PiCK

How Far Will the High Climb of the Won-Dollar Exchange Rate Go... "Possible to Surpass 1500 Won"

Summary

- NH Investment & Securities stated that domestic political uncertainty is increasing short-term volatility in the exchange rate, with a possibility of surpassing 1500 won.

- There seems to be little benefit in chasing dollar purchases, and the exchange rate is expected to stabilize with the emergence of export company volumes.

- The average exchange rate for the first half of next year is expected to remain in the early 1400 won range.

NH Investment & Securities Report

"Little Benefit in Chasing Dollar Purchases"

"Early 1400 Won Range Expected for First Half of Next Year"

Since the passage of the impeachment bill by the acting president, political instability has intensified, causing a sharp rise in the exchange rate. On the previous trading day, the 27th, the won-dollar exchange rate exceeded 1486 won during the day, marking the highest level in 15 years and 9 months.

In this context, the securities industry sees domestic political uncertainty as increasing short-term volatility in the exchange rate more than external factors, suggesting that if additional impeachments and foreign capital outflows materialize, it could surpass 1500 won.

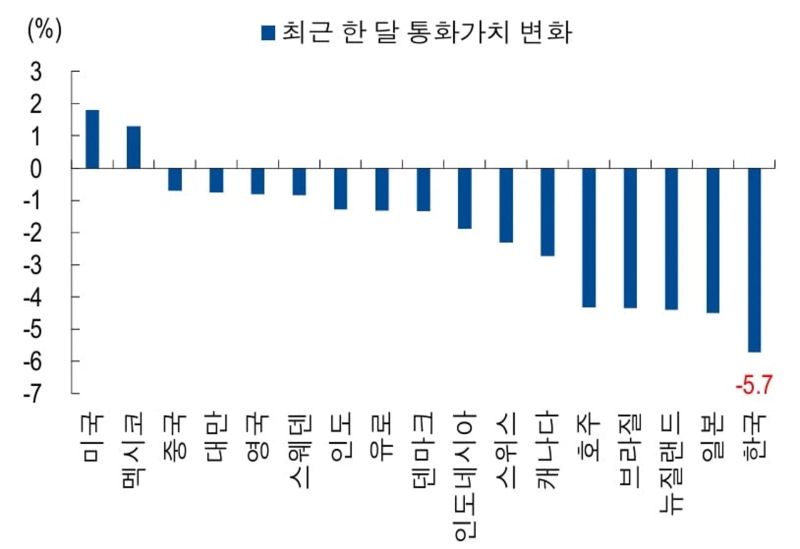

On the 30th, Kwon A-min, a researcher at NH Investment & Securities, stated, "The exchange rate level of around 1480 won reflects the domestic fundamental deterioration and political uncertainty amid the dollar strength betting from Trump and the Fed, and is considered excessively weak compared to major currencies."

Researcher Kwon mentioned that if domestic variables intensify, there is a possibility of surpassing 1500 won in the short term. He said, "While maintaining the outlook on external factors, domestic political uncertainty is currently increasing short-term volatility in the exchange rate," adding, "It may not be the most likely scenario, but if additional impeachments and foreign capital outflows actually occur, it could exceed 1500 won."

He advised that there seems to be little benefit in chasing dollar purchases. According to him, the uncertainty of Trump's policies after the presidential election and the strong dollar outlook following the FOMC and Fed's rate cut expectations have already been somewhat reflected in the global dollar 'buy' betting.

Researcher Kwon said, "If trading volume returns to normal levels at the beginning of the new year and short-term borrowing by banks through the emergence of export company volumes expands, the exchange rate level will also stabilize." He continued, "The average exchange rate for the first half of the year is expected to be in the early 1400 won range, and the trajectory for the year is expected to show 'high early, low later' from the already high current level."

Shin Min-kyung, Hankyung.com reporter radio@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] Toss Reviews Acquisition of Overseas Crypto Exchange… In Talks With US Institutional Platform](https://media.bloomingbit.io/PROD/news/148973fc-2c49-4ab4-8934-c7e9d49c847b.webp?w=250)

![[Exclusive] Toss sets up a dedicated blockchain unit…begins building digital-asset infrastructure](https://media.bloomingbit.io/PROD/news/76d3ff2d-0b0f-402b-b842-90eeeb7f183d.webp?w=250)