Summary

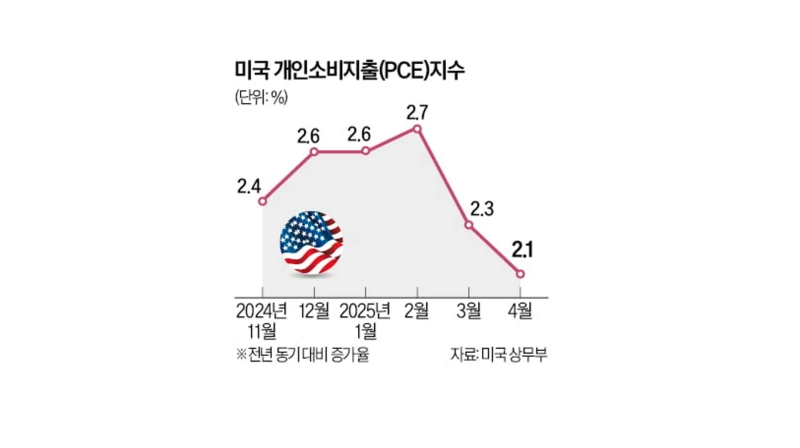

- US April PCE Price Index rose by 2.1%, marking the lowest increase in seven months.

- The growth in consumer spending slowed to 0.2%, while personal income increased by 0.8%, exceeding market expectations.

- Bloomberg News analyzed that the decline in consumer spending reflects concerns about the US economy.

Up 2.1% Year-on-Year…Below Expectations

Consumption Drops Amid US Economic Slowdown Concerns

The price increase of the Personal Consumption Expenditures (PCE) Price Index, which the Federal Reserve System (Fed) uses as a measure of inflation, recorded its lowest level in seven months.

On the 30th, the US Department of Commerce announced that the PCE Index for April rose 2.1% compared to the same period last year. This figure is 0.1% point lower than the expert forecast compiled by Dow Jones. Compared to the previous month, it increased by 0.1%. This is the lowest level since September last year (2.1%).

The PCE Index is used by the Fed when comparing the inflation rate to its target (2%). By item category, housing and utilities costs rose 24.7% from a year ago, healthcare costs increased by 20.3%, restaurant and accommodation services by 13.0%, and gasoline and other energy costs by 8.1%. On the other hand, other nondurable goods (-5.9%), financial services and insurance (-4.6%), automobiles and parts (-4.5%), and clothing and footwear (-3.4%) declined. Excluding volatile food and energy, the core PCE Price Index was up 2.5% year-on-year.

Consumer spending increased by just 0.2%, slowing down from the previous month's 0.7%. Personal income rose by 0.8%, exceeding the market's expected 0.3%. This means that spending did not increase as much as incomes did. Bloomberg News analyzed that "the decrease in consumer spending shows concerns about the US economy."

Reporter: Kim Juwan kjwan@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)