PiCK

Tariff 'Record Rollercoaster'... Nvidia Rebounds Over 3% [New York Stock Market Briefing]

Summary

- The New York Stock Exchange showed overall mixed trends with volatility due to tariff policy news.

- In particular, a rebound was achieved centered on tech stocks, with Nvidia rising 3.53%, and several large tech stocks reported gains.

- As bargain hunting flowed in, the Nasdaq index successfully closed higher, which could act as a positive signal for investors.

Stock Market Volatility Due to Tariff 'Fake News' Incident

Palantir Ends 5% Up After 10% Volatility

Philadelphia Semiconductor Rebounds 2.7% After Fluctuations

Amid the uncertainty of the Donald Trump administration's tariff policy, which led to a sell-off over the past two trading days, the New York Stock Exchange calmed down somewhat on the 7th (local time).

In particular, the tech-heavy Nasdaq index managed to recover all intraday losses and closed higher.

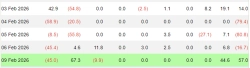

On this day, the Dow Jones Industrial Average closed at 37,965.60, down 349.26 points (-0.91%) from the previous trading day, and the Standard & Poor's (S&P) 500 index closed at 5,062.25, down 11.83 points (-0.23%) from the previous trading day.

In contrast, the tech-heavy Nasdaq index closed at 15,603.26, up 15.48 points (0.10%) from the previous trading day.

As investors focused on the tariff policy and sought buying opportunities at low points, the Dow index showed a record rollercoaster market, with the largest single-day drop.

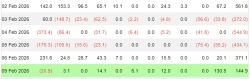

Sangyoung Seo, a researcher at Mirae Asset Securities, said, "Nvidia (3.53%) fell more than 8% due to Trump's mention of additional tariffs on China, but it surged more than 8% as the panic selling due to margin calls weakened. Eventually, it ended up 3.61% higher after showing high volatility."

With Nvidia's strength, "most semiconductor sectors such as Broadcom, Micron, Lam Research, and ARM increased their gains," he said, adding, "TSMC also reduced its losses after a significant drop."

The Philadelphia Semiconductor Index fell as much as 5.88% but eventually rose 2.7%.

Palantir (5.18%) showed increased volatility, falling more than 10% and then rising more than 10%.

On this day, the New York Stock Exchange opened with a sharp decline for the third consecutive trading day as President Trump maintained his stance of not backing down on tariff policy.

The S&P 500 index lowered its intraday low to 4,835.04, entering a bear market territory at one point. On Wall Street, a decline of more than 20% from the previous high is considered entering a technical bear market. The Nasdaq index also seemed to be in a sharp decline for the third consecutive day, with intraday losses reaching over 5% in the morning.

However, around 10 a.m. local time, after an unsubstantiated report emerged that President Trump was considering temporarily suspending reciprocal tariffs for 90 days for all countries except China, the three major indices rebounded rapidly and turned positive.

In just about 10 minutes, the Nasdaq index rose more than 10% compared to its intraday low.

The Dow index recorded the largest intraday fluctuation, rising 2,595 points from its intraday low to high.

However, after the White House officially confirmed that the report on the temporary suspension of reciprocal tariffs was 'fake news,' the three major indices of the New York Stock Exchange plummeted again, showing a mixed trend around the previous day's closing price.

As bargain hunting flowed in, many large tech stocks rebounded, leading the Nasdaq index to rebound.

The stock price of Nvidia, a leading AI stock, rose 3.53%, and the stock prices of Amazon and Meta Platforms also rose 2.49% and 2.28%, respectively.

In contrast, Apple and Tesla, which have high exposure to the Chinese market, fell 3.67% and 2.56%, respectively. This was influenced by President Trump's warning that he would impose an additional 50% tariff from the 9th if China did not withdraw its 34% retaliatory tariff against the U.S. by the 8th.

Min-kyung Shin, Hankyung.com reporter radio@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.