Editor's PiCK

[Breaking] Abolition of Financial Investment Income Tax and 2-Year Delay in Cryptocurrency Taxation Confirmed… Passed by National Assembly

Summary

- It was announced that with the abolition of the financial investment income tax and the two-year delay in cryptocurrency taxation, related investors can temporarily escape the tax burden.

- It is expected that the short-term investment attractiveness of the stock and cryptocurrency markets will increase with the passage of the Income Tax Law amendment.

- According to the amendment, taxation on cryptocurrency income is scheduled to apply from 2027, providing investors with a longer preparation period.

The amendment to the Income Tax Law, which includes the abolition of the financial investment income tax and a two-year delay in cryptocurrency taxation, passed the plenary session of the National Assembly on the 10th.

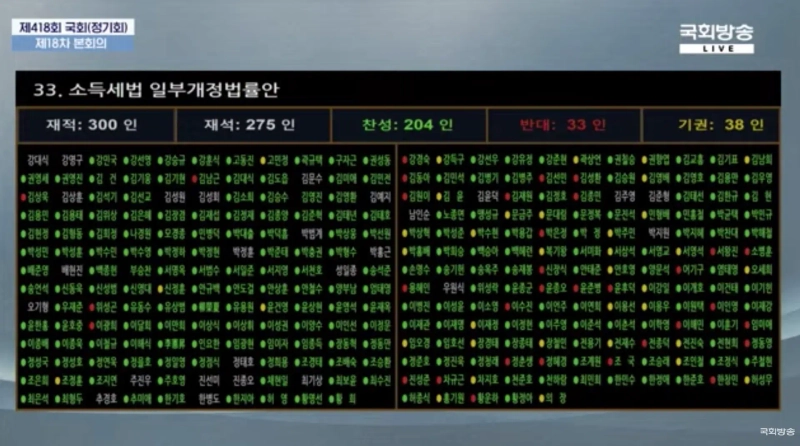

In the plenary session held at the National Assembly in Yeouido, Seoul, the amendment to the Income Tax Law was passed with 204 votes in favor, 33 against, and 38 abstentions out of 275 members present. The amendment includes the abolition of the financial investment income tax on financial investment income exceeding 50 million won from stocks, bonds, funds, and derivatives, and a two-year delay in the implementation of cryptocurrency income taxation from January 1, 2025, to January 1, 2027.

The financial investment income tax, introduced in June 2020, was a system that taxed investors who earned income exceeding a certain amount (50 million won for stocks, 2.5 million won for others) from financial investments, and was set to be implemented on January 1 next year. However, it was ultimately scrapped after Lee Jae-myung, leader of the Democratic Party of Korea, agreed to the government's and ruling party's 'abolition of the financial investment income tax' last month.

With the handling of the amendment to the Income Tax Law, the taxation on cryptocurrency investment income has been postponed for another two years. Cryptocurrency taxation applies a 22% tax rate to the amount exceeding the basic deduction of 2.5 million won from investment income. This provision under the Income Tax Law was originally scheduled to be implemented from 2022 but has been postponed twice.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.