Editor's PiCK

Fed Governor Waller: "Tariff Shock is Temporary... US Will Cut Rates This Year"

Summary

- Christopher Waller, a member of the US central bank (Fed), forecast that "the effects of tariff policy are temporary and the Fed will move to cut interest rates in the second half of this year."

- Governor Waller noted that the tariff impact is limited and that US consumer prices will converge toward the target (2.0%).

- He also emphasized the need for simpler and less interventionist regulation in light of the emergence of non-bank payment methods such as stablecoins.

Bank of Korea '2025 BOK International Conference'

Low Probability of 'Inflation Spiral'

Stablecoins Expected to Reduce Fees

Christopher Waller, a member of the US central bank (Fed), said on the 2nd that "the impact of (the Trump administration's tariff policy) on inflation will be temporary" and predicted, "the Fed is likely to cut rates in the second half of this year."

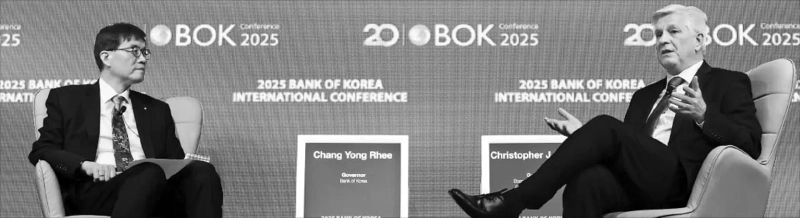

At a keynote speech delivered at the '2025 BOK International Conference' hosted by the Bank of Korea that day, Governor Waller stated, "As the impact of tariffs is not significant, US consumer prices will converge toward the target level (2.0%)," sharing his outlook. Although Governor Waller was previously regarded as a hawk (favoring monetary tightening) within the Fed, this year he has repeatedly mentioned the possibility of rate cuts. He is also being mentioned as a possible successor to Jerome Powell, the current Fed chair, whose term ends in May next year.

According to Governor Waller, in a 'high-tariff scenario' where the US's effective tariff rate averages 25%, if companies pass tariff costs on to consumers, the personal consumption expenditure (PCE) price index could rise to 5%. Even if companies absorb part of the costs, PCE may still rise to 4%. In a 'low-tariff scenario' with an average effective tariff rate of around 10%, the PCE index temporarily climbs to 3% and then gradually falls. He said, "Although the exact tariff level is uncertain, I currently estimate the average effective tariff rate at about 15%," adding, "The impact of tariffs will be most pronounced in the second half of this year."

Governor Waller analyzed that the current situation is different from the COVID-19 period, during which prices surged. He explained, "During COVID-19, labor supply fell, supply chains faced disruptions, and expansionary fiscal policy overlapped. At present, none of these three factors are in play."

In a conversation following his keynote, Bank of Korea Governor Chang Yong Rhee asked Governor Waller about his views on regulation of stablecoins. Governor Waller responded, "Stablecoins are a new means of payment that can be provided by non-bank institutions. For non-banks that only provide payment services, it makes sense to apply simpler and less intrusive regulations."

He added, "Because payment fees in the US are relatively high, allowing more competition from the private sector could help lower costs. Creating a fair competitive environment between banks and non-bank payment providers is important."

Governor Rhee responded, "We need to carefully consider whether to allow non-bank-issued won stablecoins, as issuing stablecoins by non-bank financial companies could also be exploited as a way to evade capital regulations." He added, "Because this issue is linked to relaxing capital regulations, Korea must take a more cautious approach than the US."

Reporter: Ikhwan Kim lovepen@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)