Are Japanese Funds Returning Home? When Rising Interest Rates Threaten the Stock Market

Summary

- Recently, long-term government bond yields are on the rise globally, and this is reportedly having a negative impact on risk assets like U.S. stocks.

- It is noted that volatility in the Japanese government bond market and the BOJ's scaled-back bond purchases are raising the possibility of Japanese investors repatriating funds.

- Investors are cautioned that if yen appreciation accompanied by Japanese capital outflows materializes, it could deliver a shock to U.S. equities and the global asset market.

Long-term government bond yields are on the rise globally. President Donald Trump’s reciprocal tariffs were ruled invalid by the United States Court of International Trade on the 28th (local time), and then, in less than 24 hours, that invalidation was stayed—a bizarre turn of events that briefly shifted the market’s focus to tariffs. However, what has fundamentally steered the recent major market trends is interest rates—more precisely, long-term government bond yields.

Because bond yields can also affect risk assets, they are of particular interest to U.S. equity investors. Recently, the U.S. 10-year and 30-year Treasury yields each temporarily surpassed 4.5% and 5%, respectively, which triggered a sharp 1.6% drop in the S&P 500 Index.

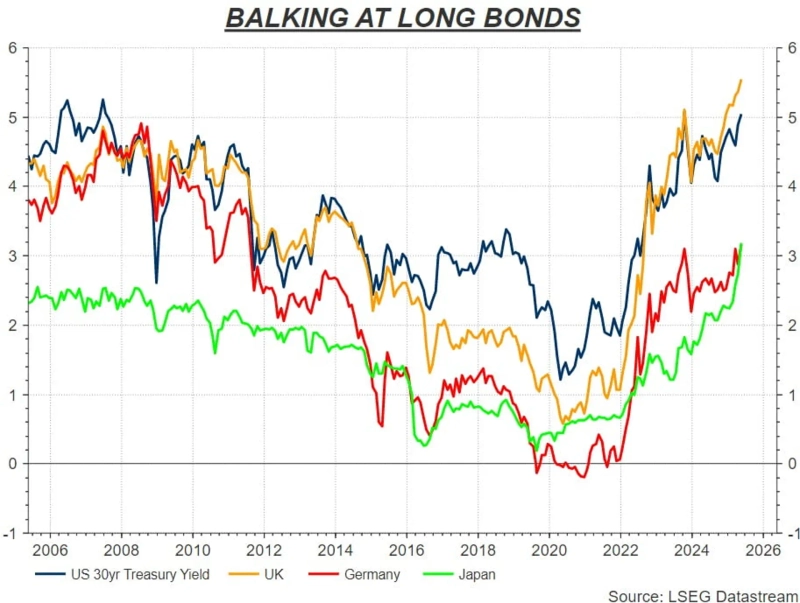

The upward trend in long-term yields is not unique to the United States. The 30-year government bond yields of major economies like Germany, the United Kingdom, and Japan are all soaring as well. Trade tensions sparked by President Trump, along with persistent inflation, have left governments with little choice but to continue robust fiscal spending, ruling out any return to zero interest rates. This inevitably raises investor concerns about whether governments can handle massive fiscal deficits.

Among these, global investors are paying particularly close attention to the Japanese government bond market. Having long been regarded as the world’s most stable, it is now showing notable volatility. Japan, as the world’s largest net external creditor nation, also holds more U.S. Treasuries than any other foreign government. Any cracks in Japan’s financial markets could have far-reaching effects on U.S. and global asset markets. Yardeni Research has even warned, “A spike in Japanese government bond yields could serve as a dangerous turning point for global financial markets.”

What’s Happening in the Japanese Government Bond Market?

Japan’s 30-year government bond yield has now climbed to about 3%, hitting an all-time high—with the sharpest increase seen this year. For decades, the Bank of Japan (BOJ) had kept yields in check by purchasing unlimited amounts of government bonds, but that grip now appears to be loosening.

Key events that have drawn intense market attention included auctions for Japanese 20-year and 40-year bonds on the 20th and 28th, respectively. The bid-to-cover ratios, normally averaging 3 times, plummeted to 2.5 and 2.2 times, indicating significantly weaker buying interest. As a result, long-term government bond yields in not only Japan but also the U.S. and other major markets climbed in tandem.

