Editor's PiCK

Altcoins Hit by Ice Age, Rebound Triggered by Trump's 'Tariff Delay'? [Kang Min-seung's Altcoin Now]

Summary

- Following President Trump's tariff delay announcement, the cryptocurrency market is showing a positive trend and signs of a rebound.

- As Bitcoin dominance maintains its upward trend, the altcoin market continues to be weak.

- The rebound of the altcoin market will be greatly influenced by stock market trends and macroeconomic variables.

The virtual asset (cryptocurrency) market, which faced an unexpected crypto winter due to 'tariff panic,' is showing a rebound today due to President Trump's tariff delay policy. Market experts predict that as tensions rise with the imposition of high U.S. tariffs and China's countermeasures, significant fluctuations are likely to continue for some time.

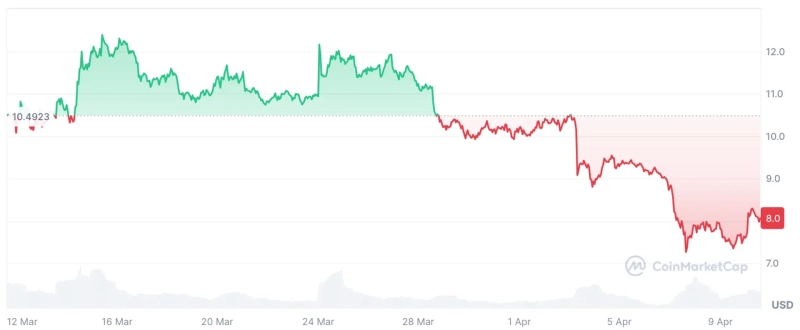

Following President Trump's announcement of a tariff delay, the cryptocurrency market is showing a very positive trend. The leading altcoin, Ethereum (ETH), is trading at $1,622 on the Binance USDT market as of 3:06 PM on the 10th, up 11.96% from the previous day (239,300 KRW on Upbit). However, the relative value of Ethereum compared to Bitcoin (ETH/BTC) is at its lowest level since January 2020, at 0.01968. This shows a trend where funds within the market are concentrated on Bitcoin even during a rebound.

On this day, Bitcoin (BTC) dominance (the proportion of Bitcoin in the total cryptocurrency market capitalization) recorded 63.46%, continuing its upward trend. As cryptocurrency investors focus more on Bitcoin than altcoins, a pattern is emerging where altcoins have limited gains during market rises and experience larger declines during downturns.

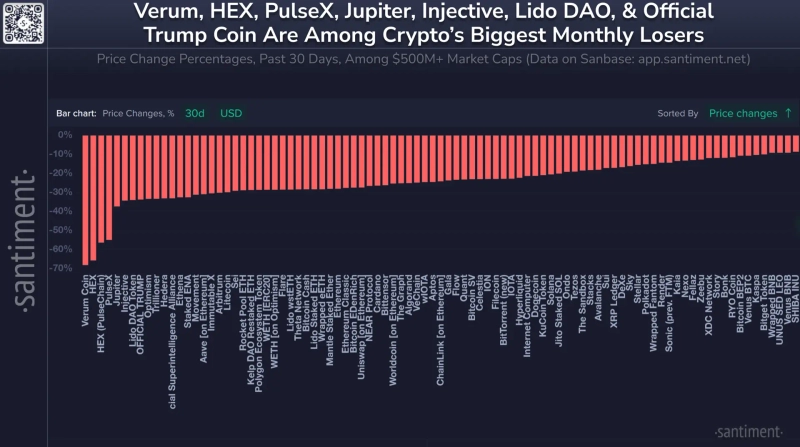

Altcoins with a Market Cap of $500 Million Plunge Up to 68% in a Month... Meme Coins Also 'Shaken'

Recently, due to President Trump's high tariff policy and the resulting concerns about economic slowdown, investor sentiment towards risky assets has rapidly contracted, causing a sharp decline in altcoins overall.

According to cryptocurrency data analysis firm Santiment, among altcoins with a market capitalization of over $500 million (approximately 729.1 billion KRW), the coin with the largest decline in the past month was Verum (VERUM), which plunged about 68%. This was followed by HEX at -56%, PulseX (PLSX) at -55%, and Jupiter (JUP) at -38%. President Trump's official meme coin, OfficialTrump (TRUMP), Injective (INJ), and Lido DAO (LDO) also all fell by 34%, showing weakness. Optimism (OP) and Hedera (HBAR) also recorded similar declines.

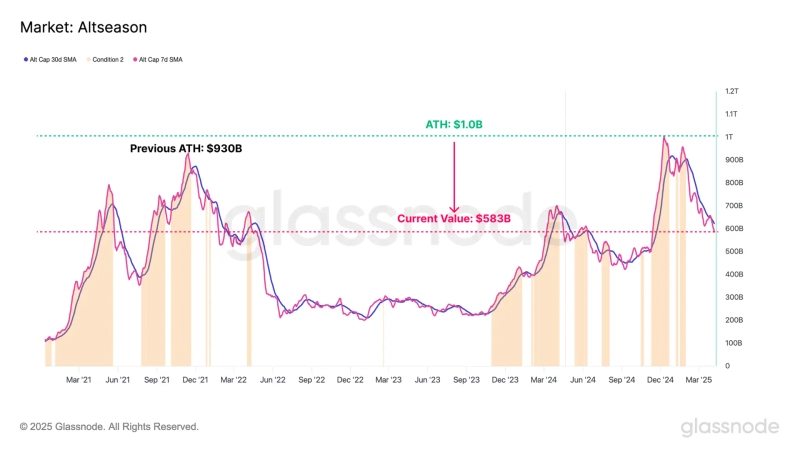

The total cryptocurrency trading volume and market capitalization have rapidly contracted this year. The total altcoin market capitalization has shrunk by nearly 40% from $1 trillion (approximately 1,457 trillion KRW) in December last year to the current $583 billion (approximately 849 trillion KRW). Santiment analyzed, "April 2025 is likely to be recorded as one of the most turbulent months in cryptocurrency history. The sharp decline is reminiscent of the market shock in March and April 2020, at the onset of COVID-19."

