Editor's PiCK

US-China Trade Negotiations Cause Exchange Rate Fluctuations… "Avoid Forex Tech for Now"

Summary

- The KRW-USD exchange rate is showing significant volatility due to US-China trade negotiations, and investors are advised to be cautious.

- The KRW-USD exchange rate is expected to generally decline by the end of the year, but volatility exists depending on the progress of trade negotiations.

- Experts are skeptical about forex tech expecting significant profits from exchange rate rises.

Cover Story

KRW-USD Exchange Rate Outlook

Fluctuates 30 KRW in a Day

Due to Tariff Issues

Exchange Rate Falls Below 1400 KRW

Amid US-China Truce

Volatility Expected to Increase

Depending on Trade Negotiation Progress

"Even if it Rises, 1430 KRW

Expected to be 1350 KRW in the Second Half

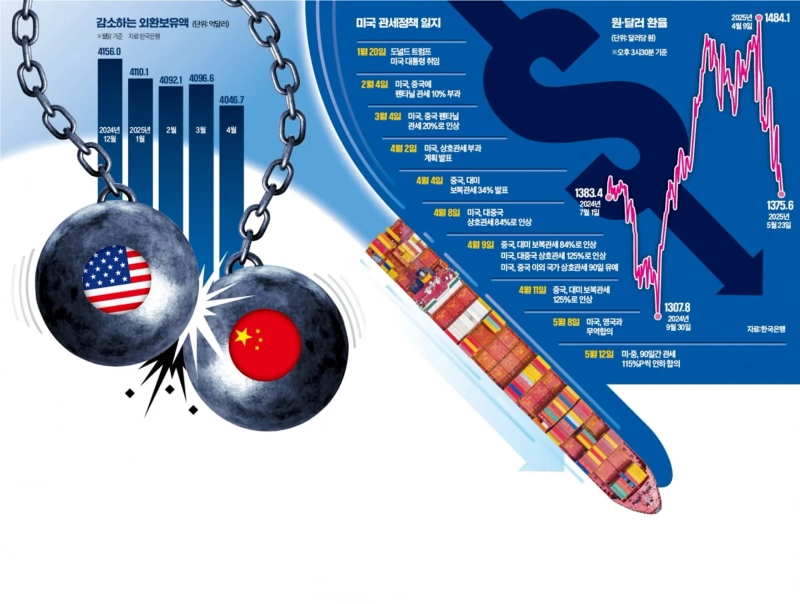

The KRW-USD exchange rate is experiencing sharp fluctuations. This is due to rapidly changing market conditions influenced by US tariff policies and trade negotiation news. The rate can rise by over 30 KRW in a day and then drop by the same amount the next day. Recently, the KRW-USD exchange rate fell to the 1370 KRW range as news emerged of eased US-China trade tensions and US-South Korea authorities engaging in exchange rate negotiations. Experts believe that the value of the Korean won will continue to show high volatility depending on US trade policies. However, they predict that the exchange rate will stabilize downward to the 1360-1370 KRW range by the end of the year.

KRW-USD Exchange Rate Fluctuates by 30 KRW

According to the foreign exchange market on the 25th, the KRW-USD exchange rate has shown significant volatility since last month. On the 4th of last month, when the Constitutional Court removed President Yoon Suk-yeol, domestic political uncertainty was resolved, and the KRW-USD exchange rate (as of 3:30 PM) closed at 1434 KRW 10 jeon, down 32 KRW 90 jeon from the previous day (1467 KRW).

However, the very next day, on the 5th, the KRW-USD exchange rate rose by 33 KRW 70 jeon to 1467 KRW 80 jeon, reversing the previous day's decline. The announcement of retaliatory tariffs by the Chinese government in response to the US's reciprocal tariff imposition plan fueled fears of a global trade war, driving up demand for the safe-haven dollar. Subsequently, the KRW-USD exchange rate surged to 1484 KRW 10 jeon on the 9th. This is the highest level in about 16 years since March 12, 2009 (1496 KRW 50 jeon) during the global financial crisis.

The soaring KRW-USD exchange rate began to decline in mid-last month. Despite repeated large fluctuations of over 10 KRW a day, it closed at 1375 KRW 60 jeon on the 23rd of this month, marking the lowest level since November 4 last year (1370 KRW 90 jeon).

Recent stabilization of the exchange rate is attributed to the easing of global trade tensions. Seo Jeong-hoon, a senior researcher at Hana Bank, explained, "The Trump administration decided to defer reciprocal tariffs on major US trade surplus countries, including South Korea, and temporarily lowered tariffs with China this month." He added, "Rumors that the US-South Korea bilateral trade negotiations are proceeding in a direction to lower the KRW-USD exchange rate have spread, bringing the rate down to the 1390 KRW range."

"Exchange Rate Decline Expected in the Second Half"

Experts predict that exchange rate volatility may increase depending on the progress of global trade negotiations. However, they expect the KRW-USD exchange rate to generally decline by the end of the year. Lee Nak-won, an FX derivatives specialist at NongHyup Bank, said, "The fundamental cause of the weak won, the US-China trade friction, has eased, and the US tariff policy, which has been a stale factor affecting the foreign exchange market for over six months, is causing fatigue." He added, "As the tariff issue gradually subsides, the average KRW-USD exchange rate in the second half is expected to be in the 1360-1370 KRW range."

Baek Seok-hyun, a researcher at Shinhan Bank, said, "The political uncertainty that led to the undervaluation of the won has been removed with the impeachment ruling, and the uncertainty of US tariffs has also eased compared to before." He added, "We see the lower end of the KRW-USD exchange rate at 1360 KRW by the end of the year." Baek noted, "Although the US has set a 90-day grace period for reciprocal tariffs on China, uncertainty remains during the negotiation process," but added, "Even if the KRW-USD exchange rate rises again, 1430 KRW is the limit."

Seo added, "Depending on changes in US trade policy, the KRW price per dollar may fluctuate by 10-20 KRW around 1400 KRW by the end of the year." He further analyzed, "Considering Korea's economic fundamentals, if geopolitical disputes such as the Russia-Ukraine war ease and US-South Korea trade negotiations progress, the KRW-USD exchange rate could fall to 1350 KRW."

"No to Forex Tech Expecting Profits"

Experts are skeptical about dollar investments expecting exchange rate rises. The KRW-USD exchange rate is already declining, and even if trade negotiations do not progress and the won's value falls again, the expected profit from investing in dollars is not significant.

Park Sang-hyun, a specialist at iM Securities, emphasized, "The KRW-USD exchange rate is expected to fall to 1350 KRW by the end of the year, and even if the US's high tariff policy prolongs, causing the US economy to stagnate and a preference for safe assets to emerge, it is difficult for the KRW-USD exchange rate to exceed 1450 KRW this year." He added, "The maximum short-term profit rate expected from buying dollars in anticipation of exchange rate rises is less than 5%." Park diagnosed, "The KRW-USD exchange rate around 1450 KRW experienced since last December is clearly excessive." He continued, "There may be criticism that there are no realistic means to artificially lower the exchange rate in US-South Korea trade negotiations as Korea's foreign exchange reserves continue to decrease," and added, "The KRW-USD exchange rate may temporarily rise at the end of the second quarter, but even if it rises, it is expected to be around 1420-1430 KRW."

Reporter Jeong Eui-jin justjin@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)