Australian stock market 'wobbles' due to Trump's tariffs... Falls up to 6.5% during the day

Summary

- It was reported that the Australian stock market fell by up to 6.5% due to President Trump's 'reciprocal tariff bomb'.

- The financial market is seeing the possibility of a rate cut by the Reserve Bank of Australia (RBA).

- The value of the Australian dollar has the potential for further decline, and news of a request to start U.S. tariff negotiations was reported.

Australia 10% Reciprocal Tariff

Impact of China's Retaliatory Tariff

Amid concerns over the escalation of a global trade war due to U.S. President Donald Trump's 'reciprocal tariff bomb', the Australian stock market also wobbled.

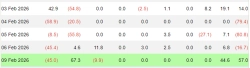

On the 7th (local time), the S&P/ASX200 index, representing the Australian stock market, fell by up to 6.5% during the day. This is the largest drop since March 2020, when the stock market was severely hit by the COVID-19 pandemic. The value of the Australian dollar against the U.S. dollar and Australian government bond yields also fell significantly.

As of 12:30 PM, the S&P/ASX200's decline narrowed to around 3.7%, but the financial market expects the Reserve Bank of Australia (RBA) to quickly cut rates to stimulate the economy.

Sean Callow, a senior analyst at InTouch Capital Markets, said, "The Australian dollar may not easily collapse due to falling U.S. interest rates and recession fears, but there is room for further decline," adding, "It wouldn't be surprising if the Australian dollar falls to 0.58 U.S. dollars."

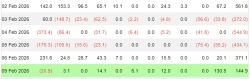

Currently, in the foreign exchange market, 1 Australian dollar is trading at around 0.6 U.S. dollars. On the 2nd, the U.S. government imposed a 10% reciprocal tariff on Australian imports. This is the lowest level compared to other countries.

However, as the Australian economy is heavily influenced by the Chinese economy, concerns about a slowdown in the Chinese economy, which has been hit with a 34% retaliatory tariff, are worsening the outlook for the Australian economy.

Meanwhile, Australian Prime Minister Anthony Albanese announced that he has requested the U.S. to start tariff negotiations. Prime Minister Albanese said, "Trump's tariffs are negatively impacting global trade and the global economy, and this is hitting our stock market hard," adding, "We will continue to consult with the U.S."

The S&P/NZX50 index, representing the New Zealand stock market, also fell by up to 3.7% on the same day and is continuing to decline around 3% as of 2:30 PM.

Reporter Park Subin, Hankyung.com waterbean@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.