Summary

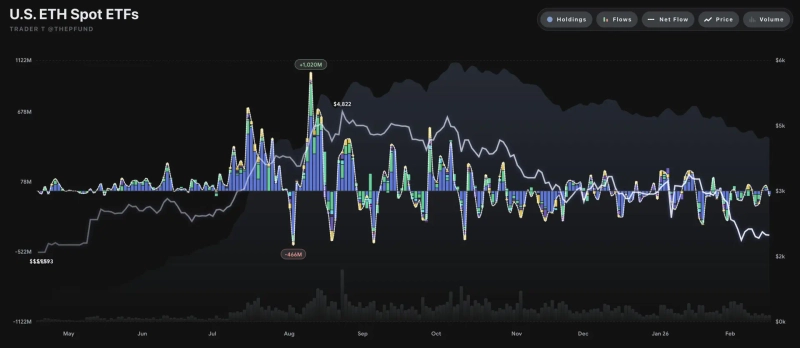

- US spot Ethereum (ETH) exchange-traded funds recorded $42.5 million in net outflows in a single day.

- BlackRock’s ETHA $30.6 million, Fidelity’s FETH $8.23 million, and Invesco’s QETH $3.67 million each posted net outflows.

- With several Ethereum ETFs ending flat, the report said the slowdown in institutional inflows is continuing, following spot Bitcoin ETFs.

US spot Ethereum (ETH) exchange-traded funds recorded net outflows of $42.5 million in a single day.

According to data compiled by Trader T on the 18th (local time), total net outflows across US spot Ethereum ETFs came to $42.5 million.

BlackRock’s iShares Ethereum Trust (ETHA) saw $30.6 million leave the fund. Fidelity Ethereum Fund (FETH) also posted net outflows of $8.23 million. Invesco Ethereum ETF (QETH) recorded outflows of $3.67 million.

Meanwhile, Bitwise Ethereum ETF (ETHW), 21Shares Core Ethereum ETF (CETH), Franklin Ethereum ETF (EZET), VanEck Ethereum ETF (ETHV), Grayscale Ethereum Trust (ETHE) and Grayscale Ethereum Mini Trust (ETH) were flat, with no inflows or outflows.

Following spot Bitcoin ETFs, spot Ethereum ETFs have also continued to see net outflows, pointing to a sustained near-term slowdown in institutional inflows.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

![Trump, after ruling mutual tariffs illegal: “10% additional tariff on the whole world” [Lee Sang-eun’s Washington Now]](https://media.bloomingbit.io/PROD/news/6db53d1e-258b-487d-b3ae-a052b6e919cf.webp?w=250)

![Wall Street rises on ruling that ‘Trump reciprocal tariffs are unlawful’…uncertainty lifted [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/446b6f3b-7068-4a6a-bd23-fea26c188a3f.webp?w=250)