There is also an analysis that 'long-tail (non-mainstream)' altcoins with low market capitalization were more vulnerable to adjustments. Cryptocurrency specialist newsletter Asymmetric stated, "Despite expectations of regulatory easing and positive news continuing from the beginning of the year, the prices and trading volumes of the cryptocurrency market have shown a simultaneous sharp decline," adding, "Some project tokens with small market capitalizations have fallen by 80-99%." Cryptocurrency analyst Benjamin Cowen also analyzed, "As Bitcoin dominance is likely to continue its upward trend for the time being, altcoins with small market capitalizations are likely to be hit hard in the adjustment phase."

Meme coins, which received significant attention from investors during the bull market, are also unable to escape weakness. Cryptocurrency service provider Matrixport stated in a recent research report, "Meme coins, which were noted during the last bull market, are still experiencing severe sluggishness and show no signs of recovery." The representative meme coin, Dogecoin (DOGE), is trading at a price that has fallen about 70% from its peak this year.

Trump's 'Tariff Breather'... Tariff Delay Card Leads to Short-term Rebound in Cryptocurrency Market

The cryptocurrency market, which was contracted due to the aftermath of Trump's tariff war, is showing signs of rebounding again with the news of the tariff delay. Market experts predict that the cryptocurrency market is likely to be closely linked to stock market trends for the time being, and short-term volatility may further expand. Some are also raising expectations that recovery signals may be captured around the second half of the second quarter.

In the market, concerns and expectations are simultaneously emerging. Global cryptocurrency exchange Bitfinex stated in a weekly research report, "The recent trend of Bitcoin (BTC) funding rates and open interest (OI) in the cryptocurrency derivatives market suggests that market volatility may intensify in the future," but also predicted, "In the second half of the second quarter, the possibility of market recovery will increase due to the easing of macroeconomic uncertainties, the resumption of ETF inflows, and the spread of state-led (pro-cryptocurrency) narratives." Open interest refers to the number of contracts that traders have not liquidated in the derivatives market. Generally, the more open interest there is, the greater the potential for coin price volatility.

The cryptocurrency market has recently been showing sensitivity to global stock market trends. Alexander Kuptsikevich, a senior market analyst at FXPro, stated, "The cryptocurrency market rebounded slightly as the European stock market opened on Monday (the 7th), but has gradually lost strength since then," adding, "During such times, the correlation with traditional assets also tends to increase in the short term. If there are no clear rebound signals in the stock market, this recovery may also be a temporary technical rebound."

There is also a forecast that the rebound of the market will still be determined by macroeconomic variables. Cryptocurrency analyst Benjamin Cowen also predicted through YouTube broadcasts and X (formerly Twitter), "The U.S. government sees it as inevitable to lower asset prices to fundamentally curb inflation in the long term," adding, "However, achieving this without a recession will be the biggest challenge, and the rebound of the cryptocurrency market will also be greatly influenced by future stock market trends."

An analysis is emerging that major altcoins, including Ethereum, have entered a technical bottom zone. Cowen stated, "Recently, Ethereum has finally reached 'home (technical and psychological bottom),'" adding, "Now Ethereum can attempt a sustained rebound for several weeks or days." He also analyzed, "Currently, the dollar-cost averaging (DCA) perspective seems valid for Ethereum from a long-term perspective." Previously, Ethereum successfully rebounded strongly after expanding its decline to key support levels in September 2015, November 2016, and November 2019.

There are also criticisms that the market sentiment and actual price trends are diverging. Cryptocurrency strategist Michaël van de Poppe stated through X, "The current market sentiment is extremely volatile," diagnosing, "The overall cryptocurrency market has recently experienced a 'bloodbath,' and altcoins are showing double-digit declines." He also predicted, "With the strengthening preference for safe assets, gold and bonds are rising together," adding, "If this decline is similar in structure to the March 2020 adjustment, Bitcoin and altcoins may also reproduce a strong upward trend in the future."

Recently, there is also an analysis that the weakening of the yuan is affecting the altcoin market. A strategist predicted, "As additional U.S. tariff measures become a reality, the value of the yuan is collapsing daily," adding, "If the People's Bank of China (PBoC) defends the yuan or the U.S. Federal Reserve (Fed) takes measures to induce dollar weakness, it could be a signal for an altcoin bull market." Typically, cryptocurrency prices tend to inversely correlate with the dollar, but recently, a synchronized movement with the yuan is also being observed.

Latest on-chain analysis also suggests that the bearish trend centered on Bitcoin may continue for some time. Cryptocurrency on-chain analysis platform Glassnode stated in a weekly research report, "Bitcoin is currently trading in the $76,000 to $87,000 range. In the short term, fatigue from selling is accumulating," but also diagnosed, "There are still no clear signals of a rebound." It continued, "Bitcoin is showing a temporary rebound, but the trend of investors selling at a loss continues," adding, "The overall liquidity and profitability of the market are deteriorating. A structural bearish phase is likely to continue for the time being."

Kang Min-seung, Bloomingbit Reporter minriver@bloomingbit.io

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![[Market] Bitcoin breaks below $68,000 as losses deepen](https://media.bloomingbit.io/PROD/news/3a08fe32-6a33-4a62-bb89-4afb5c5399ca.webp?w=250)