Editor's PiCK

10 Million Virtual Asset Investors... Trading Volume Surpasses KOSPI

Summary

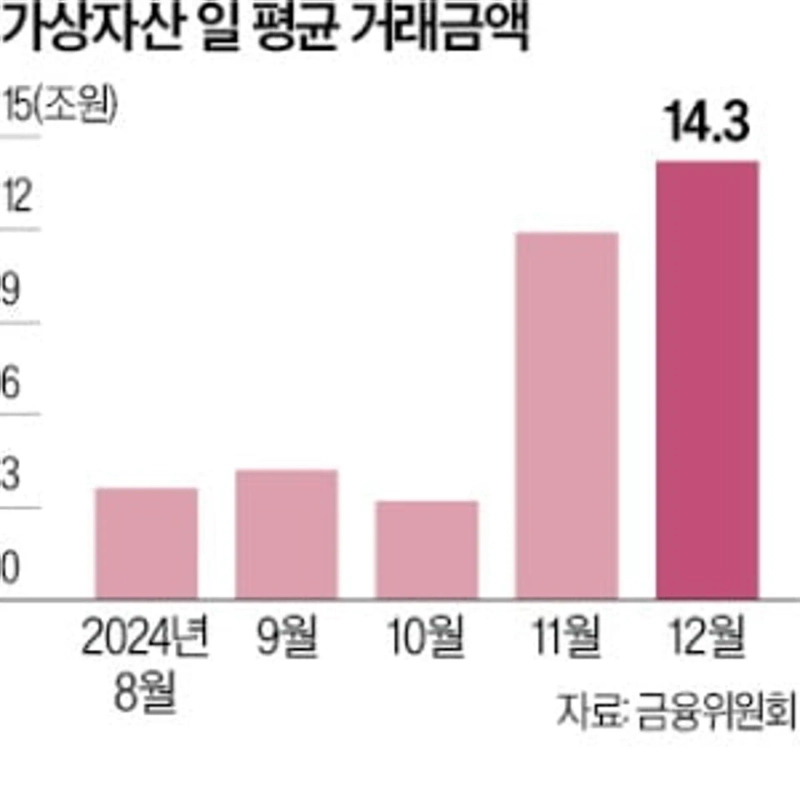

- It was revealed that the number of virtual asset investors in Korea is approaching 10 million, and the average daily trading volume is 14.3 trillion won, surpassing the stock market trading volume.

- The market capitalization of domestic virtual assets recorded 107.7 trillion won, a 91% increase from the previous year, and won deposits also increased by 114%.

- The operating profit of virtual asset operators increased by 28% compared to the first half, but coin market trading decreased by 81%, resulting in a deficit.

Financial Intelligence Unit Survey

Market Cap at 107 Trillion Won at Year-End

Daily Average Trading Volume is 14 Trillion Won

It has been revealed that the number of virtual asset investors in Korea is approaching 10 million. The daily trading volume also surpassed that of the stock market.

The Financial Services Commission's Financial Intelligence Unit (FIU) announced on the 20th the results of a survey on virtual asset operators for the second half of 2024. This survey targeted 25 virtual asset operators, including 17 exchanges and 8 custodians and wallet providers.

At the end of last year, the market capitalization of domestic virtual assets was 107.7 trillion won, a 91% increase from six months earlier (56.5 trillion won). This was due to the expectation of pro-virtual asset policies following the election of Donald Trump as President of the United States in November last year. The average daily trading amount was 14.3 trillion won at the end of last year, surpassing the stock market trading volume (10.8 trillion won) during the same period.

The Korean won deposits also increased sharply. The won deposits recorded 10.7 trillion won, a 114% increase from six months earlier (5 trillion won). Won deposits refer to the amount stored in personal accounts for trading virtual assets. Analysts say that a 'money move' from bank deposits to the virtual asset market has occurred.

The operating profit of virtual asset operators increased by 28% to 7.415 trillion won compared to the first half of last year (5.813 trillion won). However, while the daily average trading volume of the won market increased by 22% to 7.3 trillion won, coin market trading decreased by 81% to 1.6 billion won. The operating profit of the won market was 7.572 trillion won, but the coin market recorded a deficit of 126 billion won.

The total number of employees at virtual asset exchanges was 1,862, an 18% increase compared to the first half of last year. The number of personnel related to Anti-Money Laundering (AML) tasks increased by 46% to 207 during the same period.

As of the end of last year, 1,357 virtual assets were traded in Korea (including duplicates), a 12% increase from the end of June last year (1,207). Among them, 287 virtual assets were exclusively listed on one domestic exchange, an increase of 2 from the first half. Among the exclusively listed virtual assets, 97 so-called 'Kimchi Coins', which were issued by Koreans or traded more than 80% on domestic exchanges, decreased by 5 compared to the end of June last year.

Reporter Mi-hyun Cho mwise@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)