Editor's PiCK

US Bitcoin Spot ETFs Record Net Outflows for 4 Consecutive Trading Days

Doohyun Hwang

Summary

- US Bitcoin spot ETFs reported net outflows for 4 consecutive trading days.

- Multiple ETFs including Grayscale's GBTC and Bitwise's BITB experienced fund outflows.

- Bitcoin recorded a 1.8% decline in the Binance Tether market.

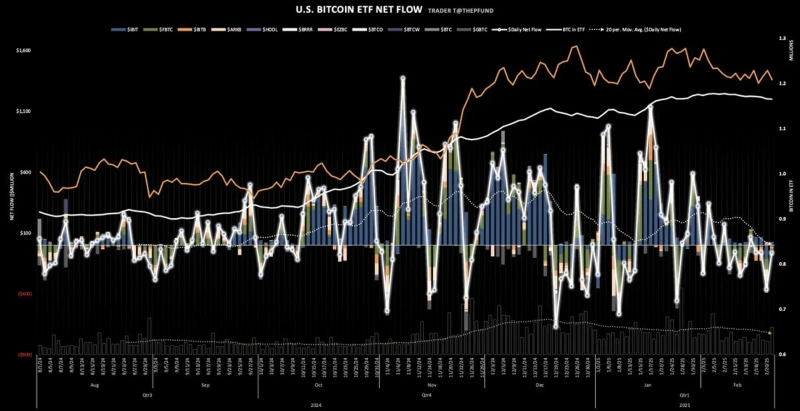

US Bitcoin (BTC) spot ETFs have experienced net outflows for 4 consecutive trading days.

According to data from TraderT on the 21st (local time), Bitcoin spot ETFs traded in the US recorded total net outflows of $62.81 million.

While BlackRock's IBIT ($21.61 million) and VanEck's HODL ($4.71 million) saw net inflows, Grayscale's GBTC ($60.08 million), Bitwise's BITB (-$16.58 million), and Fidelity's FBTC ($12.47 million) all experienced fund outflows.

On this day, Bitcoin is trading at around $96,400 on the Binance Tether (USDT) market, down 1.8% compared to the previous day.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Analysis] "XRP risks repeating the 2022 rout…most short-term investors in the red"](https://media.bloomingbit.io/PROD/news/845f37bb-29b4-4bc5-9e10-8cafe305a92f.webp?w=250)