquidations of long Bitcoin futures positions reached about $3.25 billion, and liquidity restoration is expected to take time.

- 30-day delta skew up to 13%, options market hedging against downside risk, and the pace of ETF outflows were cited as key variables for Bitcoin’s near-term direction.

Large-scale capital is continuing to exit Bitcoin spot exchange-traded funds (ETFs), intensifying downside pressure on Bitcoin prices.

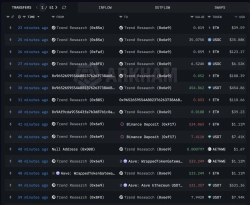

According to Cointelegraph on the 4th (local time), U.S.-listed Bitcoin spot ETFs saw total net outflows of $2.9 billion over the past 12 trading days. Over the same period, Bitcoin fell about 26%, sliding below the $73,000 level.

Average daily net outflows from ETFs were estimated at roughly $243 million. This nearly coincided with the point on Jan. 14 when Bitcoin met resistance around $98,000. As prices fell thereafter, a large volume of leveraged long positions in Bitcoin futures was liquidated, triggering forced liquidations totaling about $3.25 billion.

Some in the market say the fallout from last October’s mass-liquidation episode still lingers. At the time, a technical error on Binance sparked widespread liquidations, and the exchange moved to compensate affected users. Hasib Qureshi, managing partner at hedge fund Dragonfly, said, “With the liquidation engine operating without market-stabilizing functions, even market makers were hit,” adding, “Restoring liquidity will take time.”

The options market is also showing signs of caution over further declines. The 30-day delta skew for Bitcoin options rose to 13%, suggesting professional investors are hedging against downside risk. This is interpreted as indicating limited conviction that Bitcoin has formed a bottom around $72,100.

Meanwhile, with tech stocks weakening, Bitcoin’s increasing correlation with the Nasdaq index is also acting as a headwind. Industry sources dismissed as unfounded the recent rumors raised in some quarters about liquidity at major exchanges.

As market uncertainty persists, when ETF outflows begin to abate is seen as a key variable that will determine Bitcoin’s near-term direction.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)