Summary

- The OECD lowered its growth outlook for South Korea to 1.0% this year, far below the G20 average of 2.9%.

- Experts said the potential growth rate is declining and South Korea is now expected to reach a per capita GDP of USD 40,000 as late as 2029.

- The OECD and KDI stressed that growth recovery requires structural reforms such as labor market changes.

South Korea Losing Growth Momentum

Era of USD 40,000 GDP May Be Delayed

OECD Lowers Forecast by 0.5%P in Three Months

South Korea Far Below G20 Average of 2.9%

KDI and Overseas IBs Predict 0% Range Growth

Only Four Instances of Sub-1% Annual Growth (Oil Shock, FX Crisis, COVID-19, etc.)

South Korea Likely to Trail US Growth for Third Consecutive Year

Next Year, Per Capita GDP to Be Overtaken by Taiwan

"Structural Reforms Needed to Boost Growth Rate"

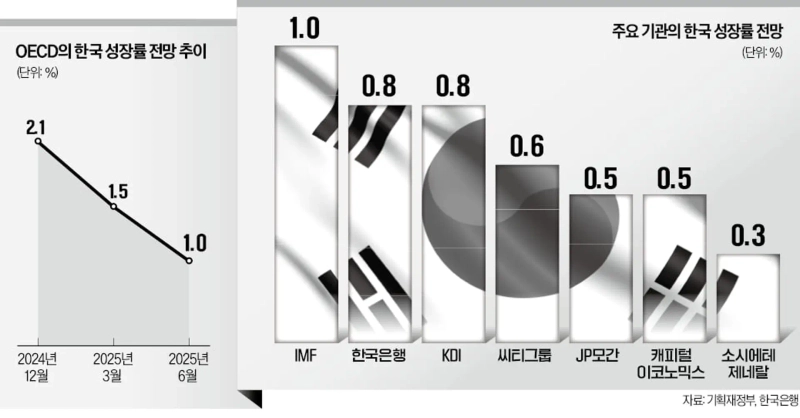

The Organisation for Economic Co-operation and Development (OECD) revising its economic growth forecast for South Korea and the US to 1.0% and 1.6%, respectively, carries significant implications for the new administration. Over the past six years, South Korea's economic growth rate has lagged behind the US four times. Should the OECD outlook materialize, Korea will trail the US for a third consecutive year.

Park Jae-wan, Chairman of the Institute for the Future of the Korean Peninsula (former Minister of Strategy and Finance), commented, "The fact that Korea's growth rate continues to fall below that of the US, whose per capita income is 2.5 times higher, is proof that the Korean economy is losing steam."

◇Declining Potential Growth Rate

Last December, the OECD forecast Korea's 2025 economic growth rate at 2.1%. On March 12, in light of the emergency martial law incident and related factors, it lowered this to 1.5%, and now, just three months later, the figure has been dropped by another 0.5 percentage points. During the same period, the US growth forecast was also reduced from 2.8% to 1.6% but remains 0.6 percentage points above Korea. Korea's growth forecast for this year lags far behind the G20 average of 2.9%, largely due to its export-dependent economy, which has made it particularly vulnerable to the "Trump tariff war."

The OECD's outlook is relatively optimistic. The Bank of Korea and the Korea Development Institute (KDI) expect the Korean economy to grow by only 0.8% this year. According to Bloomberg, 11 out of 36 overseas investment banks (IBs) predict growth as low as 0.3–0.7%, lower than the forecasts from the Bank of Korea and KDI (0.8%).

Since 1960, South Korea has recorded less than 1.0% annual growth only four times: during the 1980 oil shock (-1.5%), the 1998 foreign exchange crisis (-4.9%), the 2009 global financial crisis (0.8%), and the 2020 COVID-19 pandemic (-0.7%).

The outlook for next year is also bleak. The Bank of Korea expects a 1.6% growth rate for 2026; KDI also projects growth in the 1% range. The OECD is maintaining its 2025 growth forecast at 2.2%, but this still lags well behind the G20 average (2.9%).

As the economic fundamentals deteriorate, the potential growth rate is falling. In May, KDI estimated Korea's potential growth rate at 1.8% for this year, lower than the Bank of Korea's late-2023 forecast for 2024–2026 (2.0%). The Korean government and the International Monetary Fund (IMF) previously expected the potential growth rate to enter the 1% range in 2030–2040, but this milestone may be reached five years earlier. KDI warned that, due to demographic changes, the potential growth rate could turn negative from 2041.

With the economic growth rate falling, the time for per capita GDP to reach USD 40,000 is projected to be delayed by about two years to 2029. The IMF expects that, because of this, Korea's per capita GDP will be overtaken by Taiwan next year.

◇"No Solution Except Structural Adjustment"

The new government, upon inauguration, has inherited tasks including responding to US trade pressure and, simultaneously, reviving the sluggish economy while raising the potential growth rate in the medium to long term.

In its report, the OECD stated, "Short-term fiscal support may be appropriate, but there must also be a framework for long-term fiscal management," and recommended, "Labor market reforms are needed to boost growth, alleviate elderly poverty, and reduce the opportunity costs associated with childbirth and childcare." Regarding the Bank of Korea’s monetary policy, it advised, "Additional easing should be considered given sluggish domestic demand."

Experts unanimously stated that restoring productivity through structural reforms is the only solution. Chairman Park asserted, "April saw declines in all-industry production, consumption, and facility investment—clear signs of a slowdown," adding, "It is urgent to raise the potential growth rate through structural reforms."

KDI also emphasized the need for urgent responses to demographic changes. Jeong Kyu-chul, Director of the Economic Outlook Office at KDI, said at a briefing on the 8th of last month, "Efforts must continue to promote work-life balance, increase economic activity among seniors, and open up the labor market to mitigate the decline in the workforce."

Reporter: Jeong Young-hyo hugh@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)