[Analysis] "Stablecoin Inflows Slow Down... Possibility of Short-Term Adjustment Arises"

Summary

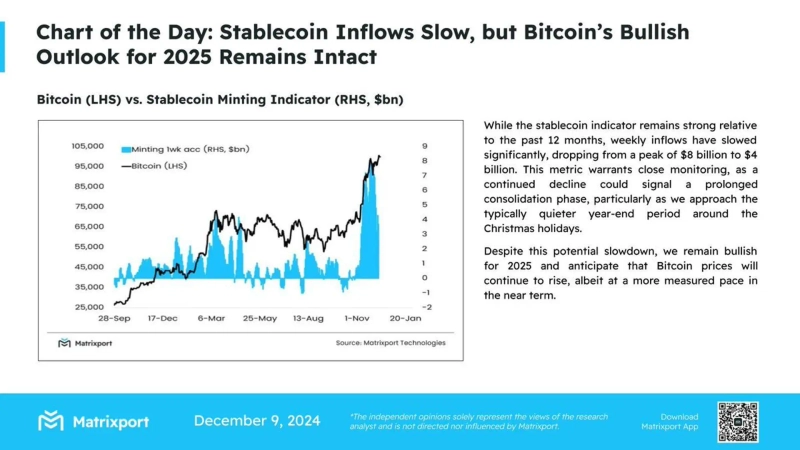

- Matrixport stated that recent stablecoin inflows have decreased from $8 billion to $4 billion per week.

- An analysis has been raised that the decrease in market liquidity has increased the likelihood of a short-term adjustment in asset prices.

- Matrixport added that despite the potential slowdown, Bitcoin is expected to rise in the long term next year.

Recently, there is an analysis suggesting that the possibility of a short-term adjustment is increasing as stablecoin inflows show a slowdown.

On the 9th, the virtual asset (cryptocurrency) service provider Matrixport stated through X (formerly Twitter) that "the inflow of funds into the stablecoin market has decreased from $8 billion to $4 billion weekly," and "the continuous slowdown suggests the potential for consolidation (forming a box range)." It is explained that as the market liquidity decreases, asset prices are also slowing in their upward trend, increasing the likelihood of a short-term adjustment.

A decrease in the circulation of stablecoins typically means that the inflow of funds into the virtual asset market is decreasing.

Matrixport added, "Despite the potential slowdown in stablecoin inflows, we expect Bitcoin prices to rise in the long term, next year."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.