Summary

- The Bank of Korea is expected to lower the current base rate of 2.75% two to three times within the year to respond to the domestic economic downturn.

- Economic experts predict a high likelihood that this year's economic growth rate will be below 1%, with the new government's economic policies and US tariff policies being major variables.

- The won-dollar exchange rate is expected to remain between 1350 and 1400 won by the end of the year, and attention should be paid to the volatility of the economic situation along with the rate cuts.

Hankyung Economist Survey

60% Say "Growth Rate Below 1% This Year"

New Government's Expansionary Fiscal Policy and US Tariff Variables

Year-end Exchange Rate at 1350-1400 Won Level

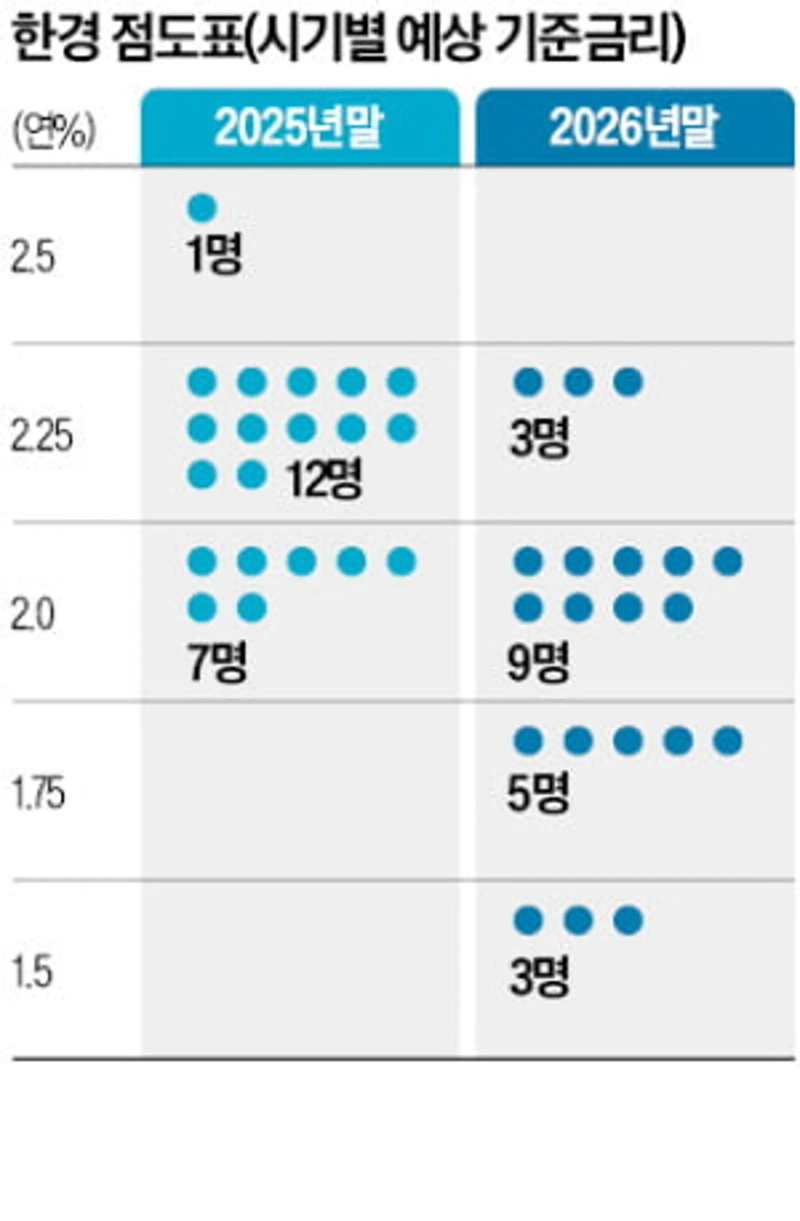

Economic experts from the Hankyung Economist Club expect the Bank of Korea to lower the current base rate of 2.75% two to three times this year to respond to the domestic economic downturn. They cited the US tariff policy and the economic policies of the new government, which will be established after next month's presidential election, as key variables that will influence the domestic economy in the second half.

"Interest Rate Cut on the 28th... 1-2 More Cuts in the Second Half" All 20 economic experts who responded to the survey on the 27th predicted that the Bank of Korea would lower the base rate on the 29th, based on the judgment that the growth engine is rapidly cooling.

In the survey, six experts (30%) presented an economic growth rate forecast of 0.8% for this year, the highest number. Three experts (15%) expected 0.7%. A total of 60% (12 people) predicted a growth rate below 1.0% this year. Only eight experts expected it to be 1.0% or higher. The average growth rate forecast of the 20 experts was 0.87%, significantly lower than the Bank of Korea's growth rate forecast of 1.5% for this year.

Park Seok-gil, an economist at JP Morgan, who presented a growth rate forecast of '0.5% or less,' explained that "the recovery of domestic demand is delayed, and the export outlook is also uncertain." Some experts left open the possibility that the economy could revive somewhat if the new government implements expansionary fiscal policies and the uncertainty from US trade policies disappears.

Lee Seung-heon, a professor at Soongsil University's Graduate School of Business, said, "The negative growth in the first quarter was due to the Trump tariff shock and political instability," adding, "If the Trump tariff risk is resolved in the future, the economic flow may change due to economic sentiment stabilization and the new government effect." However, even assuming such cases, the growth rate forecast for this year was only 1.0-1.2%.

Nineteen out of 20 experts (95%) predicted that the base rate at the end of this year would be 2.25-2.5%. Considering the current rate level (2.75% per annum), they expected one or two more rate cuts in addition to this month's cut.

The US Federal Reserve's rate cut pace is not expected to be faster than Korea's. The most common forecast was that it would cut rates twice by 0.25 percentage points each from the current rate level (4.25-4.5%), with 13 people (65%) predicting this. Three people (15%) expected one cut, and two people (10%) expected no change. If the Bank of Korea cuts rates faster than the Fed, the current 1.75 percentage point gap between the Korean and US base rates will widen.

The most common forecast for the won-dollar exchange rate at the end of this year was 1350-1400 won, with 11 experts (55%) predicting this. This was followed by 1300-1350 won (4 people), 1400-1450 won (3 people), and 1250-1300 won (1 person).

Reporter Left King leftking@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)