Summary

- It was reported that the price of Bitcoin has surpassed $100,000 for the first time, causing the yield of related ETFs to soar.

- Investor interest in ETFs including Coinbase and MicroStrategy is increasing.

- The securities industry expects the upward trend of cryptocurrencies to continue and positively evaluates the yield outlook for ETFs.

Coinbase·MicroStrategy

ETFs Including Related Stocks on the Rise

'RISE American AI Tech' Jumps 7.8%

Bitcoin's price has surpassed $100,000 for the first time, and the yield of exchange-traded funds (ETFs) containing related companies is also soaring.

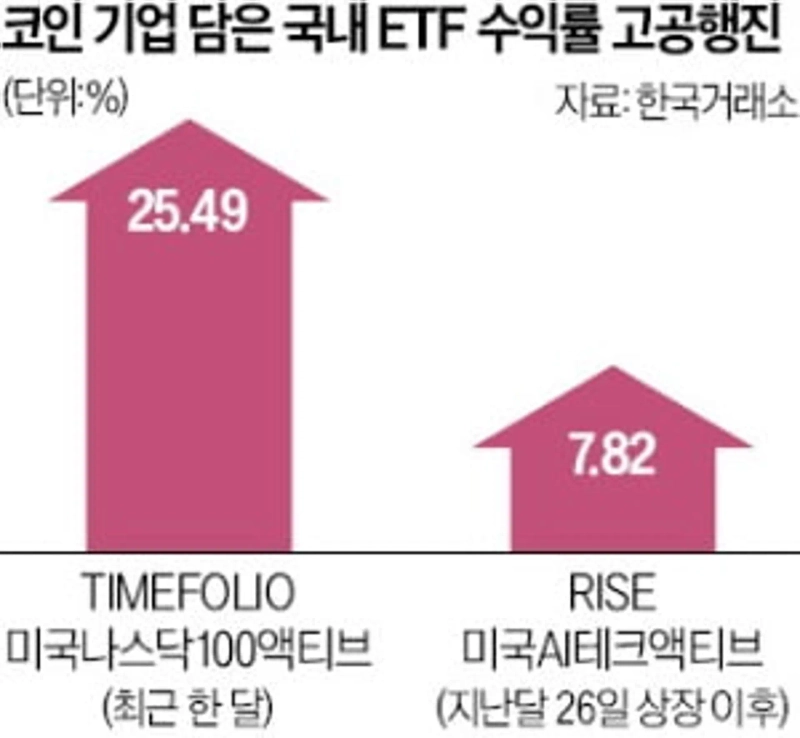

On the 6th, the 'RISE American AI Tech Active' ETF closed at 10,745 won, up 0.89%. Since its listing on the 26th of last month, it has achieved a yield of 7.82% in just nine trading days. This ETF includes the U.S. cryptocurrency exchange Coinbase with a weight of 6.36%.

The 'TIMEFOLIO NASDAQ 100 Active' ETF also recorded a yield of 25.49% over the past month. This product includes MicroStrategy, the company with the largest Bitcoin holdings, at 10.43% and Coinbase at 6.75%.

As Bitcoin's strength leads to a rise in the stock prices of cryptocurrency-holding companies and exchanges, investor interest is focusing on ETFs containing related companies. After the U.S. presidential election, Bitcoin's price surged by 28.71%, and the stock prices of MicroStrategy and Coinbase rose by 49.87% and 26.05%, respectively.

MicroStrategy is the world's largest coin-related company, holding over 400,000 Bitcoins. Coinbase is the largest cryptocurrency exchange in the U.S. and is a representative company that directly benefits from the increase in cryptocurrency prices and trading volumes. Domestic investors are prohibited from trading Bitcoin spot ETFs listed in the U.S., which is why they often invest in ETFs containing coin-related companies.

The securities industry expects the upward trend of cryptocurrencies to continue and positively evaluates the yield outlook for related ETFs. Hong Sung-wook, a researcher at NH Investment & Securities, said, "We believe the effects of President-elect Donald Trump's election victory have not yet been fully reflected in the market," adding, "If regulations are eased after the new government is inaugurated, the industry will begin to blossom in earnest from the second half of next year." Lim Min-ho, a researcher at Shinyoung Securities, said, "Following MicroStrategy's success, more companies like Samra Scientific, Samara, and Horse Therapeutics are deciding to invest in Bitcoin for strategic purposes," adding, "From next year, the valuation gains of cryptocurrencies in the U.S. will be reflected as non-operating income, expanding the benefits for related companies."

Yang Hyun-joo, reporter hjyang@hankyung.com

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit