"Bitcoin Spot ETF Struggling with New Capital Inflows... Macroeconomic Catalysts Needed"

Summary

- "New capital inflows into Bitcoin spot ETFs require macroeconomic catalysts," they stated.

- Matrixport reported that "current Bitcoin funding rates and market trading volumes are low."

- "They emphasized that volume from short-term traders is moving to long-term holders," they added.

An opinion has emerged that macroeconomic catalysts are needed for large-scale new capital inflows into Bitcoin (BTC) spot exchange-traded funds (ETFs).

On the 18th (local time), Matrixport stated via X, "Currently, both Bitcoin funding rates and market trading volumes are in a sluggish state," adding that "special macroeconomic catalysts are needed for large-scale new capital to flow into Bitcoin spot ETFs."

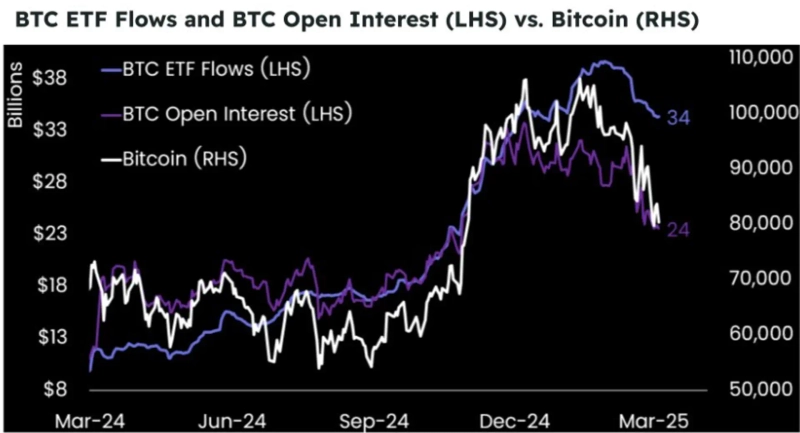

They continued, "Until mid-December last year, Bitcoin perpetual futures open interest (OI) reached approximately $35 billion," explaining that "since then, futures positions have dropped sharply, while Bitcoin spot ETF inflows have remained relatively stable." They added that "this indicates Bitcoin volume from short-term traders is being transferred to long-term holders."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit