US Pushes 'Dollar Coin' to Maintain Dollar Hegemony... South Korea's Trade and Payment Systems on High Alert

Summary

- President Trump announced plans to activate dollar stable coins to maintain dollar hegemony.

- South Korea faces systemic risks of weakening won sovereignty and financial market concerns.

- Stable coins are increasing their influence in the international financial market, and South Korea needs to respond through regulation.

DEEP INSIGHT

Trump's 'Stable Coin' Threatens South Korean Monetary Sovereignty

Helpless Against 'Dollar Coin' Assault

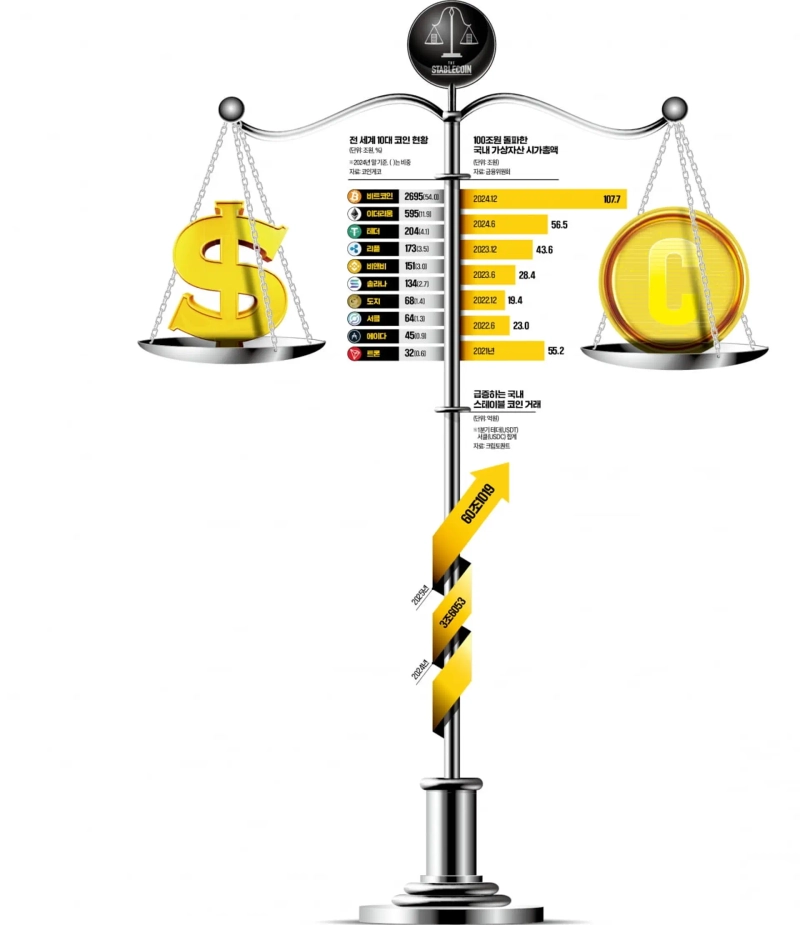

Interest and debate surrounding stable coins are intense. In the first quarter of this year, the trading volume of stable coins on domestic virtual asset exchanges reached 60.1 trillion won, a 16.7-fold increase compared to the same period last year. The controversy over the issuance of won stable coins is also fierce in the presidential election. The overseas atmosphere is similar. There are many days when the daily trading volume of Tether, the number one stable coin, is more than twice that of Bitcoin, the king of the coin market.

This is due to President Donald Trump's push to 'activate dollar stable coins and use them as an international payment method' since the beginning of his term. Trump's plan is to protect the threatened dollar hegemony with dollar coins, along with the 'strategic assetization of Bitcoin.' It is a revolutionary attempt to replace gold with Bitcoin and the dollar with dollar-based stable coins. It is a Trump-style solution similar to the tariff surge.

We are currently in the era of the artificial intelligence (AI) revolution and the currency revolution. Stable coins are at the center of this. The reason stable coins are innovative is because they are 'currency.' They guarantee '1 coin = 1 dollar' based on safe reserve assets. The grand plan of the superpower United States is bound to bring megaton-level aftershocks to the world. South Korea is facing a systemic risk of weakening won sovereignty. Dollar stable coins are already affecting the exchange rate and currency market with the surge of 'Seohak Ants.' There are even unbelievable rumors that 10% of trade is conducted with dollar stable coins.

The assault of dollar coins is fierce, but the response is too slow. There is a regulatory vacuum with ambiguous laws and regulations to apply. The political world is clearly showing 'coin populism,' with 9.7 million virtual asset investors in mind, actively stepping forward to legislate won coins.

'Stable Coins' Expanding... Concerns Grow Over South Korean Monetary Sovereignty

"The dollar is our currency, but your problem." This is the saying of John Connally, the Treasury Secretary during President Nixon's era, that naturally comes to mind when observing the recent changes in domestic and international currency and financial markets. The stable coin market, which is exploding with the opportunity of President Donald Trump's inauguration, is calling for fundamental risks such as the weakening of won sovereignty, affecting the lives of Koreans. The United States experiences the 'Triffin Dilemma' as a fate, but the side that always suffers through this dilemma is the weak currency countries. We are currently in the era of the artificial intelligence (AI) revolution and the currency revolution. Stable coins have emerged at the center of this.

Stable Coins Are 'Currency,' Not 'Coins'

The simplest definition of a stable coin is 'blockchain-based fiat currency.' It is designed to maintain the value of '1 coin = 1 dollar.' Blockchain is characterized by decentralization, immutability, security, and transparency, as it is a data tamper-proof technology based on distributed computing. The first implementation of blockchain is Bitcoin.