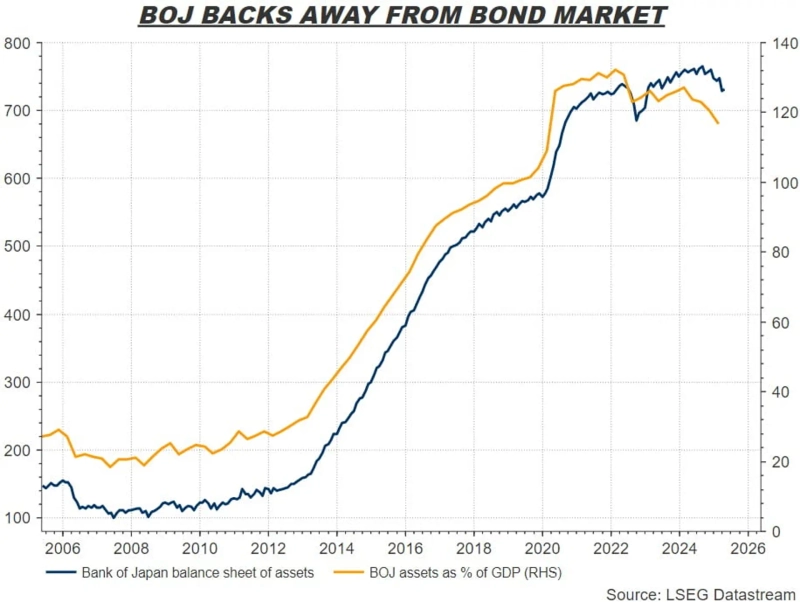

At the heart of this weak demand is the BOJ’s scaled-back bond purchases. Since the 1990s, Japan had attempted to defeat persistent deflation with massive central bank government bond acquisition, boosting the economy by aggressively injecting liquidity. If yields on 10-year bonds exceeded a certain level, the BOJ stepped in purchasing unlimited amounts to cap rates—a strategy known as yield curve control (YCC). The outcome: the BOJ became the “whale” holding 52% of all Japanese government bonds.

But as Japan’s economy finally exited deflation, the BOJ ended YCC last year. Purchases are now being gradually reduced. The problem: with the departure of this mega-buyer, there’s a shortage of demand to fill the gap. Major domestic buyers in Japan, such as life insurers, banks, and pension funds, are holding off purchases, as there’s no rush while further rate hikes by the BOJ are widely expected. With yields rising, these institutions are already facing steep mark-to-market losses on their existing holdings. The four major Japanese life insurers, for example, posted a combined ¥60 billion (about $6 billion) in government bond valuation losses in their latest fiscal year—a fourfold increase from the previous year. Despite falling bond prices of late, hesitant buying persists.

For a country like Japan, saddled with a staggering debt load of 260% of GDP, rising bond yields and weak demand are dire threats. The Ministry of Finance Japan is considering reducing long-term bond issuance to help lower yields. There’s also hope that the BOJ will adjust its purchase plans and increase them again in June. That’s why June could turn out to be a critical month for global bond markets.

Concerns About Capital Outflows from the U.S.

Still, doubts remain about whether these measures can reverse the structural upward trend in rates. The era of zero interest rates and unlimited money printing is ending, a transition hastened by President Trump’s era. The ultra-low-rate era that persisted from the global financial crisis through the COVID-19 pandemic is closing.

