Summary

- It was reported that IBIT recorded net inflows for 15 consecutive days and could act as a long-term positive for Bitcoin.

- The inflow of funds into IBIT continues to increase despite the price rise, indicating a factor worth expecting further increases.

- There is a forecast that the assets under management of Bitcoin ETFs will reach three times that of Gold ETFs within the next 3 to 5 years.

There is a claim that the inflow of funds into BlackRock's Bitcoin (BTC) spot Exchange-Traded Fund (ETF), IBIT, could act as a positive factor despite the price increase.

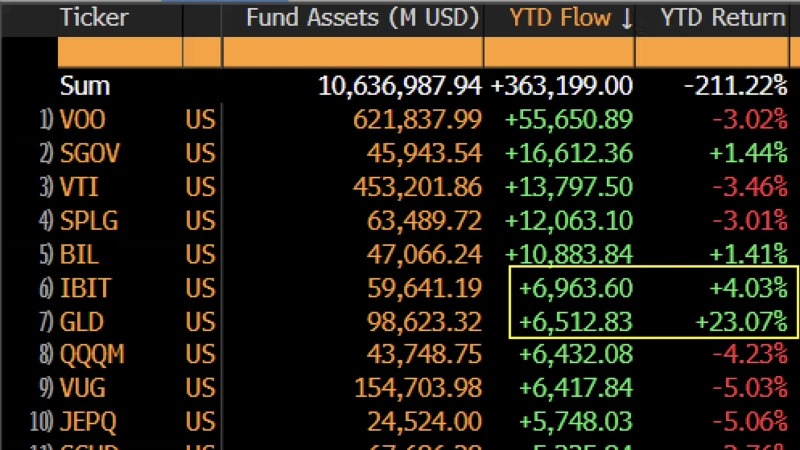

On the 6th (local time), Eric Balchunas, a Bloomberg ETF analyst, stated on X (formerly Twitter), "IBIT has recorded net inflows for 15 consecutive days and ranked 6th in ETF fund inflows this year," and evaluated that "this could act as a long-term positive for Bitcoin."

Comparing the trends of the Gold ETF (GLD) and IBIT, he emphasized, "GLD rose by 23% but IBIT only rose by 4%," adding, "Nevertheless, the fact that more funds are flowing into IBIT is a factor worth expecting (further increases)." He further added, "Within 3 to 5 years, the assets under management (AUM) of Bitcoin ETFs will be three times that of Gold ETFs."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit![[Market] Bitcoin falls below $71,000…Lowest level since October 2024](https://media.bloomingbit.io/PROD/news/0e5880b9-61dd-49d4-9d2e-c47a3fb33a93.webp?w=250)