Tether, the leading stable coin, holds a 4.1% share of the coin market. Although it ranks third after Bitcoin (54.0%) and Ethereum (11.9%), its weight is different. Bitcoin is 'digital gold,' but stable coins are 'digital currency,' in other words, they are acquiring the status of currency. In the United States, legislation is in the final stages for stable coins to be supervised by the Federal Reserve (Fed), Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency (OCC). Other coins are basically under the jurisdiction of the Securities and Exchange Commission (SEC). Due to this 'currency nature,' there is a view that stable coins should be supervised and responded to separately from other virtual assets.

Threatening the Currency System with Low-Cost, Fast Payments

98% of the world's stable coins are dollar-based. The two leading coins, Tether (USDT) and Circle (USDC), are also dollar coins. The market share of these two coins reaches 85%. Dollar stable coins have established themselves as the key currency in the virtual asset market. This is because the payment process is very simple. It is rapidly spreading in real life, based on the strengths of fast cross-border remittances and low fees. It operates 24/7 and significantly reduces high fees. It also provides an opportunity for 2 billion people worldwide without bank accounts to participate in finance. In countries with high currency value volatility, such as Africa and South America, there are many cases of fleeing to Tether. In Argentina, where Tether usage has become commonplace, the exchange rate gap between the unofficial private market and the official market exceeds 50%.

Is the Value of Stable Coins 100% Guaranteed?

The alpha and omega of stable coins is the trust that 'redemption in fiat currency is always guaranteed.' Coin holders must be able to provide a fixed amount immediately upon withdrawal request. The moment this reasonable expectation collapses, it is a 'coin run.' This trust comes from thorough reserve asset management. After receiving 1 dollar and issuing 1 coin, it is invested in safe assets such as government bonds and deposits.

However, 100% safety is not guaranteed. Even US Treasury bonds, where most of the liquidity of coin companies is invested, are not 100% safe. This is because extreme crisis situations where government bonds cannot be sold periodically occur. The Silicon Valley Bank (SVB) incident, the second-largest bank failure in US history two years ago, illustrates this well. When the US Treasury bond prices, which filled half of the portfolio, plummeted due to the rapid interest rate hike, 55 trillion won fled in 36 hours. At that time, Circle experienced 'depegging,' falling to 0.88 dollars per coin. The moral issues of coin operators are also significant.

Dollar Coins Swallowing the International Financial Market

Even during the Biden administration, the US and the world were negative about stable coins. When Facebook (now Meta) announced its plan to launch the stable coin 'Libra' in 2019, the US Congress summoned CEO Mark Zuckerberg to a hearing and bombarded him with questions.

"With Trump's inauguration, the atmosphere in the US has completely reversed" (Lee Seung-seok, Senior Researcher at the Korea Economic Research Institute). The potential as a future currency, demand for US Treasury bonds, and new business opportunities for the traditional financial sector are being highlighted. Last year, Tether ranked 7th in US Treasury bond purchases. At the end of the first quarter of this year, the US Treasury bonds held by Tether and Circle amounted to 128.3 billion dollars, more than South Korea (124.9 billion dollars) and Germany (111.4 billion dollars). In terms of power in the international financial market, it is comparable to many countries.

Shaking Monetary Sovereignty, Stirring Foreign Exchange and Financial Markets

Coins are unrivaled in terms of convenience, but they cannot avoid the controversy of undermining monetary sovereignty. They replace the demand for won and reduce the effectiveness of monetary policy. The negative effects that could occur if dollar coins become a domestic payment method are unimaginable. This is why Bank of Korea Governor Lee Chang-yong emphasizes that "the introduction of dollar stable coins should be cautious and regulated." Regulation at the level of the Foreign Exchange Management Act is essential because they are substitutes for the dollar.

Many countries share these concerns. The European Union (EU) is a representative example. The comprehensive regulation law on virtual assets (MiCA), which has been in effect since last year, forces stable coins circulating within the region to accumulate reserve assets within Europe. It also sets a limit to prevent stable coins from increasing beyond a certain amount. China also prohibits the use of stable coins on the mainland. However, dollar coins linked to offshore yuan are partially used in trade settlements.

Is Won Stable Coin a Solution?

As dollar coins advance, voices are rising to issue won coins to counter them. Kim Yong-beom, CEO of Hashed Open Research and former Vice Minister of Strategy and Finance, argues that "won stable coins should be introduced quickly to respond to the reorganization of the digital currency order at the national strategy level." The political world is also participating. Lee Jae-myung, the presidential candidate of the Democratic Party, sparked controversy by saying, "Let's create a won stable coin market to prevent the outflow of national wealth." The Democratic Party immediately pledged a basic digital asset law for the issuance of won stable coins.

However, won coins require a cautious approach as they involve significant changes such as 'allowing alternative currencies.' The effectiveness of won stable coins is also debatable. Ko Kyung-chul, head of the electronic finance team at the Bank of Korea, said, "I do not agree with the claim that we can defend monetary sovereignty by making coins with the weak won." The Financial Services Commission and the Ministry of Strategy and Finance, the relevant ministries, are cautious, fearing criticism that they may hinder innovative finance and technology. It is time to come together for Solomon's wisdom to strengthen the competitiveness of the won and protect monetary sovereignty while utilizing revolutionary technology.

Baek Kwang-yeop, Chief Editorial Writer kecorep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)