Editor's PiCK

Companies Borrowing to Buy 'Bitcoin'... The Real Hoarding Race Begins

Summary

- It was reported that the competition among global companies to purchase Bitcoin is intensifying, with the possibility of it rising to $200,000.

- It was stated that supply pressure due to companies' hoarding competition could promote Bitcoin's strength.

- It was analyzed that large-scale institutional purchases could strengthen Bitcoin's fundamentals and serve as a stepping stone for long-term rise.

Acceleration of Bitcoin Purchases by Companies

$200,000 Forecast Due to Supply Pressure

Market Expectations Rise with Increased Realized Price

The competition among global companies to purchase Bitcoin (BTC) is intensifying. There are even forecasts that Bitcoin could reach $200,000 by the end of the year, driven by aggressive institutional buying based on capital increases.

On the 1st (local time), MicroStrategy (MSTR) announced during its first-quarter earnings report that it would conduct a $21 billion (approximately 29 trillion won) common stock capital increase to purchase additional Bitcoin. On the same day (local time, 2nd), Metaplanet also fueled the Bitcoin hoarding race by issuing additional corporate bonds worth 3.6 billion yen (approximately 35.2 billion won) with the goal of holding 10,000 BTC by the end of the year.

The number of new companies participating in Bitcoin hoarding is also increasing. Recently, SoftBank partnered with stablecoin USDT issuer Tether and U.S. securities firm Cantor Fitzgerald to establish the Bitcoin investment company Twenty One Capital. The initial investment size, including convertible bond issuance, amounts to a whopping $3.6 billion. Additionally, 12 companies, including GameStop (GME) and Mingxing Group (MSW) subsidiary Lead Benefit, have newly joined the Bitcoin hoarding ranks in the first quarter of this year alone.

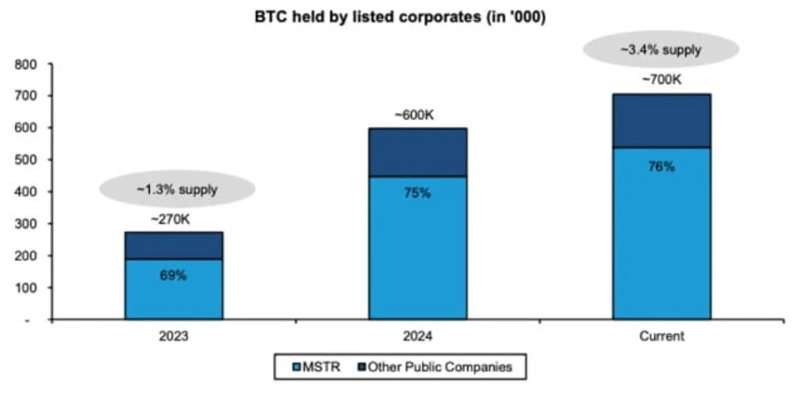

This trend is expected to become even stronger. Asset management firm Bitwise stated, "As of last month, the Bitcoin holdings of listed companies increased by approximately 167% compared to the first quarter of last year and by 26.3% compared to the fourth quarter," and predicted that "as Bitcoin's position changes, the pace of companies' hoarding participation will accelerate."

Global investment bank Bernstein also predicted that "U.S. pro-crypto regulations are stimulating companies' buying sentiment," and that the scale of companies' Bitcoin purchases could reach $330 billion by the end of 2029.

Rising Expectations for Bitcoin Due to Institutional Demand

As a result, there are also forecasts that the increasing institutional demand for Bitcoin will ultimately drive Bitcoin's strength.

Bernstein stated, "Supply pressure is expected due to the expansion of companies' hoarding competition. Bitcoin could rise to $200,000 by the end of this year." The aggressive demand increase, such as the establishment of Twenty One Capital, combined with the limited supply (21 million BTC), could start a full-fledged Bitcoin rally.

Investment bank Standard Chartered (SC) also stated in a report, "Considering the increase in institutional interest and the trend of investors moving away from U.S. assets, now is the time to buy Bitcoin," and analyzed that "Bitcoin will soar to $120,000 within the second quarter and to $200,000 by the end of the year."

The rise in Bitcoin's Realized Price due to institutional buying also adds strength to the bullish outlook.

According to data from on-chain analysis platform CryptoQuant, the recent rise in Bitcoin's Realized Price has steadily reached an all-time high of $44,900. The Realized Price of Bitcoin is the average purchase price of all investors, and as the Realized Price increases, the purchase price of Bitcoin for investors rises, making Bitcoin more resistant to selling.

CryptoQuant analyst Crypto Dan said, "The recent rise in Bitcoin's Realized Price is a result of the aggressive buying by large institutions like MicroStrategy, rather than an overall increase in market demand," and "ultimately, large-scale institutional purchases can strengthen Bitcoin's fundamentals in the long term and serve as a stepping stone for its rise."

Furthermore, the recovery of investment sentiment brought about by corporate buying could also act as a positive factor. He said, "Institutional buying has the effect of stimulating the buying sentiment of other companies and individual investors," and "the buying momentum brought about by psychological effects can greatly contribute to Bitcoin's long-term rise."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit