Summary

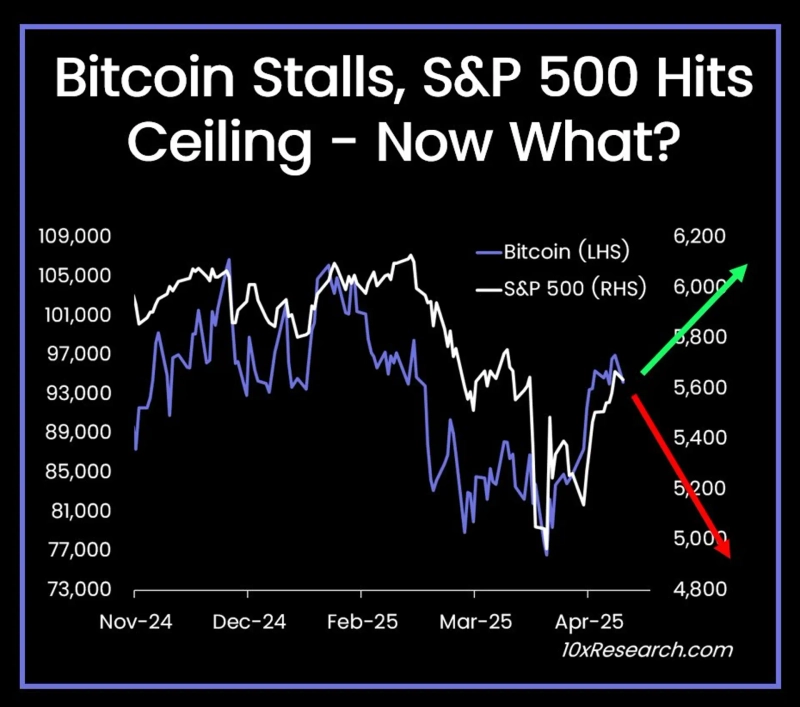

- Bitcoin's upward momentum is reported to be slowing despite spot ETFs and institutional buying.

- The decline in the Coinbase premium and low funding rates suggest a slowdown in upward momentum.

- Macroeconomic conditions such as the Fed's neutral stance and tariff uncertainties are exerting pressure on the market.

Despite the continuous inflow of Bitcoin (BTC) spot Exchange-Traded Funds (ETFs) and institutional buying, an analysis has emerged that Bitcoin's upward momentum is slowing.

On the 6th (local time), 10X Research reported, "Over the past month, Bitcoin has risen by about 25% thanks to spot ETFs and institutional buying," but also analyzed, "The decline in the Coinbase premium and low funding rates suggest a slowdown in upward momentum."

It continued, "The options market skew (the difference in implied volatility between call options and put options) remains positive, but macroeconomic conditions such as the Federal Reserve's (Fed) neutral stance and tariff-related uncertainties are exerting pressure on the market."

As of 7:18 PM, Bitcoin is trading at $94,227, down 0.17% from 24 hours ago, based on the Binance USDT market.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit![[Market] Bitcoin falls below $71,000…Lowest level since October 2024](https://media.bloomingbit.io/PROD/news/0e5880b9-61dd-49d4-9d2e-c47a3fb33a93.webp?w=250)