Summary

- World Liberty Financial said it plans to issue tokens by tokenizing equity interests in the loan proceeds from a Trump resort in the Maldives.

- The tokens will be offered via a private placement to accredited investors, structured to distribute fixed returns along with cash flows from loan proceeds linked to the resort’s development.

- With World Liberty’s WLFI token and Bitcoin (BTC) prices falling sharply, attention is on whether a real estate-backed income-rights tokenization strategy can offer a new breakthrough.

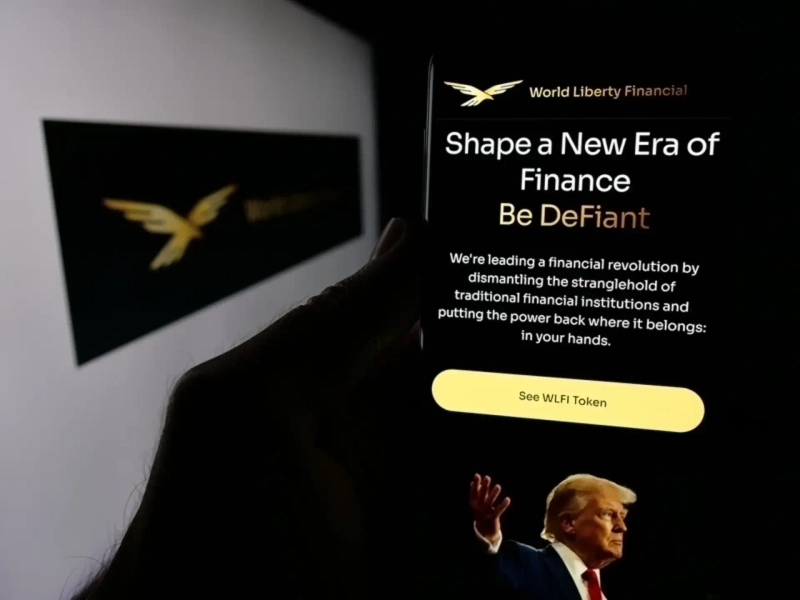

World Liberty Financial, a crypto-asset project linked to U.S. President Donald Trump, said it will tokenize equity interests in the loan proceeds from a Trump resort under development in the Maldives.

According to Bloomberg on the 18th (local time), World Liberty Financial plans to issue blockchain-based tokens tied to loan proceeds related to the Trump International Hotel & Resort Maldives project. The announcement was made at the World Liberty Forum held at the Mar-a-Lago resort in Palm Beach, Florida.

The tokens will be issued via a private placement to verified accredited investors. Investors will receive a fixed return as well as allocations from the cash flow of loan proceeds linked to the resort’s development. The project is being pursued in partnership with Dar Global and tokenization platform Securitize, which is used by BlackRock for its on-chain money market fund.

The Maldives resort is being developed by Dar Global, a London-listed subsidiary of a Saudi Arabian developer, in collaboration with the Trump Organization. It is slated for completion in 2030 and will comprise about 100 ultra-luxury beachfront and overwater villas.

World Liberty Financial has recently been expanding its real-world asset (RWA) tokenization offerings. The company has issued the stablecoin USD1 with a market capitalization of about $5 billion, and it has also launched the WLFI Market, which allows token holders to borrow and lend using coins as collateral. It has also flagged plans to roll out a mobile application and a debit card later this year.

Still, the crypto market has recently been on a weak footing. World Liberty’s WLFI token has lost more than half its value since trading began last year. Bitcoin (BTC) is also down about 50% from its peak in October last year. With the market entering a correction phase, attention is on whether tokenizing real estate-backed income rights can provide a new breakthrough.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

![Trump, after ruling mutual tariffs illegal: “10% additional tariff on the whole world” [Lee Sang-eun’s Washington Now]](https://media.bloomingbit.io/PROD/news/6db53d1e-258b-487d-b3ae-a052b6e919cf.webp?w=250)

![Wall Street rises on ruling that ‘Trump reciprocal tariffs are unlawful’…uncertainty lifted [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/446b6f3b-7068-4a6a-bd23-fea26c188a3f.webp?w=250)