Editor's PiCK

'One More Step Left'... Can Ripple Resolve Institutional Sales Restrictions?

Summary

- The SEC withdrew its appeal against Ripple's unregistered securities sales, indicating that the legal dispute may proceed positively.

- Ripple is continuing its cross-appeal to resolve the fines and institutional sales legal disputes.

- The industry is focusing on Ripple's legal response, suggesting the possibility of gaining an advantage in future negotiations.

SEC Withdraws Appeal on Unregistered XRP Sales

Ripple's Cross-Appeal Still Ongoing

Fines and Institutional Sales Disputes Likely to Continue

The U.S. Securities and Exchange Commission (SEC) has withdrawn its appeal in the lawsuit against Ripple Labs for unregistered securities sales, leading to opinions that remaining legal disputes, such as institutional sales restrictions, may also proceed positively.

On the 19th (local time), Brad Garlinghouse, CEO of Ripple Labs, announced via X (formerly Twitter) that the SEC had withdrawn its appeal against Ripple. This marks a major turning point in the four-year dispute between the SEC and Ripple. Garlinghouse celebrated, saying, "Today is a victory day. The SEC has finally given up its long-standing appeal," and "We have won on all key legal issues, legally proving that XRP is not a security."

Following the news, the price of XRP surged. On the 19th, XRP traded at around $2.5, up approximately 14% on the Binance USDT market, reflecting market expectations. However, not all disputes between the SEC and Ripple have been resolved. Ripple has not withdrawn its cross-appeal against the New York court ruling from last October.

Legal Risks of Fines and Institutional Sales Restrictions Remain

In December 2020, the SEC filed a lawsuit claiming that Ripple Labs and its executives, including Brad Garlinghouse, distributed or sold unregistered securities worth a total of $2.6 billion to institutional and individual investors. After three years of legal battles, in July 2023, Judge Analisa Torres of the Southern District of New York ruled in summary judgment that XRP itself is not a security, classifying the security status based on the sales method.

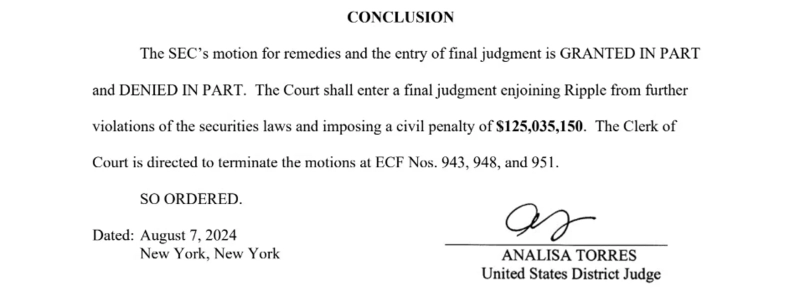

Judge Torres interpreted that "XRP sold through distribution and programmatic (retail sales) methods does not constitute an investment contract and therefore does not violate federal securities laws, but XRP sales to institutional investors do constitute an investment contract and are unregistered securities sales." In the final ruling last August, she confirmed a $125 million fine and an order restricting XRP sales to institutional investors for Ripple's institutional token sales.

In October last year, the SEC filed an appeal related to programmatic sales, and Ripple also proceeded with a cross-appeal regarding the $125 million fine and institutional sales sanctions. On the 19th, the SEC decided to withdraw its appeal, but Ripple's appeal is still ongoing.

Eleanor Terrett, a Fox Business reporter, stated, "Judge Torres's ruling remains valid, and Ripple's cross-appeal has not been withdrawn. The appeal regarding fines and institutional sales sanctions continues. The direction of additional negotiations and legal battles remains uncertain."

Ripple indicated that it would continue to respond to the ongoing cross-appeal. Brad Garlinghouse, CEO, said in an interview with Bloomberg on the 20th (local time), "We have spent over $150 million on litigation over the years, and the $125 million fine is held in an escrow account. We want to recover it through due process."

The Ball is Now in Ripple's Court... Can Legal Disputes Be Concluded?

The industry is focusing on Ripple Labs' future legal responses and the progress of the appeal. Recently, opinions have emerged that the SEC's withdrawal of its appeal increases the likelihood of a settlement in Ripple's cross-appeal.

Stuart Alderoty, Ripple's Chief Legal Officer (CLO), stated on his X, "With the SEC's withdrawal of its appeal, the initiative has now shifted to Ripple," and "We will carefully review how to proceed with the cross-appeal related to institutional sales and fines."

If Ripple continues with the appeal, there is a possibility that the SEC's recognition of the security status of institutional token sales, as acknowledged by Judge Torres, may not be upheld. Consequently, if future negotiations proceed, Ripple may have the upper hand. Attorney John Deaton explained, "The SEC likely does not want Ripple to proceed with the cross-appeal. If the appeal proceeds and the court does not recognize the security status of XRP institutional sales, it could set a disadvantageous precedent that weakens the SEC's regulatory and supervisory authority."

There is also speculation that a settlement between the two sides may already be underway. Attorney Fred Rispoli predicted, "It is quite unnatural for the SEC to withdraw its appeal without linking it to Ripple's cross-appeal," and "The two sides are likely already negotiating Ripple's appeal withdrawal and fine reduction."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit