Summary

- Jensen Huang, CEO of NVIDIA, stated that due to US export regulations, the Chinese AI chip market share has sharply declined, resulting in billions of dollars in losses.

- CEO Huang reported that the restriction on selling H20 chips has caused NVIDIA to miss significant opportunities in the Chinese market.

- He expressed that easing regulations on the Chinese market could have positive effects on the US and promote technological innovation.

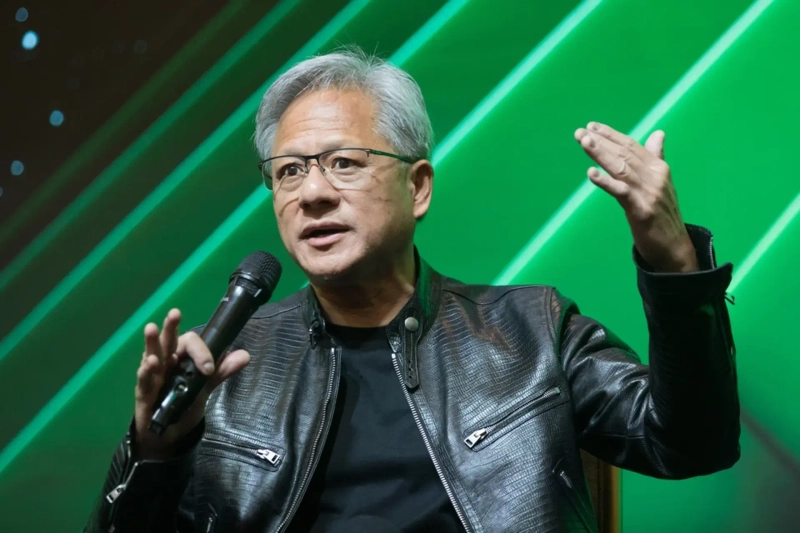

NVIDIA Global Media Conference

Emphasizing "China is an Important Market"

Jensen Huang, CEO of NVIDIA, stated on the 21st, "(The US) export controls have failed. The facts speak for themselves."

CEO Huang made this statement at the 'Global Media Q&A' event held at the Mandarin Oriental Hotel in Taipei, Taiwan. When asked about the impact of US export regulations and his stance on the policy, he responded as such.

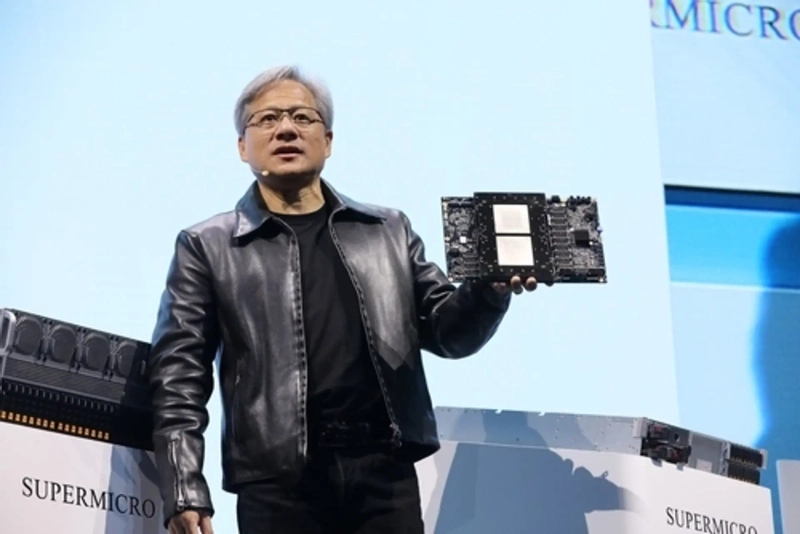

He explained, "Due to export controls, we were unable to ship H20 products to China, resulting in a total write-off of inventory worth billions of dollars," adding, "This is equivalent to the entire revenue of some semiconductor companies."

Last year, NVIDIA generated approximately $17 billion in revenue from China, accounting for 14% of the company's total revenue. H20 was the only AI chip that NVIDIA could legally sell in China, but the Trump administration recently restricted its export as well.

CEO Huang said, "Four years ago, at the start of the Biden administration, we held 95% of the Chinese AI chip market, but now it has decreased to 50%. Moreover, we could only sell lower-spec products, which reduced the average selling price (ASP) and significantly impacted our profits."

Additionally, CEO Huang dismissed claims that NVIDIA would release a lower version of the H20 chip in China. He emphasized, "There is no further way to reduce the performance of the current H20 or Hopper architecture. Doing so would render them useless in the market."

CEO Huang's remarks are interpreted as a deliberate statement in response to the snowballing losses from US export restrictions to China. It is also seen as a concern about losing opportunities in the potentially growing Chinese market.

He stated, "The Chinese market is very important. China is the second-largest computing market in the world, and I expect the entire AI market to be around $50 billion next year," adding, "This is a tremendous opportunity for NVIDIA and too valuable to miss."

He also mentioned that easing regulations on the Chinese market could have positive effects on the US and could stimulate technological development, posing a threat.

CEO Huang pointed out, "Through the Chinese market, the US can increase tax revenue, create jobs, and maintain the industry," adding, "We believe the US should maximize the speed of 'AI diffusion.' Otherwise, competitors (China) will catch up." He continued, "We must not forget that Huawei, one of the largest and most powerful tech companies in the world, is rapidly innovating," adding, "They hope we don't return to China."

CEO Huang requested that the US government provide opportunities to compete in China. He said, "I believe the current policy direction is wrong," adding, "I hope the US government recognizes that this ban is ineffective and that the 'truth on the ground' influences policymakers to allow us to compete in the Chinese market again."

Furthermore, he explained, "The US government should allow US technology to serve, participate, and compete in the Chinese market because 50% of AI researchers worldwide are in China, and it's important that they develop on American technology."

Finally, CEO Huang stated, "The options are very limited, and we have already drastically reduced product performance," adding, "There is no good solution right now, but we will continue to think about it."

Jinyoung Ki, Hankyung.com Reporter young71@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)