Summary

- CEO Joo Ki-young stated that the strategic reserve of Bitcoin is a feasible approach to solving US debt.

- CEO Joo argued that securing 1 million BTC by 2050 can offset 36% of US debt.

- The US's Bitcoin reserve could contribute to Bitcoin securing global authority.

There is a claim that the strategic reserve of Bitcoin (BTC) can solve the US debt.

On the 20th (local time), Joo Ki-young, CEO of CryptoQuant, stated on X, "Solving US debt through the strategic reserve of Bitcoin is a feasible approach."

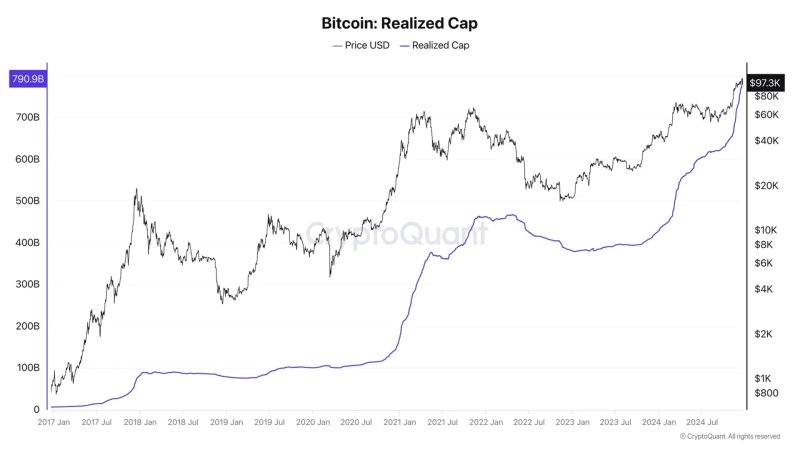

He mentioned, "Over the past 15 years, $790 billion has flowed in, and Bitcoin has reached a market capitalization of $2 trillion," adding, "This year alone, $352 billion has flowed in, increasing by an additional $1 trillion." He continued, "70% of US debt is held by domestic institutions," and argued, "Considering this, securing 1 million BTC by 2050 can offset 36% of the debt." Furthermore, he noted, "The remaining 30% of debt held by foreign institutions may oppose debt repayment through Bitcoin," but added, "Since not all debt is resolved with Bitcoin, it is quite feasible."

CEO Joo suggested, "The strategic reserve of Bitcoin by the US is the first step in Bitcoin securing global authority equivalent to gold," indicating the possibility of Bitcoin being accepted in a broader market.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![Dow Tops 50,000 for First Time Ever as “Oversold” Narrative Spreads [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/1c6508fc-9e08-43e2-81be-ca81048b8d11.webp?w=250)