Editor's PiCK

Even Safe Assets Like Japanese Government Bonds Plummet Amid Concerns of Reckless Fiscal Policy

Summary

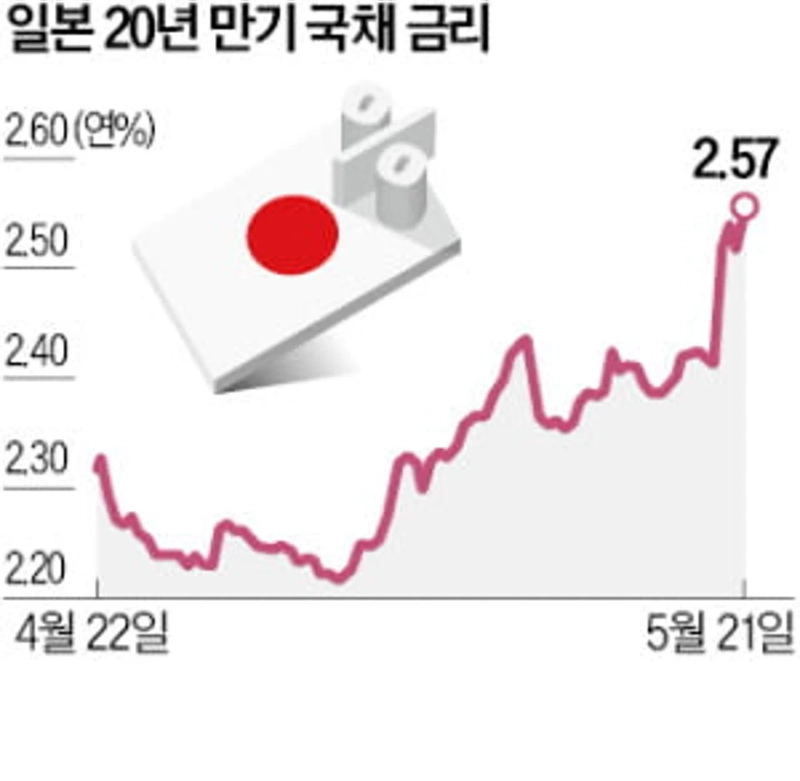

- The yield on Japanese government bonds surged to the highest level in 25 years, reflecting market anxiety.

- Discussions on consumption tax cuts in the political arena are raising concerns about increased issuance of deficit bonds.

- Experts point out that the surge in Japan's bond yields, with the world's highest debt ratio, is a warning sign of fiscal expansion.

20-Year Bond Yield Hits 25-Year High

Tax Cut Competition Ahead of Elections

"National Debt Will Increase" Market Cools Rapidly

Warning Signs of National Debt in Japan Following the US

The yield on Japanese government bonds, known as a symbol of safe assets, has surged to a record high (bond prices plummeting). This is due to growing concerns that Japan's political circles will issue 'deficit bonds' to reduce consumption tax ahead of the House of Councillors (upper house) election in July. Following the US, where national credit ratings were downgraded due to increased national debt, warning signs of reckless fiscal policy are also growing in Japan.

On the 21st, the yield on 20-year Japanese government bonds in the bond market rose to 2.575% per annum at one point, marking the highest level in 25 years since October 2000. The bond sell-off continued following the shock of the 20-year bond auction conducted by the Japanese Ministry of Finance the previous day. In this auction, the difference between the average bid price and the lowest bid price, which shows bond demand, widened to 1.14 yen, the largest in 38 years since 1987. Kazuhiko Sano, chief bond strategist at Tokai Tokyo Securities, said it was "shocking" and noted that "investor demand is clearly not gathering."

As the auction results became known, the yield on Japan's 30-year bonds rose to 3.185% and 40-year bonds to 3.635%, both hitting record highs. Typically, ultra-long-term bonds more sensitively reflect fiscal risks. The yield on 10-year bonds also rose to 1.53%, the highest level in about two months.

The backdrop to the surge in bond yields is concerns over fiscal expansion. Japan's ruling and opposition parties are both proposing consumption tax cuts ahead of the House of Councillors election. There is growing concern that there is no suitable revenue to make up for the reduced tax revenue from the consumption tax cut, ultimately leading to increased bond issuance. Last year, Japan's national debt-to-GDP ratio was 236.7%, the highest among developed countries and double that of the US (120.8%). In this situation, the proposal to issue more deficit bonds has shocked the bond market.

Prime Minister Shigeru Ishiba said on the 19th, "We must recognize the fear of a world with interest rates."

Tokyo = Il-kyu Kim, Correspondent black0419@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)