Summary

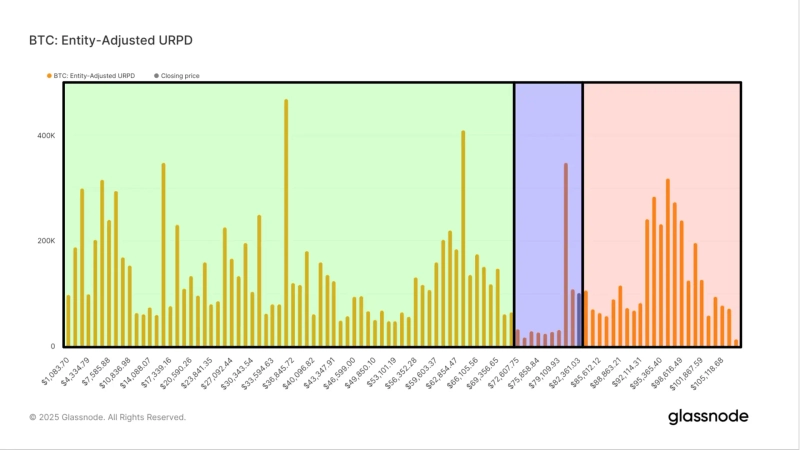

- Analysis suggests that "if Bitcoin falls below $80,000, there is a high possibility of a sharp decline."

- Due to President Trump's election, a Bitcoin supply gap has occurred, and if prices fall, they will be lower than existing buyers' purchase prices, likely resulting in insufficient additional buying pressure.

- Currently, 20% of Bitcoin holding addresses are at a loss, suggesting additional selling pressure and potential price declines.

An analysis suggests that Bitcoin (BTC) is likely to plummet if it falls below $80,000.

On the 17th (local time), CoinDesk cited Glassnode data stating, "If Bitcoin falls below $80,000, it is likely to plummet," and analyzed that "due to Bitcoin's surge following President Trump's election, a 'supply gap' has occurred between $70,000 and $80,000." This means there are few investors who purchased Bitcoin in this price range, making it unlikely for a support level to form.

The report continued, "If Bitcoin's price falls below $80,000, it will be lower than the average purchase price of existing buyers, making additional buying pressure likely to be insufficient," adding that "a significant drop to the March 2024 high ($73,000) is expected."

Furthermore, additional selling pressure is anticipated to be strong. The media outlet stated, "Currently, 20% of Bitcoin holding addresses are at a loss," and "there is a possibility of additional selling to avoid losses, which could accelerate the price decline." It added, "Bitcoin short-term holders have already sold 100,000 BTC during the recent downturn."

As of 8:31 PM, Bitcoin is trading at $83,542 on Binance's USDT market, down 0.95% compared to 24 hours ago.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit