Editor's PiCK

Bernstein "Fierce Bitcoin Hoarding Competition Among Companies... Target of $1 Million by 2033"

Summary

- Bernstein reported that the fierce competition among companies to hoard Bitcoin could create supply pressure.

- The report forecasts that Bitcoin will reach $1 million by 2033.

- The competition for Bitcoin purchases by companies and countries is expected to intensify supply pressure.

An analysis has emerged suggesting that as companies' hoarding competition intensifies, Bitcoin (BTC) could reach $1 million by 2033.

According to The Block on the 28th (local time), Bernstein stated in a report that "the expansion of companies' Bitcoin hoarding competition could create supply pressure," and "Bitcoin will reach $200,000 by the end of this year, $500,000 by 2029, and $1 million by 2033."

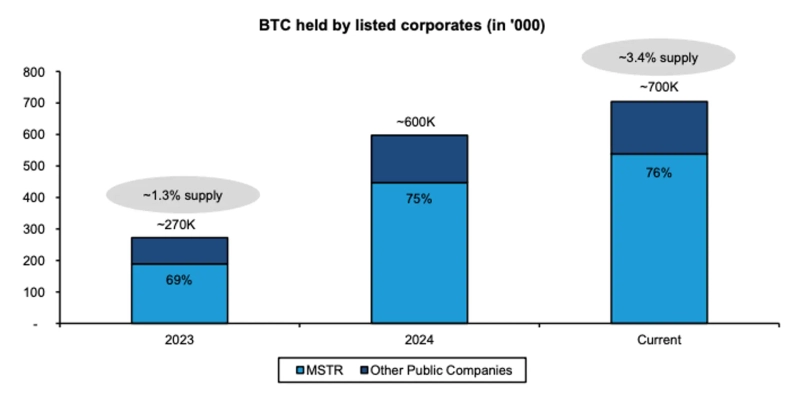

Bernstein focused on the movement of institutions expanding their Bitcoin hoarding. The report stated, "The establishment of TwentyOne Capital shows that the competition among companies to accumulate Bitcoin is becoming increasingly fierce," and "currently about 80 companies hold 700,000 BTC, which is 3.4% of the total Bitcoin supply (21 million BTC)." It added, "Combining the holdings of Bitcoin spot ETFs and companies accounts for 9% of the total supply," and "this is a sevenfold increase since January last year."

The 'Strategic Bitcoin Reserve Bill' by U.S. President Donald Trump also raises expectations. Bernstein predicted, "Even with the currently anticipated flow of companies' Bitcoin hoarding, it could reach a new all-time high this year," but also "if the U.S. government starts purchasing Bitcoin, it will trigger a price surge and a global Bitcoin hoarding competition." It explained that the competition for Bitcoin purchases by institutions and countries could intensify supply pressure.

It also noted that the decrease in Bitcoin holdings on centralized exchanges (CEX) suggests the possibility of supply pressure. Currently, exchange Bitcoin holdings are at 13% of the total supply, significantly down from 16% at the end of 2023," it added. It further explained, "There could be a year of decline during the rise," but "considering the demand growth curve and the limited supply (21 million BTC), it is difficult to predict a long-term bearish trend."

Meanwhile, SoftBank, Tether (USDT), and Bitfinex previously announced the establishment of the Bitcoin investment company 'TwentyOne Capital.' It is known that they will secure about 42,000 BTC in the initial stage.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![[Market] Bitcoin falls below $71,000…Lowest level since October 2024](https://media.bloomingbit.io/PROD/news/0e5880b9-61dd-49d4-9d2e-c47a3fb33a93.webp?w=250)