Summary

- The US has demanded the appreciation of the won-dollar exchange rate from Korea but did not specify a concrete exchange rate target.

- The US views the exchange rate issue as the cause of its trade deficit, and the Trump administration is trying to bring negotiating partners to the table through a tariff war.

- The Korean government also desires won appreciation but lacks the means to artificially induce it.

Government "Discussing Directionality

No Specific Exchange Rate Level Suggested"

It has been identified that the US has demanded measures for the appreciation of the Korean won in the Korea-US currency negotiations. However, it is reported that no specific level (appropriate exchange rate level) was suggested.

A senior government official stated on the 21st, "The US sees the fundamental cause of its massive trade deficit as the exchange rate (strong dollar)," and "they are discussing the directionality of the exchange rate in negotiations with our country." The official added, however, "The US has not mentioned a specific level." Although the US has not demanded a specific exchange rate target like 'lower the won-dollar exchange rate to 1,300 won,' it is interpreted as a suggestion to negotiate in the direction of lowering the won-dollar exchange rate, which has been on a high trajectory since 2023.

The government believes that what the US truly wants from the simultaneous trade and currency negotiations with Korea is to achieve results in the currency negotiations. US President Donald Trump listed currency manipulation as the number one unfair practice in his '8 Major Non-Tariff Unfair Practices' posted on social media on the 20th of last month. An official from the foreign exchange authorities said, "While the world's attention is focused on Trump's tariffs, it shows that currency is actually the top priority in Trump's mind."

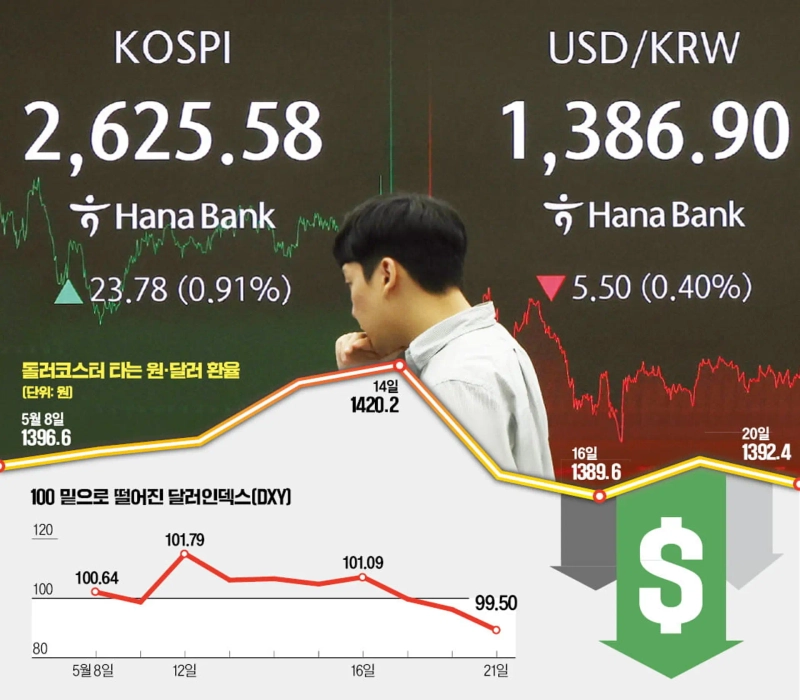

Our government also believes that the won is excessively undervalued compared to the economic fundamentals. However, it is known that they are having difficulty finding appropriate measures to propose to the US for the appreciation of the won, as the main factors for the recent won weakness are the uncertainties of Trump's tariff policy and the possibility of US inflation reigniting. On this day, the won-dollar exchange rate closed at 1,387.20 won, down 5.20 won from the previous day, due to news that the US and Japan would engage in currency negotiations at the G7 finance ministers' meeting. This is the lowest level since November 8th last year.

