"Software stock plunge is irrational… a bargain-buying opportunity in MS and others"

Summary

- JPMorgan said the recent software share-price plunge reflects an 'irrational selling phase' and called it a bargain-buying opportunity in high-quality software names.

- It said AI-resilient names such as Microsoft and CrowdStrike, which have platforms, infrastructure and data, could see structural benefits.

- It added that if AI revenue contributions and guidance are disclosed at upcoming earnings releases and Investor Day events, they could help spark a rebound in software stocks.

‘SaaS-pocalypse’ fear hits the US… JPMorgan picks ‘AI-resilient’ names

High-quality software stocks remain safe despite the AI offensive

Not that AI is collapsing SaaS

Closer to an industry-structure reshuffle

Firms with infrastructure and data stand to benefit

MS secures profitability via Copilot

CrowdStrike also remains stable

Figma surges 15% after earnings

As ‘SaaS-pocalypse’ fears swept New York markets, sending major software stocks sharply lower, JPMorgan—the world’s largest investment bank—labeled the move an “irrational selling phase.” With the decline excessive, it said this is an opportunity to buy high-quality names on the cheap. “SaaS-pocalypse” is a newly coined term referring to the view that advanced artificial intelligence (AI) could bring an apocalypse to the existing software-as-a-service (SaaS) industry.

“Many stocks are AI-resilient”

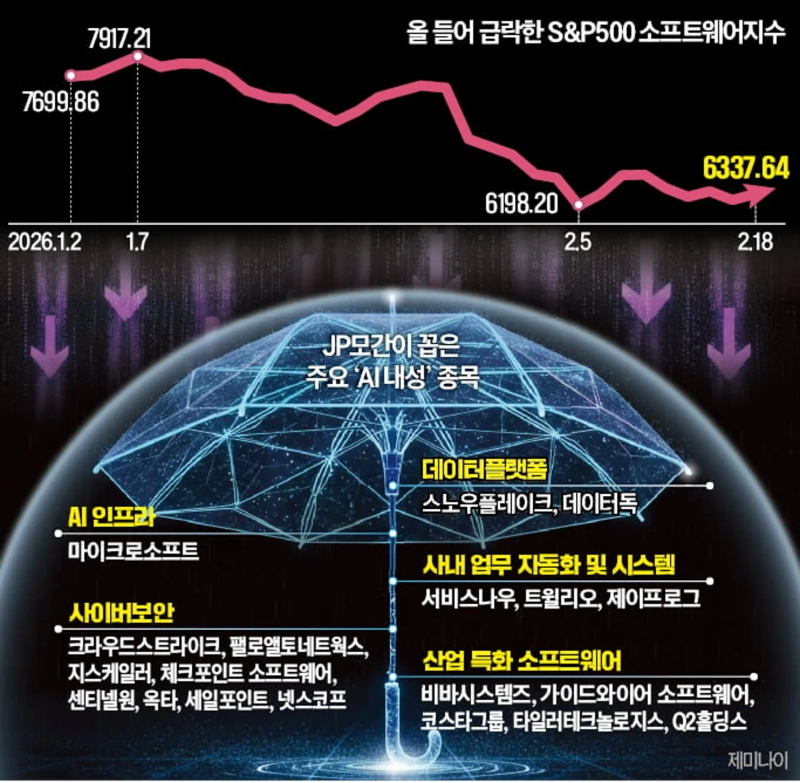

As of the 18th (local time), the S&P 500 Software Index is down more than 17% this year. The drop comes as expectations spread that “AI can replace SaaS” after Anthropic unveiled Claude Cowork, an enterprise AI tool. Salesforce, the world’s largest customer relationship management (CRM) company, has slid nearly 26% since the start of the year. Cloud software firm ServiceNow has fallen by a similar amount. Software’s weighting within the S&P 500, which once reached 12%, has shrunk to 8.4%.

JPMorgan diagnosed the weakness as an “irrational trend,” arguing that AI is not destroying the software industry but is merely in the process of reshaping its structure. It added that software companies that control platforms, infrastructure and data could actually benefit.

At the same time, it presented 19 “AI-resilient” stocks to buy in this software selloff. Many cyber-security names, including Palo Alto Networks and CrowdStrike, were included. As AI technology advances, cyberattacks become more sophisticated, so demand for security is likely to rise steadily, the bank said. Data platforms such as Snowflake and industry-specific software firms like Veeva Systems also made the list. Because AI runs on vast amounts of data, the strategic value of companies that own the infrastructure is rising, it argued.

“The software correction won’t last long”

It highlighted Microsoft and CrowdStrike in particular, saying they have structural moats that are unlikely to be shaken by external changes. JPMorgan said, “As AI spreads, productivity improvements are more likely to emerge than their existing workflows being threatened,” adding that “long-term contracts and high switching costs can serve as a buffer against short-term volatility.”

Microsoft is monetizing AI by applying “Copilot” across the Windows and Office 365 ecosystem. Through its cloud infrastructure “Azure,” it can also directly benefit from rising demand for AI compute, it said. Cybersecurity company CrowdStrike, too, was seen as having solid fundamentals despite the recent pullback. The more hackers use AI to enhance attacks, the more robust defense technology is needed. The bank said its AI detection capabilities built on vast data, along with a subscription model centered on multi-year contracts, support performance.

JPMorgan also forecast that this correction is unlikely to last very long. Alongside earnings releases by major software companies, “Investor Day” events starting at the end of this month are expected to give management a forum to push back against pessimism. It said that once AI revenue contributions and guidance are disclosed, they could drive a rebound in share prices.

There are also signs sentiment may be turning. After design software firm Figma disclosed fourth-quarter revenue for last year that surged more than 40% year on year, its shares jumped more than 15% in after-hours trading. Dylan Field, Figma’s chief executive officer (CEO), said, “Software won’t disappear,” adding, “Competition will intensify with the emergence of AI, but overall demand will actually increase.”

Reporter Ji-yoon Yang yang@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Trump, after ruling mutual tariffs illegal: “10% additional tariff on the whole world” [Lee Sang-eun’s Washington Now]](https://media.bloomingbit.io/PROD/news/6db53d1e-258b-487d-b3ae-a052b6e919cf.webp?w=250)

![Wall Street rises on ruling that ‘Trump reciprocal tariffs are unlawful’…uncertainty lifted [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/446b6f3b-7068-4a6a-bd23-fea26c188a3f.webp?w=250)