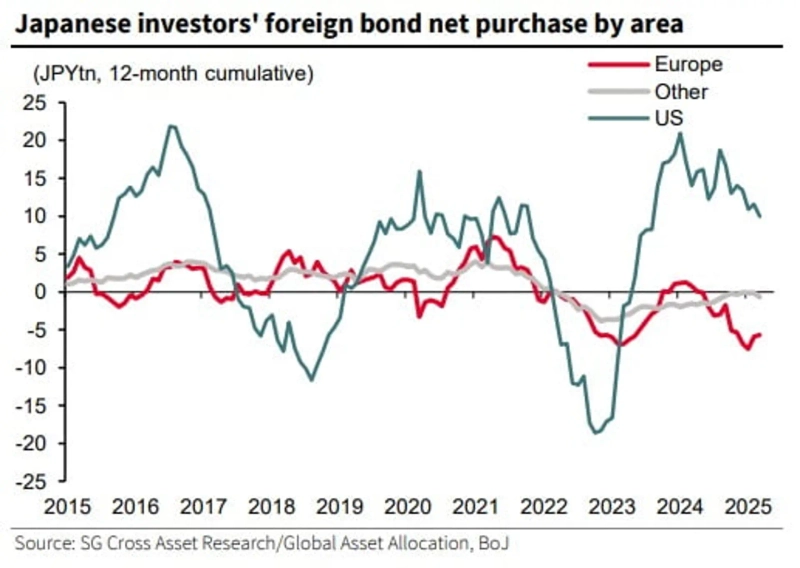

Japanese investors have long leveraged ultra-low domestic interest rates to channel capital into U.S. and global assets. If the uptrend in Japanese bond yields and yen strength continues, there is a real possibility that these investors will repatriate funds. This could rattle not just U.S. stocks and Treasuries but global asset markets as a whole. Deutsche Bank has cautioned that “Rising Japanese government bond yields could make Japanese insurers and pension funds prefer domestic bonds over Treasuries,” sounding a negative outlook for U.S. bonds.

Société Générale also pointed out, “The flow of Japanese capital that has been supporting U.S. stocks and bonds could reverse.” Even if not as abrupt as the unwinding of yen carry trades last August, the outflow may gradually accelerate—like the tide receding.

Of course, as the yield gap between U.S. and Japanese bonds remains significant, a massive outflow overnight is unlikely. But with the dollar trending weaker and the yen strengthening, if current trends persist, capital flight could become a real concern.

Mounting Bets on Yen Strength

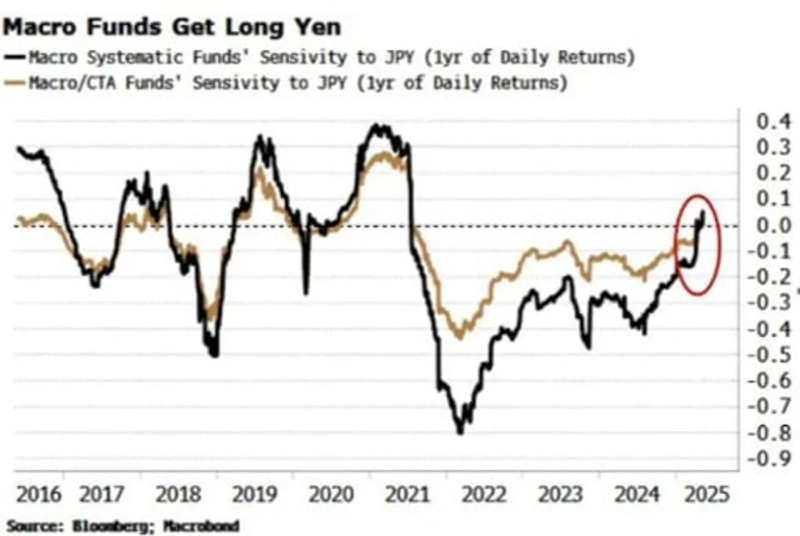

In fact, more capital is betting on yen appreciation and further rises in Japanese government bond yields. According to Simon White of Bloomberg, macro-based fund returns and their sensitivity to the yen have turned positive for the first time in four years. As macro funds pivot towards betting on a stronger yen, their returns improve along with yen appreciation.

Speculative investors' net long positions on the yen are at record highs. This suggests that investors selling global stocks and foreign bonds are converting their funds to yen, betting on a return to Japan.

When Do Rising Rates Begin to Threaten the Stock Market?

So far, the U.S. stock market hasn’t reached a crisis point due to rising rates. A recent Goldman Sachs survey of approximately 800 institutional investors found that 46% identified a U.S. 10-year Treasury yield of “5.25% or higher” as a threshold for jeopardizing U.S. equities. Another 39% answered “4.75% or higher.” As of the 29th, the 10-year Treasury yield is 4.4%.

Some warn it’s time to be cautious. UBS notes that the current 10-year Treasury yield is above its 100-day moving average and that, historically, this tends to coincide with a negative correlation between rising yields and stock prices.

There aren’t any definite answers. There’s no need to worry excessively in advance. However, the market’s sensitivity to interest rates is clearly ramping up. In line with President Trump’s “transition,” Japan’s bond market—having experienced decades of ultra-low rates—is changing rapidly, and this could significantly alter global capital flows, including into U.S. equities.

New York—Bin Nansae, Correspondent binthere@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)