'Tariff Shock' but Safe Asset 'Dollar' Plummets?…"Distrust in Trump" [Lee Sang-eun's Washington Now]

Summary

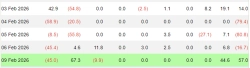

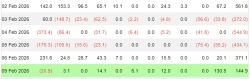

- It was reported that the S&P500 and Nasdaq indices fell by 4.8% and 6%, respectively, marking the largest drop since the COVID-19 pandemic.

- The market stated that the US dollar did not serve its usual role as a safe asset, with its value falling by 1.67%.

- It was reported that investment demand for short-term US Treasury bonds increased amid uncertainty caused by the Trump administration's tariff policies.

S&P500 down 4.8%, Nasdaq down 6%..Apple plummets 9%, Best Buy 17%

Brent crude and West Texas Intermediate prices also down about 7%

The market is showing significant concern over the Trump administration's tariff policies, which are more aggressive and rough than expected.

The S&P500 index fell 4.8% and the Nasdaq index fell 6% today. This was the largest drop since the sharp decline caused by the COVID-19 pandemic in 2020.

The market is fleeing to safe assets. It's difficult to gauge where and how much the shock from tariffs will impact.

Typically, when seeking safe assets, people rush to the US dollar, but this time, since the epicenter of the shock is the US, the value of the US dollar has instead fallen. The dollar index fell 1.67% today, marking the largest daily drop since 2022.

Market experts pointed out that confidence and trust in dollar-denominated assets are generally disappearing. Previously, Michael Cembalest, head of market and investment strategy at JP Morgan Asset Management, described the stock market in a report titled '50 Shades of Grey' as "the best voting machine reflecting prospects for profit growth, stability, liquidity, and the rule of law, which cannot be indicted, arrested, deported, threatened, intimidated, or harassed." ING's currency strategy expert Francesco Pesole told the Financial Times (FT) regarding the drop in the dollar's value, "It reflects a loss of confidence in dollar-denominated assets," adding, "The market is voting that it does not trust Trump's 100 days."

However, not all dollar assets have fallen, and there has been an increase in investment demand for short-term US Treasury bonds. This seems to reflect the judgment that the possibility of the Federal Reserve maintaining a more accommodative monetary policy has increased as the US economy deteriorates. However, if the tariff policy stimulates inflation, it will be difficult for the Fed to move easily, so it remains to be seen which factors will more heavily influence the Fed.

This volatile market is expected to continue for the time being. There is a possibility that major countries may take retaliatory tariff measures. Companies may have to invest in supply chain adjustments, albeit reluctantly, as demand weakens. Such investments are far from innovation or technology development, so they are likely to be a pressure factor on performance for the time being. With more than 60% tariffs announced on China, Apple's stock price plummeted 9.2% today. The stock price of Best Buy, the number one home appliance seller, also fell 17%.

As the possibility of a global economic downturn increases, oil prices have also fallen. Brent crude prices fell 6.8%, currently trading below $70 per barrel. West Texas Intermediate is trading at $66 per barrel, down 7.1%.

However, President Trump did not attribute any significance to the stock market crash, saying it was expected. He said that the US economy is like a sick patient that needs economic surgery, and that there will be a boom afterward. When asked if he was willing to negotiate on mutual tariffs with other countries, he replied, "It depends on whether they give us something good."

Washington = Correspondent Lee Sang-eun selee@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.