Editor's PiCK

Is Only June's Rate Cut Off the Table? July Too... Fed Signals 'September Cut' [Fed Watch]

Summary

- It was reported that the timing of the US Central Bank's rate cut is likely to be delayed until after September.

- Analysis has emerged that the uncertainty of tariff policies and fluctuations in economic indicators have made it difficult to decide on a rate cut.

- It was highlighted that the number of rate cuts itself could also be reduced.

The US Central Bank (Fed) is expected to cut rates two to three times this year, but the timing of the cuts keeps being pushed back. There is also talk of a reduction in the scale of the cuts.

On the 19th (local time), John Williams, President of the New York Fed, said at the Mortgage Bankers Association conference, "I don't think we will understand what is happening to the US economy by June," and "the same goes for July."

It means more time is needed to understand the impact of the Trump administration's tariff policy on inflation and economic growth rates. Since the tariff policy keeps changing and its effects occur with a time lag, it is not appropriate to make a decision in June or July.

Raphael Bostic, President of the Atlanta Fed, made similar remarks in a CNBC interview. He mentioned the tariff policy and the downgrade of the US credit rating, saying, "There will be ripple effects on the overall economy." He also added, "We need to wait three to six months to see how this situation resolves." He said he is "leaning towards only one rate cut this year."

Alberto Musalem, President of the St. Louis Fed, also analyzed at an event in Minneapolis on the 20th that "overall, tariffs are likely to weaken economic activity and further slow the labor market." Beth Hammack, President of the Cleveland Fed, also presented three scenarios regarding the tariff policy, predicting that the possibility of stagflation is the highest. These remarks all emphasize the factors that make it difficult to decide on a rate cut.

