Summary

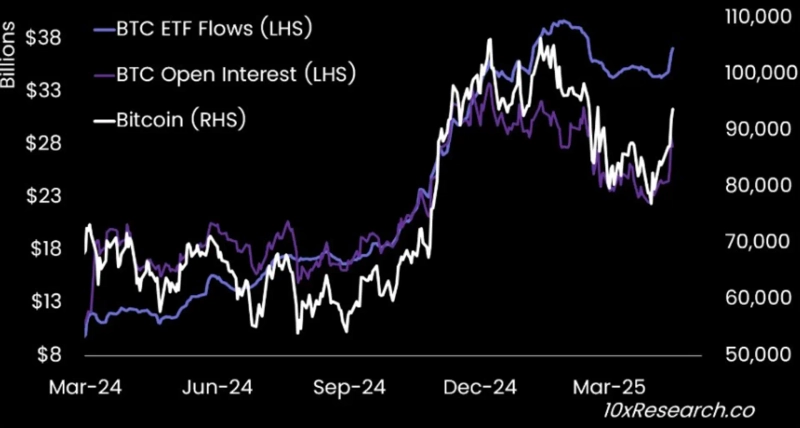

- It has been analyzed that about $3 billion has recently flowed into Bitcoin spot ETFs.

- Matrixport stated that the recent fund inflow is centered on net buying demand, interpreted as a strong bullish signal.

- The report explains that this fund inflow is maintained due to an increase in long-only investments rather than past arbitrage.

Recently, the funds flowing into Bitcoin (BTC) spot exchange-traded funds (ETFs) have been analyzed as a pure buying trend expecting a rise, rather than simple arbitrage.

On the 30th (local time), Matrixport reported that "the recent inflow of funds into Bitcoin spot ETFs amounts to about $3 billion," and "this inflow is interpreted as a strong bullish signal, centered on net buying demand expecting a rise."

They noted that this ETF inflow trend is different from the fund inflow pattern earlier this year. The report stated, "The previous ETF buying trend was mostly for arbitrage purposes. However, currently, even though Bitcoin open interest (OI) has surged, the funding rate remains low," explaining that "many investors continue long-only investments based on spot rather than short-term trading using leverage."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![[Market] Bitcoin falls below $71,000…Lowest level since October 2024](https://media.bloomingbit.io/PROD/news/0e5880b9-61dd-49d4-9d2e-c47a3fb33a93.webp?w=250)