Summary

- It reported that major software stocks and an IT-sector ETF have been sliding sharply since the emergence of Claude CoWork.

- It said that amid AI-related worries, money is rotating into traditional sectors outside tech—so-called AI-immune sectors—and defensive portfolios such as consumer staples.

- Executives at Nvidia and Arm were cited as calling software-replacement fears an illogical panic and micro-hysteria, arguing the concerns are overdone.

Anthropic unveils enterprise AI

Adds legal functions to 'Claude CoWork'

Fears spread of SW replacement in specific fields

Shares of marquee companies tumble one after another

Money rotates into non-tech names

Jensen Huang: "Just an illogical worry"

Anthropic, an artificial intelligence (AI) startup, has shaken the global software industry with its “Claude CoWork.” Concerns are spreading that such general-purpose AI could replace existing software specialized by domain. Views are split between those who see it as an opening signal of structural change and those who judge it a temporary pullback driven by excessive fear.

Major software stocks plunge

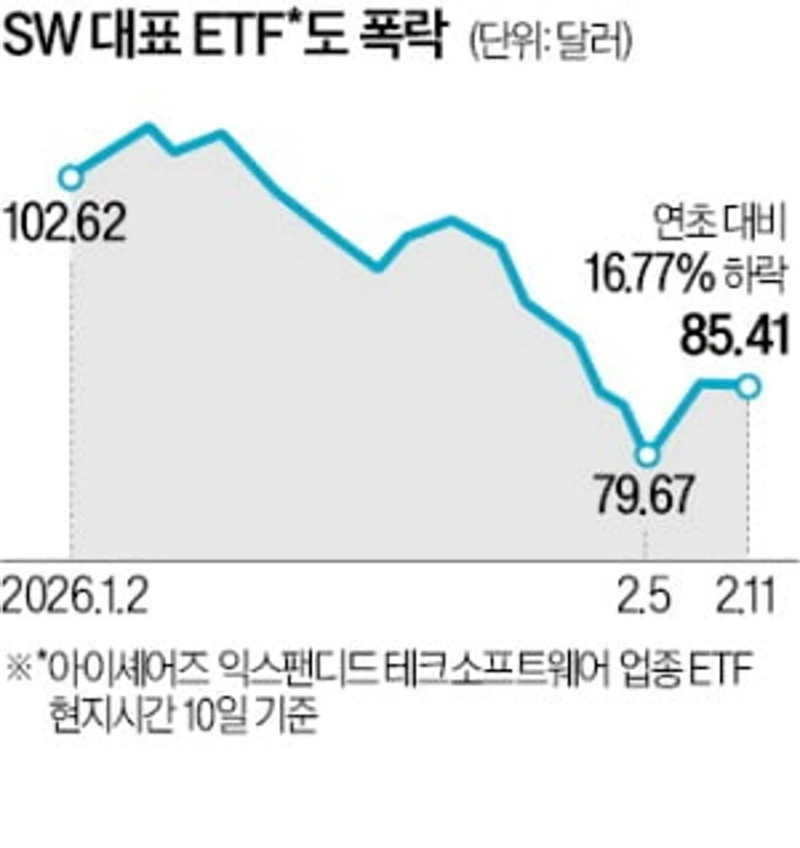

Through the 10th of this month, shares of leading software companies have extended sharp declines this year, including customer-management software maker Salesforce (-23.72%), Intuit (-33.06%), ServiceNow (-27.79%) and Adobe (-20.59%). The iShares Expanded Tech-Software Sector ETF, a major U.S. software exchange-traded fund (ETF), is also down 16.77% year-to-date.

After Anthropic announced it would add features to Claude CoWork to automate legal work such as contract review, legal-software-related names were hit hard as well, including Thomson Reuters (-28.09%), LegalZoom.com (-19.81%) and London Stock Exchange (-14.28%). Data analytics and research firms FactSet Research (-28.11%) and S&P Global (-21.76%) also saw heightened volatility on the day. The Financial Times (FT) reported that an analysis of S&P 500 sector returns showed the information technology (IT) sector fell 7.7% from late October last year through the day in question, posting the worst performance among all industry groups.

The slide is being attributed to Anthropic’s launch last month of its enterprise AI service Claude CoWork. The service is designed to help office workers without programming knowledge automate corporate tasks through conversations with AI. On the 3rd, Anthropic said the AI could also be used in the legal field, where expertise is required for tasks such as reviewing complex contracts, stoking fears that general-purpose AI could replace software specialized for specific tasks.

Bloomberg said that with valuations inflated after years of IT-sector rallies, investors are overreacting even to small negative catalysts. John Gray, chief operating officer (COO) of Blackstone, said, “This is a structural change happening across the broader economy,” adding that “even software companies that dominate the market can be threatened by disruptive innovators in AI.”

There are also concerns that weakness in software could spread into a broader risk for the AI industry. Mike O’Rourke, a strategist at JonesTrading, noted that “software companies are core customers of major hyperscalers (large-scale cloud operators) such as Amazon, Microsoft (MS) and Alphabet,” adding that “if their business models are shaken, hyperscalers supplying the infrastructure could also be hit in a chain reaction.” Will Rhind, chief executive officer (CEO) of GraniteShares Advisors, said, “We’re at a stage where it’s impossible to predict what will happen,” adding that “as effective AI use cases increase, worries about disruption are growing.”

"AI replacement fears are overdone"

Amid market jitters, money leaving the software industry is rotating into traditional sectors that were relatively left out of the AI boom. According to Deutsche Bank, $62 billion (about 90 trillion won) has flowed in over recent weeks to U.S. funds that invest in stocks excluding the tech sector. That already surpasses last year’s full-year inflows for those funds ($50 billion).

Andrew Lapthorne, a quantitative strategist at Société Générale, said “a broad rotation is taking place into so-called ‘AI-immune’ sectors,” adding that utilities, food, mining, construction and telecommunications are representative industries. Jeff Blazek, chief investment officer (CIO) at Neuberger Berman, also said, “Capital seeking stable and sustainable returns is leaving software and moving into sectors such as consumer staples,” adding, “Ultimately, it appears investors are looking for defensive portfolios where they can ‘park’ money.”

Some also argue the plunge in software shares stems from excessive worry. Nvidia CEO Jensen Huang dismissed predictions that software will be replaced by AI as “the most illogical idea in the world.” Speaking at the “Cisco AI Summit” in San Francisco on the 3rd, Huang criticized the notion that the role of existing tools in the software industry will fade and be replaced by AI, adding, “Time will tell.”

Arm CEO Rene Haas also described the selloff in software-related names as “micro-hysteria.” On the 4th, he said, “If you look at where companies are in adopting AI, we’re not even close yet to the level (AI) can reach.”

Reporter Lim Da-yeon allopen@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Trump, after ruling mutual tariffs illegal: “10% additional tariff on the whole world” [Lee Sang-eun’s Washington Now]](https://media.bloomingbit.io/PROD/news/6db53d1e-258b-487d-b3ae-a052b6e919cf.webp?w=250)

![Wall Street rises on ruling that ‘Trump reciprocal tariffs are unlawful’…uncertainty lifted [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/446b6f3b-7068-4a6a-bd23-fea26c188a3f.webp?w=250)