PiCK

[New York Stock Market Briefing] Is a Trade War Triggered by Tariffs?… New York Stock Market, 'Worst in 5 Years'

Summary

- The New York Stock Market had its worst day in 5 years due to the Trump administration's imposition of reciprocal tariffs and China's retaliation.

- Major indices plunged, raising concerns about recession and policy uncertainty.

- Investor confidence was significantly shaken by the Fed's hawkish remarks and the increased probability of a global economic recession.

The New York Stock Exchange had its worst day since 2020. This comes as the Donald Trump administration imposed reciprocal tariffs and the Chinese government retaliated.

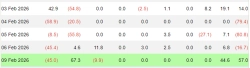

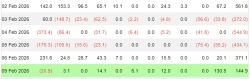

On the 4th (local time) at the New York Stock Exchange (NYSE), the Dow Jones Industrial Average plunged 2,231.07 points (-5.5%) to close at 38,314.86. The Standard & Poor's (S&P) 500 index fell 322.44 points (-5.97%) to 5,074.08, and the Nasdaq Composite Index dropped 962.82 points (-5.82%) to 15,587.79.

The S&P 500 index recorded its largest daily drop in five years since March 16, 2020, when the pandemic fear struck (-12%). The Nasdaq index has fallen more than 20% since its peak on December 16 last year, and the decline over the past two days alone exceeds 11%. The Dow Jones index has fallen 15% from its peak on December 4.

This is due to increased policy uncertainty and recession risks following President Trump's announcement of reciprocal tariffs. Moreover, the Chinese government's announcement to impose a 34% tariff on all U.S. imports in response to the Trump administration's reciprocal tariffs has further heightened fears of a trade war and recession.

Bruce Kasman, chief economist at JPMorgan Chase, saw the probability of a global economic recession this year rising from 40% to 60%.

Remarks by Jerome Powell, chairman of the U.S. Federal Reserve (Fed), also worsened investor sentiment. Chairman Powell made hawkish remarks, saying, "It's too early to talk about policy changes." Investors who expected the Fed's market response measures were disappointed and sold off.

Although the March employment figures released on this day far exceeded market expectations, they did not help quell market unrest as investors focused on the potential inflation and recession that could be caused by reciprocal tariffs on the future U.S. economy.

The sharp decline on this day continued across all sectors, including cyclical and defensive stocks.

Apple, the top market cap, and Nvidia, the leading AI chip stock, each plunged 7.3%, and Tesla, led by Elon Musk, plummeted 10.5%. Even companies with low supply chain and revenue dependence on China, like Meta Platforms (-5%), the parent company of Facebook, could not escape the fear of recession.

Experts believe that the two-year bull market in the U.S. stock market has come to an end with President Trump's announcement of reciprocal tariffs.

Reporter Lee Song-ryeol from Hankyung.com yisr0203@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.