Summary

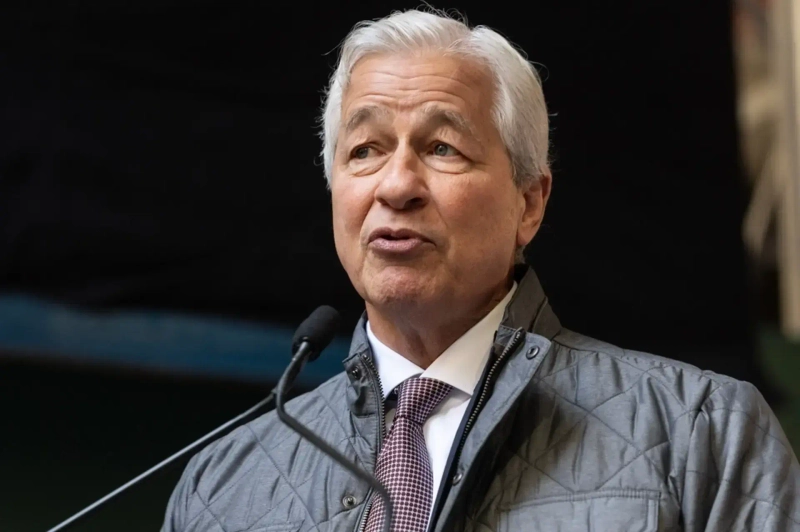

- Jamie Dimon, JP Morgan CEO, stated that Trump's tariffs are placing a major burden on the US economy and are likely to cause growth to slow down.

- He mentioned the likelihood of high interest rates, emphasizing that the US economy is facing various turmoils.

- Dimon noted that US stocks and asset prices are optimistically evaluated, and he lacks confidence in the possibility of a soft landing.

"Inflation Impact Greater Than Expected, Increasing Likelihood of High Interest Rates"

"US Stock Prices Still High Assuming Soft Landing"

Jamie Dimon, CEO of JP Morgan, stated that "the tariffs announced by President Trump last week will significantly raise prices in the US and place a major burden on the US economy."

According to foreign media such as CNBC on the 7th (local time), CEO Dimon revealed this in his annual shareholder letter. He pointed out that "while it is uncertain whether the tariffs will cause a recession, US growth will slow down." Dimon emphasized that "there is a high possibility that inflation will affect not only imported goods but also domestic prices." This is due to rising input costs and increased demand for domestic products.

He mentioned that Trump's tariff policy "has created many uncertainties, including its impact on global capital flows, the dollar, corporate profits, and the responses of trade partners." He argued that "the negative effects of Trump's tariffs will accumulate over time and become difficult to reverse, so they need to be resolved quickly."

Dimon was the first among major bank CEOs to publicly comment on Trump's tariff policy. He mentioned in January that the market needed to overcome tariff concerns. However, after the announcement last week of Trump's reciprocal tariff range, which far exceeded the expected 10-15% anticipated by the market, his tone on tariff policy changed.

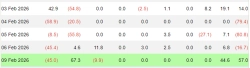

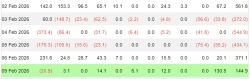

After Trump's announcement on the 2nd shocked the global market, the US stock market ended its worst week since the COVID-19 pandemic in 2020.

Dimon noted that while the US economy has performed well with $11 trillion in government borrowing and spending over the past few years, it "has been weakening in recent weeks." He added that inflation is likely to be more severe than many expect, and interest rates may remain high despite economic slowdown.

He mentioned that "the US economy is facing significant turmoil, including geopolitics." He cited the positive aspects of tax reform and deregulation, the negative aspects of tariffs and trade wars, persistent inflation, high fiscal deficits, still high asset prices, and volatility as factors of turmoil.

Dimon said that US stocks and credit spreads are still potentially too optimistic. The market has "priced assets assuming a soft landing." However, he said he cannot be sure of the US economy's ability to achieve a soft landing.

Guest reporter Kim Jung-ah kja@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.