US Wants to Raise Won Value…Concerns Over US Tariffs and Inflation Fuel Won Weakness

US "Strong Dollar is the Cause of Trade Deficit"…Government Also Wants Won Appreciation…

The Trump administration is inducing a depreciation of the dollar while raising tariffs on trade partners to reduce the trade deficit. It is pressuring major trading partners such as Korea, China, Japan, and the European Union (EU) to lower their currency values against the dollar. Experts believe that the hidden strategy of the US is to bring negotiating partners to the table with tariffs and then extract concessions on exchange rates. They argue that the 'Trump tariff war' is unsustainable.

◇ Dollar Appreciation and Tariff Increase, a Matter of Choice

The Korea Institute for International Economic Policy (KIEP) analyzed that if all the tariffs announced by President Trump on global trading partners are realized, the effective tariff rate in the US will reach 33.5%. Lee Si-wook, president of the Korea Institute for International Economic Policy, explained, "This is the highest level since 1872 when the effective tariff rate was 38%." If an average tax of 33.5% is added to all imports, import prices will rise accordingly. Even in scenarios where tariffs are partially deferred or reduced through negotiations, the effective tariff rate will reach 15%, similar to the level during the Great Depression in 1928. Experts agree that the US cannot withstand this level of inflationary pressure.

It is also impossible to achieve both tariff increases and dollar depreciation simultaneously. Imposing high tariffs on trading partners causes their currency values to fall and the dollar value to rise. As tariffs increase import prices, the volume of imports decreases, and the demand to buy the trading partners' currencies falls.

This is why the prediction that 'it will start with a tariff war and end with a currency war' is gaining traction. Historically, the US has repeatedly pressured trading partners with tariff wars and then extracted concessions on exchange rates.

In August 1971, then-President Richard Nixon imposed a 10% surcharge on all imports and suspended gold convertibility, initiating the 'Nixon Shock,' which ended with the Smithsonian Agreement in December of the same year, devaluing the dollar against gold by 8% (appreciating major currencies). The tariff war between the US and China during the first Trump administration in 2019, where retaliatory tariffs were exchanged, also concluded with the Phase 1 US-China trade agreement in January 2020, which included the provision to leave the yuan exchange rate to the market and not engage in competitive devaluation.

◇ Government Lacks Means for Won Appreciation

The appreciation of the won is something our government also somewhat desires. Foreign exchange market experts see the appropriate exchange rate, considering economic fundamentals, as in the mid-1,300 won range per dollar. They believe there is room for the current won-dollar exchange rate, which has been hovering in the high 1,300 won range after staying in the 1,400 won range, to fall by 30-40 won (won appreciation).

The government's dilemma is that there are no appropriate means to artificially induce this. This is because the recent won-dollar exchange rate is influenced by external factors. On the 29th of last month, the Korea Development Institute (KDI) announced that about 90% of the factors for the exchange rate increase after COVID-19 were due to the strong dollar reflecting external factors, not the weak won due to domestic factors, based on the correlation coefficient between the dollar index and the won-dollar exchange rate.

Foreign exchange market experts also agree that there are no appropriate means for won appreciation. Indirect means such as adjusting the foreign currency asset purchases of the National Pension Service are mentioned, but their effectiveness is not high. Lee Seung-heon, a former vice governor of the Bank of Korea and a professor at Soongsil University's Graduate School of Business, said, "There may be demands to shorten the disclosure of Korea's foreign exchange market intervention status from quarterly to monthly." Park Sang-hyun, an economist at iM Securities, said, "As the US government is concerned about the fluctuation of bond yields due to China's sale of US Treasury bonds, our pension funds and institutions can offer the card of buying more US Treasury bonds."

In a situation where Korea and the US are conducting separate negotiations on exchange rates and trade, how to connect the concessions on exchange rates to achievements in trade negotiations, such as mutual tariff or item tariff reductions, is also a concern for the foreign exchange and trade authorities.

Despite the strong pressure from the US, the foreign exchange authorities consistently explain that there is no possibility of a 'second Plaza Accord,' which some are concerned about. An official from the foreign exchange authorities explained, "The current foreign exchange market is so large compared to 1985 that even if major countries jointly intervene in the market, it is difficult to make an 'impact' on the exchange rate."

Jung Young-hyo/Nam Jung-min/Kim Ik-hwan, reporters hugh@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)