US spot Ethereum ETFs see net outflows of $130.51 million

Doohyun Hwang

Summary

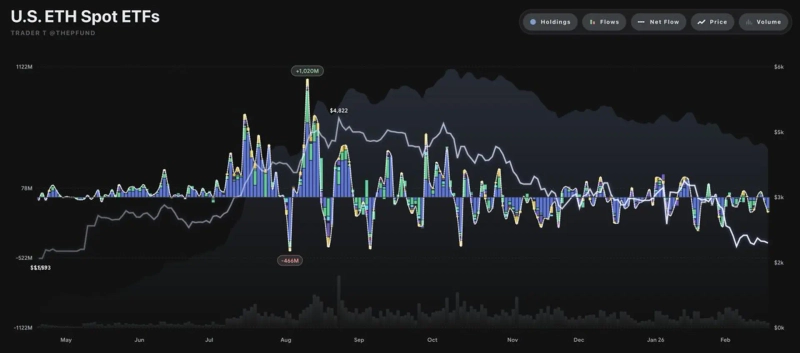

- Heavy outflows from the US spot Ethereum ETF market were reported to have continued for a second straight session.

- Total daily net outflows on the 19th were tallied at $130.51 million, with $97.11 million leaving BlackRock’s ETHA.

- Ethereum was reported to be trading around $1,950, down about 1%, on Binance’s Tether (USDT) market.

Heavy fund outflows from the US spot Ethereum exchange-traded fund (ETF) market extended into a second consecutive session.

According to data from TraderT, total daily net outflows from spot Ethereum ETFs on the 19th (local time) came to $130.51 million.

By product, BlackRock’s ETHA posted the largest outflow, with $97.11 million leaving the fund. Fidelity’s FETH saw $11.62 million in net outflows, Grayscale Mini ETH $18.44 million, and Bitwise’s ETHW $3.34 million.

Meanwhile, 21Shares (CETH), Invesco (QETH), Franklin (EZET), VanEck (ETHV) and Grayscale (ETHE) recorded no inflows or outflows.

On the day, Ethereum was trading around $1,950 on Binance’s Tether (USDT) market, down about 1% from the previous day.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![Trump, after ruling mutual tariffs illegal: “10% additional tariff on the whole world” [Lee Sang-eun’s Washington Now]](https://media.bloomingbit.io/PROD/news/6db53d1e-258b-487d-b3ae-a052b6e919cf.webp?w=250)

![Wall Street rises on ruling that ‘Trump reciprocal tariffs are unlawful’…uncertainty lifted [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/446b6f3b-7068-4a6a-bd23-fea26c188a3f.webp?w=250)