Fractional investment license mentioned by President Lee… the criteria the FSC laid out [Park Ju-yeon’s Yeouido Compass]

Summary

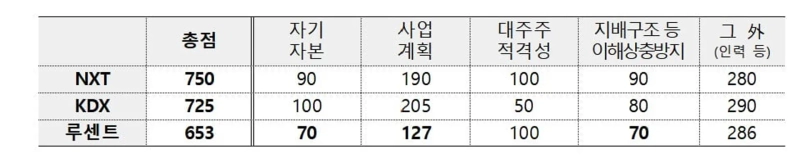

- The Financial Services Commission (FSC) said that in its preliminary licensing for a fractional-investment OTC exchange, it presented paid-in capital, business plans, and governance as core review criteria, separate from sandbox experience.

- It said Lucentblock received a low score due to a lack of paid-in capital, shortcomings in its OTC exchange operating strategy and understanding of laws and regulations, and limitations in its conflict-of-interest prevention system and governance.

- The FSC said this license is limited to trust beneficiary certificates, and that distribution of security tokens (STOs) will be determined through a separate licensing framework and licensing review.

A signal that sandbox experience alone is not enough

Scores diverged on capital, business plans and governance

STOs are a separate step, drawing a line against a distribution license

The Financial Services Commission’s (FSC) preliminary licensing decision for a fractional-investment OTC exchange—closely watched over the past month—was made on the 13th. The Korea Exchange (KDX) and the Nextrade (NXT) consortium were granted approval, while Lucentblock was rejected.

What stood out as much as the outcome was the FSC’s press release. That day, the FSC disclosed a press reference on the preliminary license for the fractional-investment OTC exchange, running to as many as 19 pages. That is an unusual length for a preliminary licensing announcement.

Normally, preliminary licensing results are summarized only in terms of whether an applicant is selected and a brief rationale. In particular, reviews by an external evaluation committee are in principle conducted as a non-public process. Even so, this time the FSC provided relatively detailed explanations, including evaluation scores, factors behind gaps by item, the relationship with sandbox operators, and even distinctions from future STO (security token offering) distribution.

Given that the material came after President Lee Jae-myung’s remarks at a Cabinet meeting, it is hard to rule out a procedural explanatory intent. Still, there is a substantial amount of content for it to be seen as a simple rebuttal. Some assess it as a document that, beyond explaining the result, shows with relative clarity how financial regulators define the meaning of the sandbox and under what standards they will review and supervise fractional-investment distribution.

“Licensing is separate; sandbox experience is not a pass”

First, the material distributed by the FSC on the 13th clearly distinguishes between existing sandbox distribution and this OTC exchange license. It defined the sandbox as an exceptional, time-limited distribution channel, while defining the OTC exchange as a “market” with no restrictions on issuers and products.

The FSC explained that operating a sandbox does not automatically lead to licensing. Its position is that being a sandbox operator neither guarantees a license nor grants exclusive distribution rights. It also cited the fact that, in past discussions on legal amendments, a proposal to allow automatic distribution was excluded.

This point, however, could have a significant impact on the industry. While firms were told to open the market first through regulatory exemptions, the upshot is a signal that “sandbox experience alone is insufficient.”

A political source said, “It clearly drew a distinction between having tried the business and earning the qualification to operate a market,” adding, “If no exceptions are made, it cannot be ruled out that more startups will stumble at the hurdle.”

“Less about ‘can it grow,’ more about ‘can it be entrusted’”

The items that drove the score gap are even more symbolic. Total scores by the external evaluation committee were 750 for NXT, 725 for KDX, and 653 for Lucentblock. The FSC said the gap stemmed from paid-in capital, business plans and conflict-of-interest prevention systems.

The item on which Lucentblock received the lowest evaluation was paid-in capital. The FSC said its “paid-in capital is markedly lower than peers, and the feasibility of plans to raise contributed capital and emergency funds is contingent depending on circumstances.” This reads as a question not simply about the size of capital, but about whether the structure can operate the market stably in the event of an incident.

A gap also opened up in the business plan. The FSC pointed out that “while it has experience operating a distribution platform, it lacks a long-term strategy for operating an OTC exchange, internal rules are insufficient, and its understanding of relevant laws and regulations is low.” The judgment placed more weight on long-term operating strategy and a compliance framework than on experience itself.

The same applied to the conflict-of-interest prevention system and governance items. Regarding Lucentblock, the FSC said, “The largest shareholder and related parties hold 51%, meaning it does not in substance appear to be a consortium structure, and it has the character of a personal company of an individual controlling shareholder.”

Even though the criteria were adjusted to recognize consortium scoring bonuses for existing corporations in consideration of startup burdens, the actual review still asked whether it was “substantively a consortium structure.” The key was not whether names were listed together, but whether stakes and authority were dispersed so that conflicts of interest could be controlled. This reflects a view of the distribution market not as a simple platform business, but as market infrastructure requiring a public-interest character.

Why leave STOs as the “next step”?

In the market, expectations also emerged that this license could lead directly to the authorization of an STO exchange. However, the FSC’s release drew a clear line on this point.

The FSC said, “Security tokens can be issued, as a form of securities, for all securities, but this distribution-market license is limited to ‘beneficiary certificates of trust (excluding collective investment securities)’ among six types of securities and does not cover all securities.” This means the current approval is limited to the distribution of trust beneficiary certificates.

Why draw such a strict distinction? Security tokens may differ from existing electronic securities in trading methods and management structures. If the method of transferring rights and the account system change, the liability structure and supervisory approach in the event of an incident must also be redesigned. It appears regulators chose an order of first bringing fractional-investment distribution into the institutional market, while assessing security tokens within a separate licensing framework. It can be read as a signal: open distribution, but do not allow technological expansion all at once.

The FSC said, “Whether the fractional-investment distribution market can handle security tokens (limited to trust beneficiary certificates) will be determined through opinion-gathering and other processes as part of establishing a licensing framework related to the Security Token Act,” adding, “If human and physical requirements different from existing securities trading methods are needed for investor protection, an STO OTC exchange will require a separate licensing review.”

Reporter Park Ju-yeon grumpy_cat@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Trump, after ruling mutual tariffs illegal: “10% additional tariff on the whole world” [Lee Sang-eun’s Washington Now]](https://media.bloomingbit.io/PROD/news/6db53d1e-258b-487d-b3ae-a052b6e919cf.webp?w=250)

![Wall Street rises on ruling that ‘Trump reciprocal tariffs are unlawful’…uncertainty lifted [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/446b6f3b-7068-4a6a-bd23-fea26c188a3f.webp?w=250)