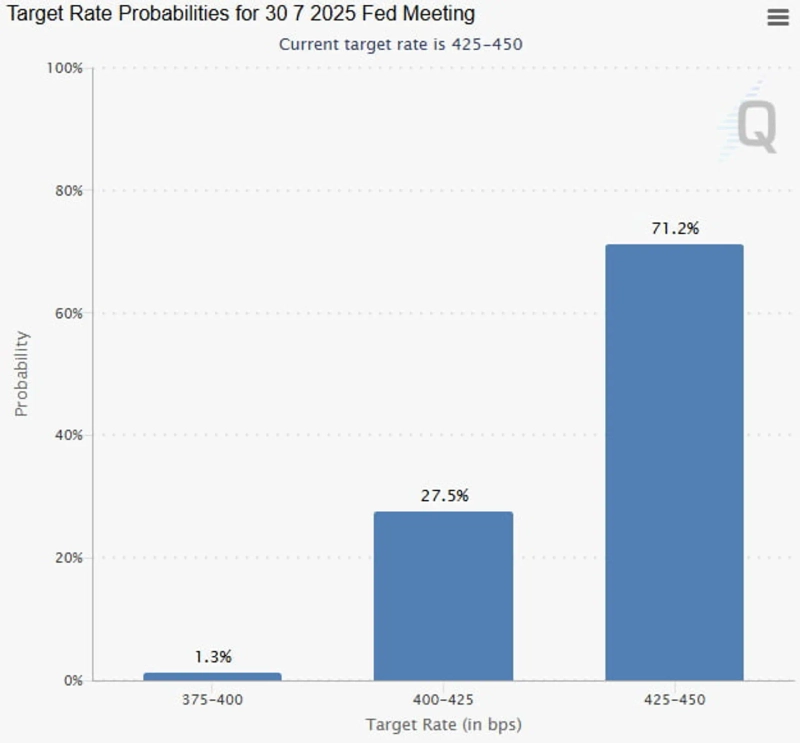

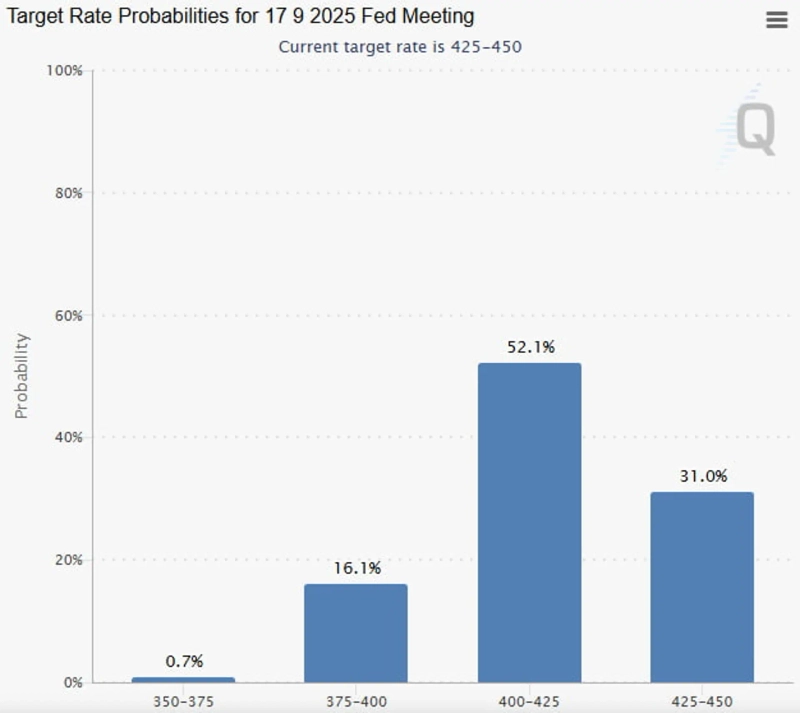

Previously, Chairman Powell emphasized at a press conference right after the last FOMC that uncertainty has increased compared to March. He particularly stated, "Inflation could rise, and unemployment could rise, but each of these situations requires opposing policy responses," indicating that it is time to wait. At that time, the market atmosphere was that a June cut was becoming difficult, and based on yesterday's remarks, it is interpreted that July is also difficult. Ultimately, it means that the timing of the cut is likely to be postponed until after September.

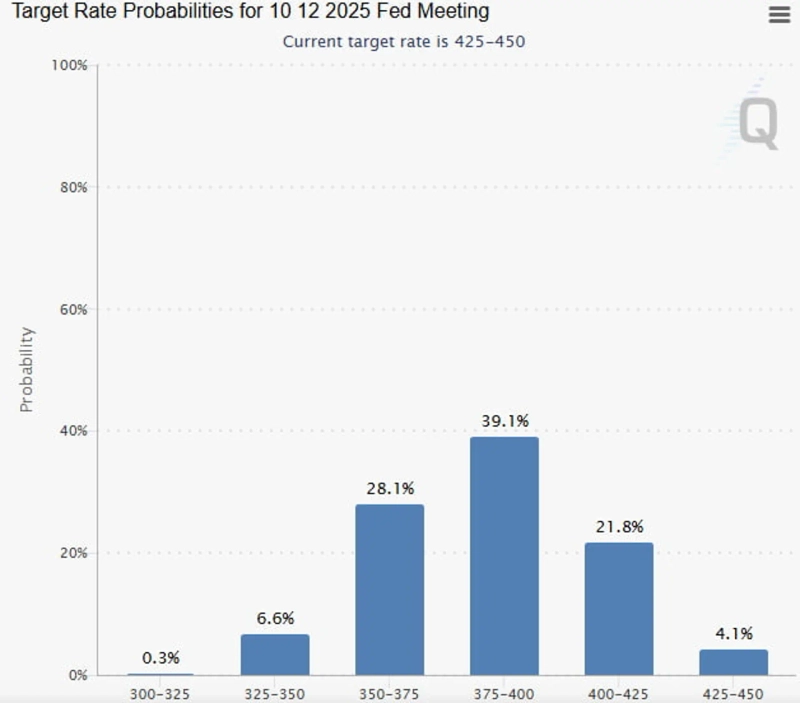

Reducing the number of cuts itself can also be seen as an option currently on the Fed's table. The dot plot released after the March FOMC predicted two 0.25% point cuts by the end of the year, but even this may not be adhered to. The market, which expected rates to be cut up to three times, may also need to revise its outlook. The impact of Trump's tariffs is holding back the rate cut, and the tug-of-war between the Fed and the White House over this issue is expected to continue.

Washington = Lee Sang-eun, Correspondent selee@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)